Can India become the ‘Factory of the World’?

“No country is ever successful in the long term… without a really strong and vibrant manufacturing base.” —Alan Mulally, former President and CEO of the Ford Motor Company

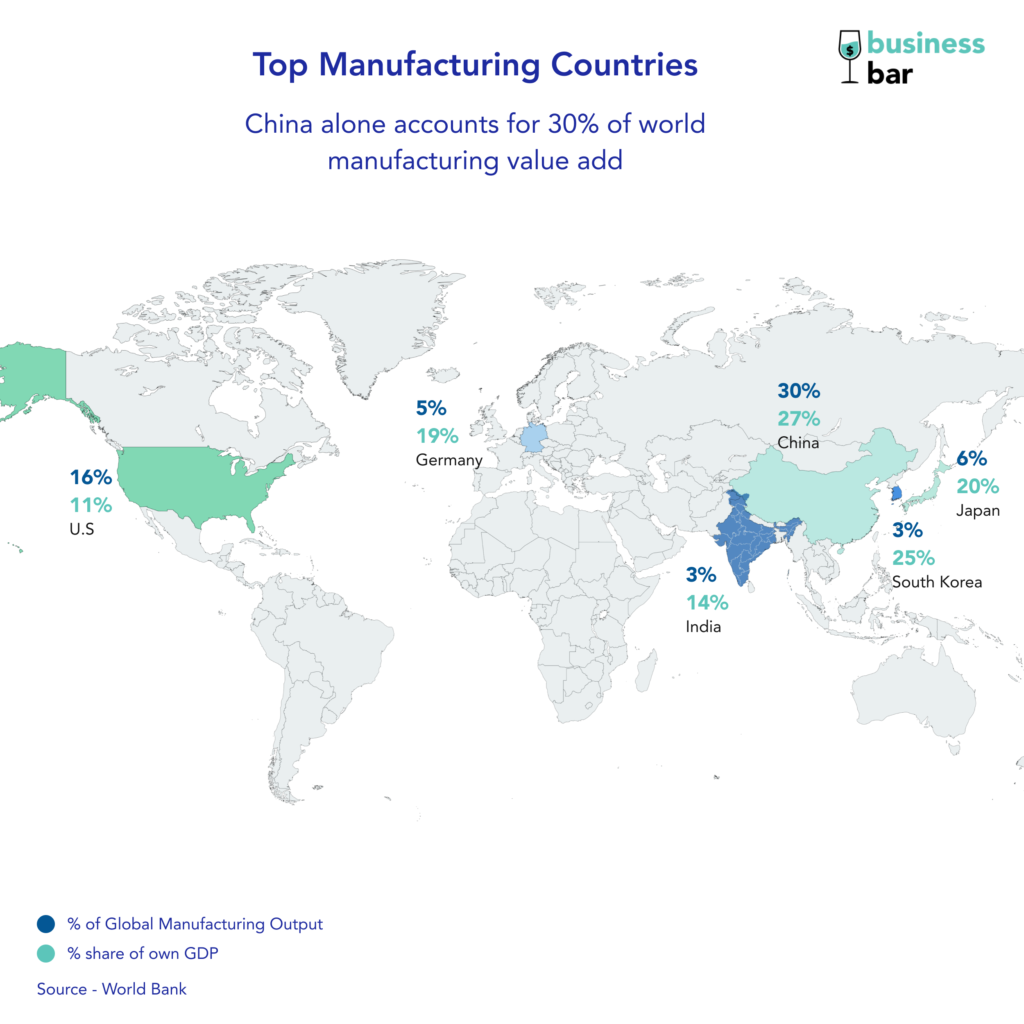

In 2021, global manufacturing contributed $16 Tn to the $96.5 Tn global GDP. China alone accounted for 30% of the global manufacturing output, as much as the next five countries put together. India ranks 6th in terms of share of global manufacturing output with a 2.8% share compared to 30% of China, 16% of US and 6% of Japan.

In the top 6 manufacturing nations, India ranks 5th when it comes to the manufacturing sector’s share in the country’s GDP. Manufacturing in India contributes 14% to the Indian GDP. The current government plans to increase this to 25% closer to 27% of China today.

China’s dominance as a Factory of the World is losing its ground. In this article, we’ll journey through India’s road towards becoming a manufacturing hub while visiting global context, history of India’s policy and what lies ahead along the way.

Manufacturing in India

A brief history

Manufacturing sector’s contribution to the Indian economy as a percentage of GDP of India has stayed the same since independence. In 1960, it was 14.75% and in 2021 it was 14%. The governments, right after independence, have tried to make manufacturing as a core part of the Indian economy.

After independence, heavy industry became the focus of Nehru’s five-year plans. Then the focus shifted on agro industries. License raj and inefficient public sector industry were the themes of the decades before liberalisation in 1991. Post liberalisation, MSMEs and the service sector received push from the government. FDIs flew into India. The last decade, the government has brought in multiple policy reforms.

So, it has been a mixed bag. Though the manufacturing sector grew at a similar pace as the GDP of the country, it never really took-off as it did in China or as the service sector did in India.

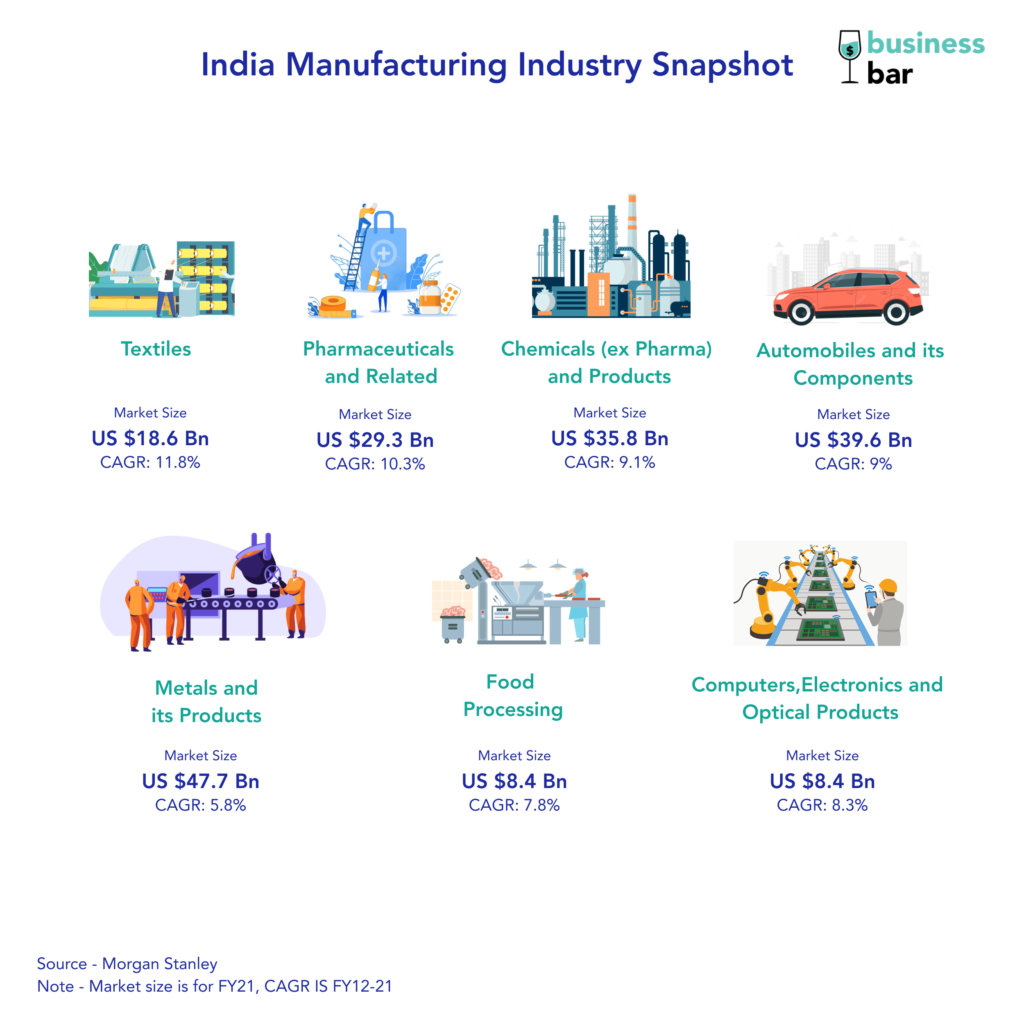

The present

In 2021, India had a manufacturing output of $444 Bn. As per National Industrial Classification, there are 24 ‘activities’ or industries that make up the manufacturing sector in India. The large industries which form a bulk share of the sector are the usual suspects: Automobiles and components, Chemicals, Pharma, Metals, Engineering, Petroleum etc.

There are also sectors like defence, EV, semiconductors, drones, energy, which are of strategic importance. The government is giving special incentives to grow these sectors.

Let’s take the defence sector as an example. For India, to become self-reliant in the global order, it is crucial to grow defence production in India. Under Defence Acquisition Policy, the government has laid down a framework to prioritise Make in India products and equipment when it comes to defence spending. The focus has also shifted to increasing exports. Defence exports grew at a 32% CAGR between FY16 and FY22, increasing from mere $300Mn to $1.6 bn in the same time. As a result, Indian defence stocks have given spectacular returns in the last few years.

Why could this be India’s time?

There are four major trends which would help the Indian manufacturing industry to ride the growth curve.

I. Shift in global order: The world has become more volatile in recent years. Each year, China exports commodities worth more than $2.5 trillion, of which $490 billion goes to the US alone. The pandemic led supply chain disruptions, US-China trade war and Russia-Ukraine conflict have made companies and countries look for a China+1 partner.

A lot of companies have already started shifting/diversifying their manufacturing base from China to other countries. India stands to benefit tremendously from this trend, as the other south-east Asian countries like Vietnam ($366 Bn GDP) are too small to absorb a significant part of $5Tn manufacturing output of China. Early trends of this are already in motion. Apple, as part of its diversification strategy, wants to shift 25% of its manufacturing to India from sub 5% currently.

II. Digitisation: The world is in awe of the national digital infrastructure of India – India Stack. It has three layers: A. Identity: Aadhar, eKYC, eSign, Digilocker. B. Payments: UPI, IMPS, BBPS, GST, Fastag. C. Consent: Account Aggregator layer.

The government is already adding three more layers that can change how India lends, spends and insures with OCEN (Open Credit Enablement Network), ONDC (Open Network for Digital Commerce) and Digital Health ID.

III. Govt renewed focus on manufacturing: The government has launched a National Manufacturing Policy which aims to grow the manufacturing sector in India. In 2019, the government took a landmark step and reduced the corporate tax rate to 25% from 35% effective tax rate earlier. A special lower rate of 17% was introduced for new manufacturing companies. In 2020, the government launched Production-Linked Incentive Schemes (PLIs) with an initial outlay of $25 Bn. Credit Suisse estimates the impact due to PLIs could generate $70 bn in revenues in FY25, contributing to 0.8% of India’s GDP!

Apart from this, focus on FDIs, increasing exports, labour reforms are some of the other things that the government is working on.

IV. Means of production: Going back to Economics 101, output is a function of capital, labour, and technology. India is home to one of the cheapest labour in the world. India has a huge supply of young workforce – skilled and unskilled – to help fuel the production. This puts India at a massive cost advantage. FDIs and public markets have brought in capital and technology. Government’s investments in infrastructure and logistics (with National Logistics Policy) will help increase the efficiencies.

Having said that, it would be a wait and watch. Especially with volatile macro conditions: turbulent geo-politics, rising interest rates, high inflation, distress in the financial sector, it is a tough time for the economy as a whole.