A record 2.7 B games were downloaded in India in Q2 2020 which is a whopping 50% hike as compared to the previous quarter.

It has been more than 4 months since India imposed a nationwide lockdown.COVID-19 has affected a lot of industries negatively but it has definitely given a boost to the already growing mobile gaming market in India. According to a report by Publicis Groupe India, gaming applications registered a whopping 41% increase in time spent per user in the first few weeks of lockdown. Paytm First games reported an increase of 200 percent in its user base in March 2020. Another popular mobile game Ludo King saw a jump of 142% in downloads between February and April.

Surely it looks like a market brimming with potential but let’s deep dive to understand how the mobile gaming sector was performing before the pandemic, what are the trends shaping this industry and the problems plaguing it?

Indian Gaming Industry Overview

India currently ranks among top 5 markets in the world based on a number of users and has become one of the fastest-growing mobile gaming markets in the world, driven majorly by an ever-increasing smartphone and internet penetration.

According to a report by KPMG, the revenue of online gaming in India has nearly doubled over a period of four years from $270 MM in FY14 to $584 MM in FY18 and are poised to reach $1.58 B by FY23 with a CAGR of 22.1 %. Mobile games are responsible for 89% of revenue coming from this huge and exponentially increasing market.

M-games categorization

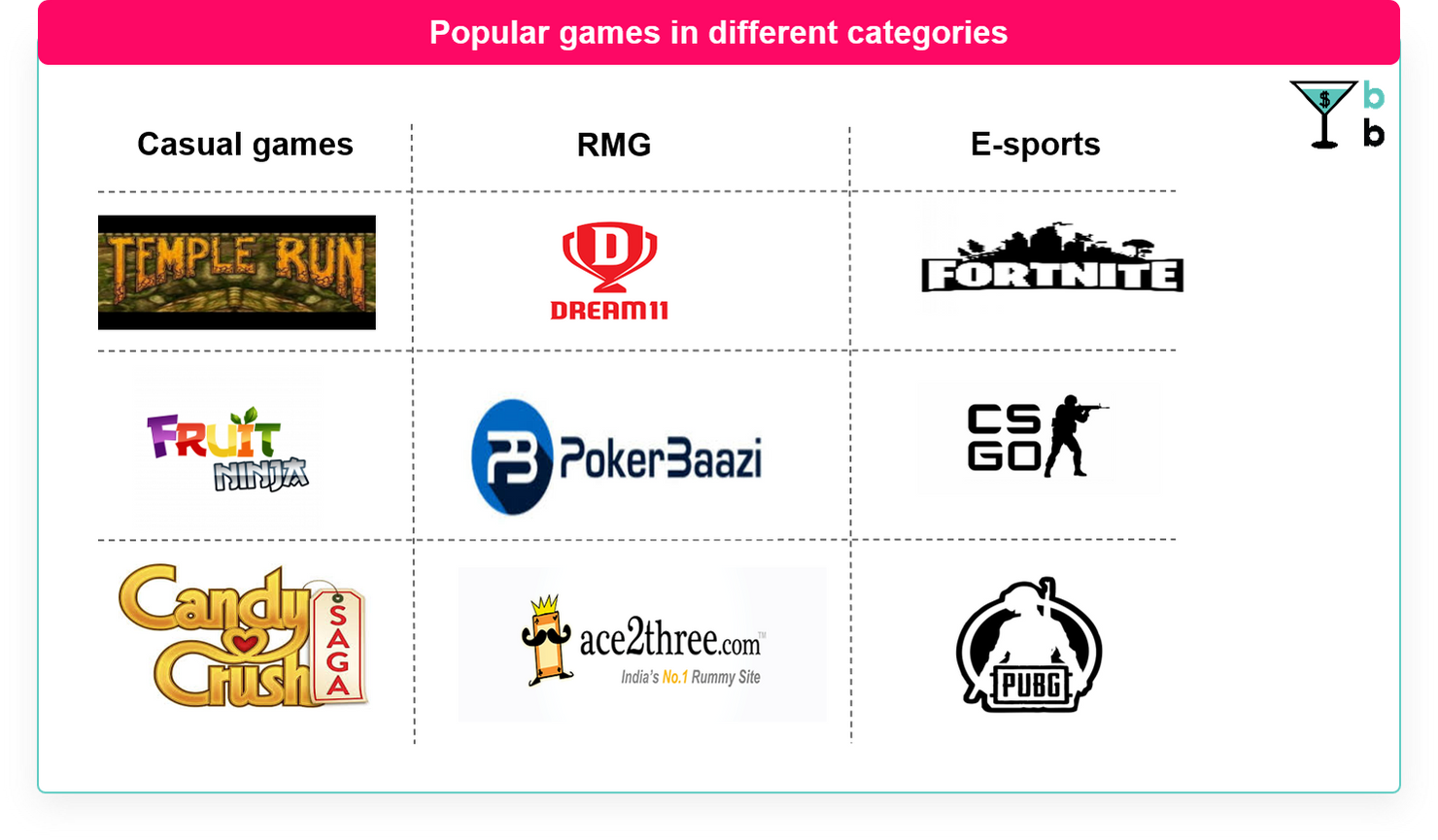

Mobile games are broadly categorized into 3 categories based on the revenue generation model and competition style.

1)Casual games: Casual games are generally easy to play games targeted at a wider audience and primarily depend on advertising revenue and in-app purchases.

2)Real money games (RMG): Real-money games are ones that charge an entry fee from players, unlike casual games that primarily depend on advertising revenue.

3) E-sports: E-sports are multiplayer and competitive video games and they heavily depend on in-app purchases and tournament fees.

Story So Far

In the last 6 years, India’s gaming industry has attracted about $350 MM in funding from investors as reported by Maple capital advisors. India currently has more than 300 MM online gamers and this number is poised to increase in the near future. With an increase in the number of gamers, the amount of investment is surely going to increase as well.

Dream 11, incorporated in 2007, became India’s first gaming unicorn in 2019 and it earned a revenue of $100 MM in FY’19. This was a pivotal movement in India’s gaming industry as it surely helped in increasing entrepreneurs’ and investors’ interest in the market. Dream 11 recently outbid BYJUs, Unacademy and Tata Group to win IPL 2020 title sponsorship rights. Recently Games2win announced Replay gaming fund which is a fund focused on startups in the gaming sector. Lumikai is another fund which although is focused on entertainment but the gaming sector forms a significant part of it. Lumikai is looking to fund 15-20 gaming companies at seed stage with deal size anywhere between $0.2MM to $2MM with enough capacity reserve for follow on funding up to series A. Going further India will have more funds focusing on the gaming market.

Looking at the investment trends it is sure that the gaming market is heating up and is poised to get more traction from both entrepreneurs and investors. One may think that the gaming market is all hunky-dory but if we compare the investments with other markets like consumer tech and fintech we can clearly say that the gaming industry has not been investors’ favourite.

Indian startups received $14B as VC investment and consumer tech, fintech, B2B commerce and SaaS contributed 80% of it. Compare this with the gaming sector which received a mere $ 350 MM in the last 6 years.

Investors have traditionally considered the gaming industry as highly unpredictable and extremely tough to monetize. Creating a ‘hit game’ was considered more of magic than science. So what has changed for the investors in the last few years? To answer this, we’ll have to get into the investors’ shoes and take a closer look at the problems faced by the industry.

Monetization – Investors’ Major Hurdle

Let’s look at two of the crucial parameters for making an investment decision and how they have changed.

1)Number of active users: The number of active users were quite less before 2016 and has increased exponentially post 2016, thanks to Jiofication. Both the number of smartphones and internet users increased rapidly post that. Data usage per subscriber increased from 0.24GB/ month in 2016 to 11 GB/ month in 2019.

2)Lifetime value of a customer (LTV): Simply put, it is the total worth of a customer to the business during their entire lifetime.

LTV=(Average revenue per user hour)*(Time spent per user in a year)*(Average number of active years)

ARPUH has been extremely low especially for the casual gaming segment which dominated the industry until a few years back. Revenue sources used by casual games are mainly these three:

1) Advertisements revenues in the freemium model

2) App download fees in paid games

3) In-app purchases

All three revenue sources had their share of problems.

Time spent per customer in a year is a difficult metric to manage as it not only involves competition with other games but also with other apps that the user spends time on, like Facebook and Netflix. Basically, every application is trying to get a larger share of the user’s leisure time. This makes it very hard for companies to compete on the above metric.

Retention period (average number of active years) is also hard to maintain because of the large number of gaming apps. Do you remember playing angry birds in 2011? How many of you are still playing it? Most of the mobile games have been popular only for a short time. It has proved hard to find loyal customers in this business.

Despite the above-said problems, there are gaming apps that have done well and generated substantial revenues. Gaming companies are now using analytics on player data to manage advertisement frequency. Some games are using newer tactics to increase advertising revenue like reward advertisements. They offer players to watch advertisements in order to avail some award within the game. Well, apart from the data backed approach and a substantial increase in the number of smartphones coupled with cheap internet, there has been a fundamental shift in the mobile gaming industry. Let’s take you to the next level!

Rise of Real Money Games and E-sports

Real money making games (including sports-based fantasy leagues) and E-sports have solved some of the above-mentioned problems. The LTV of a real money game/e-sports player is expected to be much higher than that of the casual game player.

E-sports have brought another major change – an increase in the number of active years. Life of a game has considerably extended. More and more games have been introducing season releases (once in a few months). The developers introduce exciting changes to the game aesthetics, gameplay mechanics, and new limited-time game modes.

Some E-sports have attained massive popularity in India. Take PUBG for example, It earned around $80 MM in revenue from Indian users in 2019. PUBG has a massive user base in India and its tournaments have become so mainstream that you can find tournament tickets on popular ticket booking platforms like Bookmyshow.

RMG/E-sports might find it easier to build loyal customers and help game creators to take it beyond fad as people will keep playing to earn more money. But with an increase in the number of games, demand is sure to get distributed among different games. This limits both the number of active players and the retention rate for a company and also creates uncertainty for an investor. We believe this has given rise to a new model – platform-based gaming.

Platform-based Gaming Model

Gaming platforms provide users with multiple games. The platform is an all in one application where users can play multiple games without having to download all of them separately. It can be thought of as the Swiggy/Zomato of the gaming sector.

This type of model solves two very important problems. It helps companies reach a wider user base while increasing the overall retention period. Secondly, it decreases uncertainty for investors. Gaming platforms are more similar to other consumer-tech platforms and this gives investors more confidence. Maybe this is the reason, investors have become more comfortable with the sector. Gaming platforms are gaining traction and recently a lot of big players have entered the market. Some of the major players in this category include Mobile Premier League, Gamerji, and Paytm First games.

Like in all other consumer tech platforms, we believe network effect will play a huge role in deciding who rules this multi-billion market. Greater the number of people, greater will be the prize pool and thus higher the rewards. Surely the market is big and there is room for multiple players but as we have seen with other consumer tech platforms, the platform with maximum active users always has an edge.

This is why we are seeing huge marketing spend by these companies. For instance, MPL has spent hugely on TV advertisements( )and other marketing campaigns so much that in the month of April it was one of the major buyers of TV ad space. Only time will tell whether MPL will sustain this advantage and reap benefits of the marketing campaign or other players like Gamerji and Paytm first games will give MPL a tough competition.

What Lies Ahead?

Gaming in India is at an inflection point and both the projected growth rate and investor’s interest justifies this. Although at a nascent stage, even telecom companies are focusing on the gaming market to increase ARPU as per BofA securities report.

“Gaming will be bigger than movies, music and television shows put together”- Mukesh Ambani

You ought to take statements seriously when they are coming from Mukesh Ambani. This also shows the enthusiasm running among Indian conglomerates.

The impact that mobile gaming has created on mobile companies is significant as well. Several mobile devices have been launched in the market in the last 2 years with a prime focus on gaming. ROG phone 2 by Asus and Razer phone 2 are some of the mobile gaming phones launched in the high-end category. Xiaomi Black Shark and Nubia Red Magic have been introduced as gaming phones in mid-range. Although there are no gaming-focused phones in the low range category, more and more companies are including gaming performance as a feature in their advertisements. Gaming accessories like mobile joystick and gamepads have become popular products as well.

New revenue streams such as live telecast of E-sports championship, merchandises are likely to emerge as the number of active players and the craze for E-sports increases in India. Loco which is an Indian game streaming platform witnessed 20 per cent growth (month on month) in new users in the first 4 months of the year 2020. Loco also plans to host multiple tournaments and produce non-fiction shows on gaming in order to strengthen the E-sports ecosystem in India. In 2018 itself there were over 11 gaming channels in India with over 1M subscribers on YouTube and around 50 channels between 500K and 1M. Increasing traction for gaming videos on YouTube shows that the market is ready for such new revenue streams.

Indian Market has huge potential both in terms of the number of users and ARPU. As of 2018 average revenue per user of Indian mobile gamer was $ 0.78 which is significantly lower compared to other BRIC markets with China leading at $25.17 and Russia being the second-lowest at $4.9. The Indian gaming market has a huge demographic advantage with 60% of online gamers being under 24 years of age. With a significant youth population, increasing disposable income, growing acceptance of mobile gaming, and potential for new revenue streams, the gaming market is sure to clock new high scores/playing and streaming games are bound to become mainstream.

Who knows, we can see Bollywood celebrities bidding for ‘E-sports’ teams in future.

This piece is contributed by Rishabh Salgia.

1 comment