Now that we are back from our vacation, we thought it would be great to talk about a company that’s built around vacation experiences. We’ve chosen the the biggest of them all, AirBnb

I am sure you must be wondering why we are talking about AirBnb today. I get it. It’s a huge company that can barely be called a startup anymore. It was founded way back in 2008, it’s already one of the most talked about companies in the world. Almost everybody’s heard the crazy stories about how founders Brian Chesky and Joe Gebbia sold $30,000 worth of breakfast cereal – Obama O’s and Cap’n McCains – before they managed to get the $20,000 investment from YC. It’s all real. AirBnb even went public with their IPO in December 2020 amidst Covid-19 at a humongous $47 Billion valuation, and is now worth over $90 Bn after its Q4 earnings released.

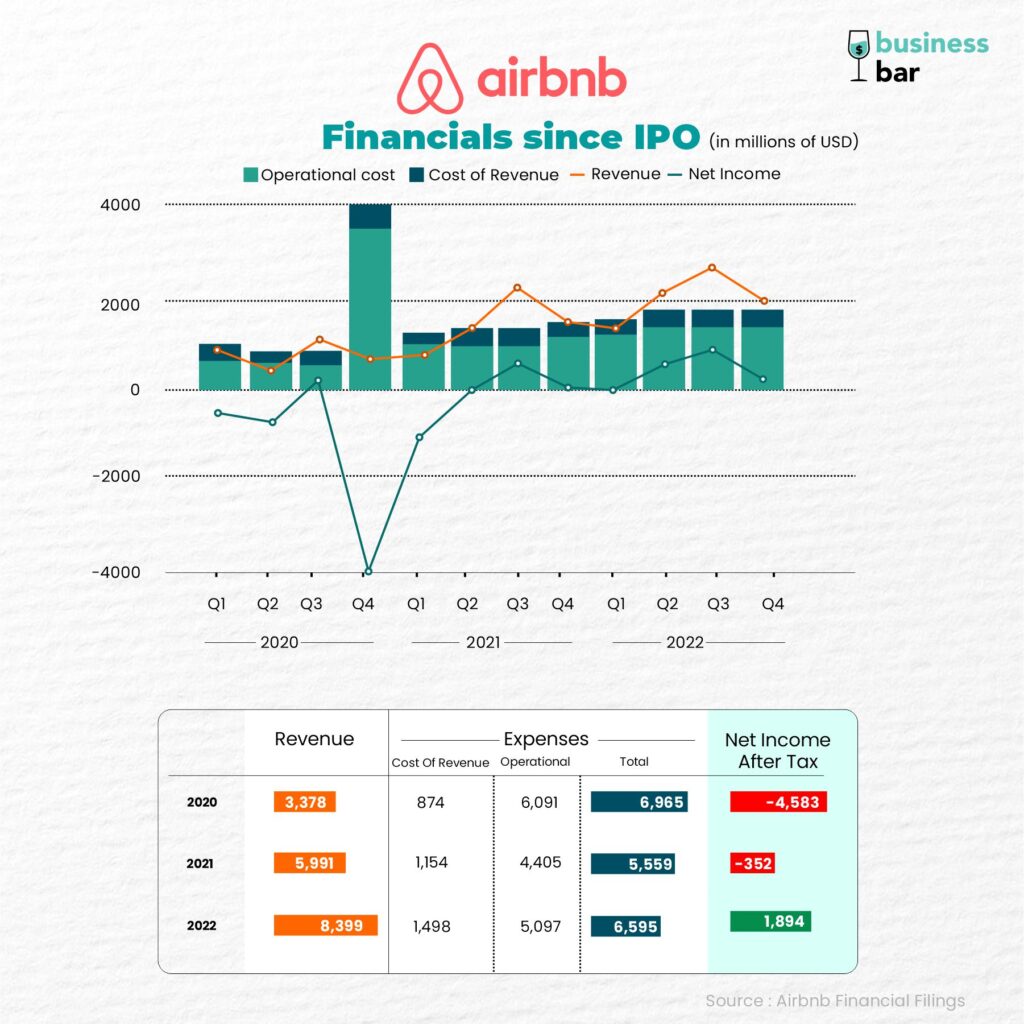

While AirBnb did not manage to turn profitable even after 14 years of operations, it has finally turned things around this year, and in great fashion. Its net profits for 2022 are $1.89 Bn (₹15.6 thousand crores) after taxes, out of which Q3 alone accounted for $1.2Bn (₹10 thousand crores), its highest ever quarterly performance. Wait what?

You must be thinking –

“That’s almost 5x the money Zerodha, the darling of Indian startups, makes in the whole year, and AirBnb does that in only 3 months?”

Well, yes and no.

First of all, Q3 has historically been its best performing quarter, accounting for 35-40% of its annual revenue each year. That is also reflected in the $319Mn net income in Q4 2022. However, something interesting reveals If we compare Q3 of 2022 to that of 2021; revenues jumped by 29% but the net income jumped by a whopping 45%. This is a testament to the economies of scale in the digital economy, which we want to draw attention to in this edition.

In the case of AirBnb, for every $100 that it makes in revenue, it spends an average of $15 directly as the cost of revenue (payment processing costs, data-centers, servers and 3rd party services etc used to carry out that booking). That is an 85% gross margin.

The other, and more significant costs, are the operational expenses that include salaries, sales, marketing and product development. In a traditional company, you would have to deploy huge manpower, and establish checks and balances at each level to handle billions of dollars. The manpower requirement would also increase with more money coming in. However, for a technology led company, a lot of these processes are automated, and actual human workers needed are far less. This is reflected in AirBnb’s operating expenses which have largely stayed in the range of $1Bn to 1.3Bn per quarter irrespective of whether it makes $800Mn or $2.8Bn in revenue.

After a certain scale, every dollar of revenue adds more to AirBnb’s bottomline than the previous. And the process to get to that scale is treacherous which is why also most startups fail. AirBnb itself has accumulated over $6.35Bn in losses over the 14 years of operating, before it finally made it into the green territory.

Airbnb as a platform has reached the critical mass required to make sense of its valuation and even make it seem under-valued at some points. With the network of hosts and guests benefiting from a virtuous cycle, Airbnb has grown from 2,500 properties listed and 10,000 users in 2009 to ~6.6 Mn active listings and 400 Mn nights booked in 2022.

With 85% gross margins and now that the scale is reached where operational expenses are covered by the revenue, every additional $1 of revenue adds roughly $0.85 to AirBnb’s net income. Effectively increasing the net margins as well.

Investors have seen this happening years in advance, which is why AirBnb is currently more valuable than Marriott International ($54Bn) and Hilton Worldwide ($40Bn). This is because Marriott is an asset-heavy business with gross margins of only 15% – 20%, compared to Airbnb’s 85% . Although 20% is a healthy gross margin for any business, it is no match for technology led companies at scale.

Along with being an online booking website, AirBnb has also created a new category of stays, which have now become synonymous with its name. Especially in markets where hotels are under-represented i.e. coastals(beaches) and mountains. Further in the post-pandemic era, the trend of working from anywhere has seemed to have persisted with people taking more frequent breaks to work from those coastal beaches and hilly areas.

Not surprisingly, the “Average Daily Rate”, rental income earned from an occupied room per day, for AirBnb at ~$150 is already on the verge of beating the ADR of $148 for hotels in the USA.

With a Net income of $1.9 Bn this year and valued at $90Bn, that is a Price/Earnings multiple of 47. ARR is expected to grow at 16% – 21% YoY, and with that net income would grow at roughly 30% if not more. With accumulated losses of Airbnb over the years at $5.9Bn, this is as encouraging as it can get.

In approximately 2 years time, Airbnb will achieve a lifetime break even, 17 years after founders Brian Chesky and Joe Gebbia first welcomed guests into their homes. It also took $11 Bn of investors’ money and 15 years to finally break into profitability, in addition to the constant effort of founders and all their early believers to make this happen.Did you like this? You can also check out our posts about the business models of MakeMyTrip and the Aviation Sector.