“If banks cannot truly be customer intimate, they are doomed to be just dumb commodities, acting behind the scenes, like utilities.” – JP Nicols, serial fintech entrepreneur

In case you are wondering if the quote above sounds familiar, you are right. We used this in our previous FinTech Industry Pitcher on Neo-banks. Only one pitcher doesn’t do justice to the ever-changing landscape, which is why we are back with another round. This time, instead of focussing on UX obsessed Neo-banks, we want to talk about Fintechs that is all about working behind the scenes but are much more than commodities.

We are talking about FinTech API companies like M2P, Zeta, Setu, Decentro, Niro and many more. You’ve probably never heard of them but this is what Akash Sinha, the co-founder of Cashfree Payments, a leading payments platform in India had to say about them,

“The front office of tomorrow will be apps, the middle office will be API, and the back office will be analytics.”

Fintech Enablers

Almost every tech business be it Amazon, Google, Airtel now offers a payment service blurring the lines between Tech and FinTech. Even insurance is now embedded when you book a cab, or a flight, or even purchase products on Amazon.

Embedded finance is enabling businesses to offer FinTech-as-a-service (FaaS) within their native product. Much like how airlines all over the world offer co-branded credit cards to build loyalty as well as generate additional revenue streams.

This has given rise to new entities – FinTech enablers. They are B2B companies that provide convenient infrastructure for anyone to build and offer financial products and services in less time.

Within the FinTech enablers, there are FinTech API companies that build APIs – allowing systems to talk to each other in a structured manner. This minimizes the hassles of bank integration and makes it convenient and less time-consuming for even non-financial businesses to offer financial services within their product.

Every consumer business like e-commerce, travel & tourism, accounting software has troves of data that it can monetize by offering customized credit products, increasing the lifetime value of customers. API-driven banking disrupts the digital finance infrastructure globally and deserves more attention.

With this transformational change heading our way, we look specifically at the FinTech API businesses within the enabler ecosystem operating in India that are leading the shift towards enhancing the banking infrastructure and establishing themselves as an indispensable bridge between banks and FinTechs.

What is an API?

For the uninitiated, let’s break down what is an API? API or Application Programming Interface is a piece of code that allows two applications to communicate with each other and share data. We are surrounded by APIs and it is impossible to imagine today’s world without APIs.

Each API has a URL (called the endpoint) and documentation, the reference manual that is meant to be read by developers to understand how to consume the APIs. A well-designed doc clearly establishes the expected inputs and outputs for better developer experience and demonstrates the technical strength of the team.

How APIs are useful?

Perhaps, the most ubiquitous example we can use here is the Google Maps API. Many businesses rely on Google Maps for delivering the best service to their customers. When you book an Uber, the app shows you the route to your destination. It would be hugely expensive for Uber to build its own Maps, and hence it pays Google a fee to access its services.

Uber shares your pickup and destination with Google Maps through its Navigation API endpoint and requests for the most optimal route between those points. For each such ‘request’, Google charges Uber a very small fee and that is how both stay in business.

Now just imagine the impact if someone builds out an API for creating a bank account? You would be able to open bank accounts with the click of a button that sends out an API request. That’s what neo-age banks do. For example, the neo-bank Fi uses the onboarding APIs provided by M2P, a 7-year-old Chennai-based startup, as building blocks which in turn leverages the Banking APIs provided by Fi’s banking partner, Federal Bank.

Banks and FinTechs create and expose APIs for every small task. There are several such use cases like KYC verification and money transfer. The interoperability and modularity of this infrastructure unlock a myriad of business models.

Just as Google Maps allowed Uber, Ola and many others to embed navigation which is their most crucial aspect, such APIs allow almost any business to embed finance within their business, like the OLA money wallet. What extra benefit does it provide to OLA to operate this wallet? We’ll come to that in a bit.

Indian Fintech API Landscape

The FinTech landscape in India has long been synonymous with consumer FinTech. This is because it addressed customer experience which has been the Achilles heel of traditional banking. With the pace of innovation in B2C, consumers came to expect largely similar experiences that led to the commoditization of the space.

Hence, the real value in the next decade will be unlocked in the B2B space with companies that combine the agility and creativity observed in consumer FinTech with the flexibility needed to make an API infrastructure useful across several industries.

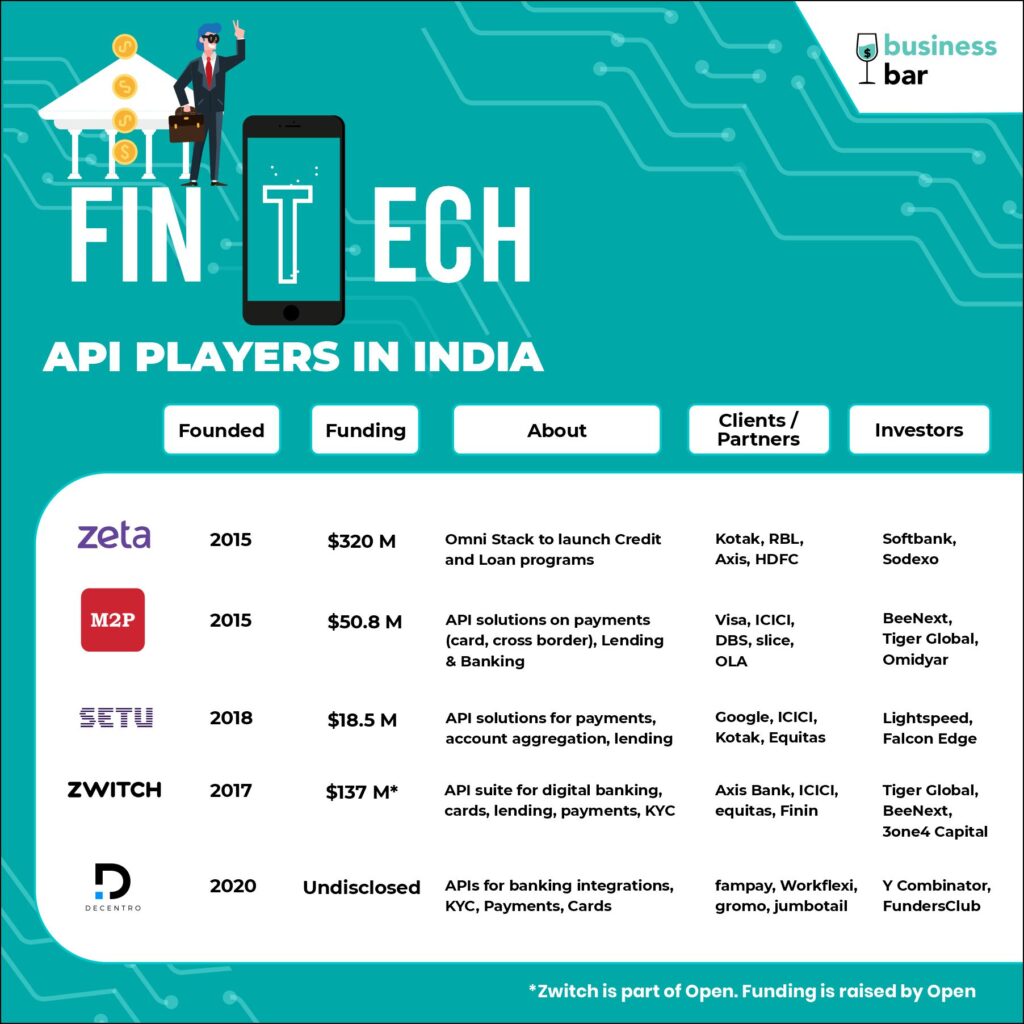

FinTech API companies, although still in nascent stages, have raised significant capital over the last couple of years. M2P Fintech, founded in 2016, raised its $35Mn Series C round at a valuation of $335 million led by Tiger Global in October this year and is already in talks with Insight Partners for a fresh round at a nearly double $600 million valuation. Eminent FinTech founders Kunal Shah (CRED), Amrish Rau (Pine Labs) are already angel investors in the space, adding credibility to potential.

Zeta, a much more global player, operating in North America, the UK and Europe, recently became a unicorn with a $250million Series C from SoftBank valuing it at $1.45 Bn. Founded by serial entrepreneur Bhavin Turakhia in 2015, its approach has been quite different as it focuses heavily on working with banks on their infrastructure, compared to other API providers.

Setu and Decentro are much younger players in comparison. Being a Y-Combinator backed startup allows Decentro to tap into a much larger industry experience pool. While Setu raised a $15Mn Series A round and is using it to aggressively expand its product suite.

API Products in FinTech

The ever-expanding scope of these FinTech APIs can be broadly divided based on the product suite they offer as Payments, Lending, Data, and Investments & Banking

Payments

Payment APIs allow anyone to integrate bill payments, UPI payments, card and wallet issuance, recurring subscriptions and forex payments within their apps. These integrations allow non-finance companies like OLA, a customer of M2P, to go to market with their OLA Money wallet much quicker without re-inventing that wheel.

These payment abilities offer businesses an additional point of engagement with their primary user base. Another significant advantage of these APIs is that the user experience is consistent with the rest of the app, avoiding a separate payment gateway to complete the transaction.

Take the example of issuing branded debit cards. Establishing relations alone with Visa and Mastercard alone takes 4 months on average, followed by tech development. Issuing cards with an API partner like M2P cuts that time to 3 – 4 weeks according to industry sources. The turnaround time can be as low as 1 day in some cases if you are already in the business with API partners.

M2P Fintech offers the most comprehensive suite of payment APIs. M2P Fintech has quickly grown to become one of the largest providers with 200+ FinTech partners in the APAC region. It counts Open, Slice, Finin and Razorpay among its customers.

Setu on the other hand only enables businesses to collect dues on any bill payment and generate receipts as of now. Decentro allows one to collect payments via QR codes and generate payment links and is in the process of category and product-wise expansion.

Zeta has built out prepaid cards in India while it also offers credit cards in the US. Fampay, which offers card payments for teens is a customer of Zeta for its prepaid cards

Lending

Take the example of a small shop owner in a tier-2 city of India who uses simple accounting software to manage her business. She needs a small business loan and has to convince the bank about her shop’s financial health to get the loan. Alternatively, she can apply for a loan online through PayTM or Lendingkart but still has to establish her creditworthiness. Who is in the best position to grant her the loan? It’s obvious, the accounting software. It has all the data it needs to judge her financial health. And guess what? Khatabook announced venturing into lending on its platform earlier this year.

For consumer internet companies, lending is an amazing tool to generate engagement and revenue from their existing customers. Just like Khatabook, Pagarbook offers loans to SMEs, Zomato to restaurants and BharatPe to its merchants to monetize their vast merchant base. This way lending becomes a feature, albeit important, on most apps, rather than a separate business. Lending has various forms. It could be a loan, a Buy Now Pay Later (BNPL) service, or even a credit card.

Setu allows any company to use its API to generate leads for their banking partners and take them through pre-built customer journeys in their loan applications. On the other side, Setu onboards banks to modernize their banking APIs and offer them leads on customers that need credit.

Decentro offers a much more full-fledged service with the ability to manage cash-flows and repayments. Decentro has already partnered with ICICI bank as its lending partner. The partnership also extends beyond lending with Decentro building its own APIs using ICICI’s banking APIs.

On the other hand, M2P and Zeta have built out suites only for BNPL and credit cards avoiding the loans segment altogether. They provide customized white-labelled virtual and physical credit cards and allow customers to control the branding as well as all other aspects of credit card management.

M2P recently also acquired the credit card management app Wizi, to help banks with sourcing customers after noticing that most banks did not have digital origination capabilities or even mobile interfaces for customers.

Zeta is the most bank-focussed player and works extensively with them to offer credit products including BNPL, and also provides personal loan management tools. It already counts the biggest private banks, HDFC and Kotak, among its clients in India.

BNPL is the fastest growing mode of payments in India, even surpassing UPI in some sectors. During the recent festive sales, both Amazon and Flipkart witnessed a 10x surge in their BNPL sign-ups. Flipkart said that BNPL also surpassed UPI for its platform. Both M2P and Zeta allow companies to launch their own BNPL facilities.

Data

Account aggregators (AAs) are RBI-regulated entities that aggregate all financial data of a customer with his/her consent. It was proposed by the RBI to regulate secure data sharing between entities with the verifiable consent of the user. PhonePe and CAMS Finserve are among the only 8 licensed AAs in India as of now. This aggregated data is beneficial for banks, lenders, insurers, and other financial bodies to make better decisions about their customers and unlock value. It is also convenient for a customer to simply share its data through an AA rather than again providing documents. Customers can also revoke access to such data at any point. eg. after they receive the loan.

“Once all the building blocks are in place, and we are able to get everyone connected on the same platform, then magic happens and things take off…We saw that with UPI” – Nandan Nilekani on Account Aggregator framework

Account Aggregators have their own APIs to manage data. Major banks in India have already joined the AA network. Setu has aggressively become the first and only FinTech API company to have partnered with some licensed AAs. It has launched its APIs in a sandbox (testing environment) mode to allow companies to leverage the value-added through this enriched customer data.

Source: TechCrunch

Investments & Banking

Banking APIs involving digital account creation and management are one of the major focus areas in the FinTech API space as they offer long-term customers for the APIs. These are built for Neo-banks to build their own digital bank and it is extremely difficult for them to switch API partners that are so deeply integrated compared to other use cases.

The API suites offer digital KYC onboarding services, debit cards, gold, fixed and recurring deposits among other building blocks for retail Neobanks to significantly reduce their development time. These companies also partner with multiple traditional banks so that their Neo-bank customers can integrate with the bank of their choice.

For example, the neobank Finin, founded by ex-Google Pay employees, uses Federal Bank as its banking partner and is a customer of M2P which has also integrated Federal Bank.

Cashfree, the payment gateway, also entered this space with their Banking-as-a-service product for Neo-banks. This is remarkable as major existing players from other segments of FinTech expand into the API-banking space. Cashfree also raised strategic funding from SBI at a $200Mn value indicating strong investor backing.

Decentro is the most comprehensive provider here with APIs for virtual and business accounts as well. Virtual accounts are used for collections from customers and payouts to vendors, while business accounts are corporate accounts that contain multiple virtual accounts. Its clientele includes wholesale food and grocery platform, Jumbotail, alternate credit platform, Blacksoil, GST account software, Vyapar, and payroll manager Pagarbook among others. This further reinforces the fact that these API suites act as Fintech enablers, unlocking value in any and all industries.

Although APIs offer only a fraction of the investment options available in the market, it is attractive to some players. Google recently partnered with Setu to offer FDs on its platform as smoothly as a UPI payment on Google Pay. Small value-added services like these are important monetization tools for UPI-based Fintechs like GPay and PhonePe as they earn no fees for UPI transactions.

FinTech APIs: Global Players

Plaid, founded in 2013 in the USA, simplifies the banking systems via its APIs making it simpler for any company to deal with accounts and transactions. Plaid raised an eye-popping $425 million in April this year valuing itself at an astronomical $13 billion dollars. But that’s not why it made headlines.

Earlier this year, Visa’s attempt to acquire Plaid for a paltry $5.3 billion fell through due to antitrust litigation. This was Visa purchasing insurance against disruption as Plaid enabled businesses to run transactions without using the Visa and Mastercard payment rails. Anti-trust is a tool that is famous for giving the likes of tech behemoths Microsoft, Facebook a rap on the knuckles from time to time. The fact that Visa was a little threatened by Plaid’s business is a testament to its immense potential, demonstrated by a 60% increase in Plaid’s customer base since.

Another API-centric company Stripe, started out as a payment gateway, has built out its services to operate within the skins of other consumer Fintechs. Founded in 2009, it is now Y-Combinator’s most valued startup at $95 billion dollars and one of the most admired organizations globally.

The global open banking API market size is estimated to be $43Bn by 2026 growing at a CAGR of 26%

Challenges and Opportunities

The B2B space was essentially dominated by the banks, but the non-banks that offered improved efficiency, convenience and costs are attempting to carve out a rather thin slice of a big pie for themselves and the banks are now looking to partner with them.

With Banks and Fintechs both customers, there are numerous opportunities out there. Working directly with legacy banking infrastructure is something that nobody looks out for. Banks that fail to upgrade will fall behind. We already see them up to their act with ICICI and Axis partnering with FIntech APIs to become preferred partners.

It is a widely accepted notion that banks and FinTechs will be indispensable partners to each other. Banks need Fintechs more than ever to expand their business to the newer generations, and Fintechs need an RBI-regulated partner to offer credit.

It is common for any FinTech to work with numerous providers for different aspects of their business. Hence, any FinTech is likely to have more than one API partner which suits their needs as well as for redundancy. This is a double-edged sword as it is fairly easy to switch partners. What builds a competitive advantage in this space?

The API providers, like any B2B business, can expand either horizontally or vertically. The competitive edge becomes bigger with more products as they can enter into strategic collaborations with customers. They also become more important as a larger share of the customers’ business flows through them.

The other option is to expand vertically as M2P did with Wizi, going deeper into credit sourcing. This has played out well in the payment gateway space where Razorpay optimized its products for small and micro businesses to such an extent with Razorpay X that it is difficult to compete with them. Similarly, there is Karza that has built expertise for regulation-tech like deriving insights from GST and ITR filings of businesses.

The relations between companies and such FinTech API providers or enablers are also to a certain degree dependent on team strength and founder relations. Strong relationship managers are able to maintain and compound relations over time resulting in deeper partnerships that are difficult for either to move away from.

Banks usually dictate strict limits on the usage of their infrastructure, and API providers that have better relations with banks might become deal-breakers as they promise better availability.

From an investor’s perspective, these API middle offices are exciting prospects for both banks to move up the value chain, and consumer Fintechs to become a deeper player. It will not be surprising to witness acquisitions happening on both sides of the ecosystem.

The key challenge for these API-led businesses is to avoid becoming commoditized like the banks they seek to replace. One would expect that the open nature of these APIs itself will lead to some sort of convergence in the products as the players will look to adopt the best parts of each. It will be interesting to observe what goes on in this playground. It might boil down to who provides the smoothest onboarding, fastest sales cycles and has better backing from banks, which might be hard to replicate across the table, unlike the tech that they are all about.

Whatever happens, India is leading the FinTech revolution in the world with digital payments and if B2B is the new frontier of disruption, it won’t be long till we see some of the Indian FinTech API companies use their homegrown experience to build FinTech solutions for other countries across the globe.

This piece has been authored by Yashvardhan Didwania and co-contributed by Preet Singh Khalsa

Analytical tools for trading binary options – https://binary-trading-in-india.club

binary signals

It is very interesting to read about binary options, analytical tools for trading binary options, binary signals.

https://www.misterpoll.com/users/2034080