“If banks cannot truly be customer intimate, they are doomed to be just dumb commodities, acting behind the scenes, like utilities.” – JP Nicols, serial fintech entrepreneur

India’s FinTech sector has come a long way from merely automating financial services to disrupting the mainstream financial systems through various innovations across payments, banking, and financial management. The sector has raised more than $10 billion in the last 5 years while the market is estimated to grow from $31 billion to $84 billion by 2025 with a CAGR of 22%. Its growth can be attributed to a large addressable market, internet and smartphone penetration, and a significant technology talent pool. The most significant factor, however, is government initiatives and regulatory forbearance. The Indian consumer has been welcoming digital payments, and it is not surprising that payments have seen the lion’s share (more than 40%) of fintech funding. Indian Stack (Aadhar, UPI, eKYC, Digilocker, etc.) has powered fintech innovations and growth. In 2020, more than 4 lakh crores worth of transactions were done via UPI alone. Payments are followed by lending (25%), wealthtech, insuretech, and personal finance management. The penetration of digital payments is also a crucial foundation for other sectors to thrive, including lending, e-commerce, food delivery, and the likes.

With so much interest in the field in the last few years, one may be tempted to ask if the FinTech story is getting past its prime. On the contrary, it is reinventing itself with the ambition to bring about a paradigm shift in the financial system and the most exciting segment – neobanks (or challenger banks) is leading the way.

What exactly are Neobanks?

Neobanks are digital-only banks with no physical branches. Okay, but banks already offer net-banking, and most banks have their mobile applications such as YONO from SBI and 811 from Kotak. So, how are Neobanks different for the users and why do they even exist?

Neobanks are essentially the digital or mobile-only fintech firms that offer personalized banking experiences which traditional banks or even payment banks cannot. These digital solutions range from banking services (like accounts, loans, transfers, cards, etc.) to recommending financial services based on lifestyle choices (such as spend analysis, automated saving, etc).

The biggest asset of banks is the trust that consumers place with them manifesting in the deposits they make. This asset is depreciating, especially with GenZ and millennials. Banks offer hundreds of services that are the same for both 16 and 80-year-olds alike, though their needs vary. GenZ and millennial users are far more comfortable making big-ticket transactions on mobile. In the enterprise segment, almost every organization and employee is frustrated with the complexities of GST, reimbursements, allowances, vendor payments, international payments, and the likes.

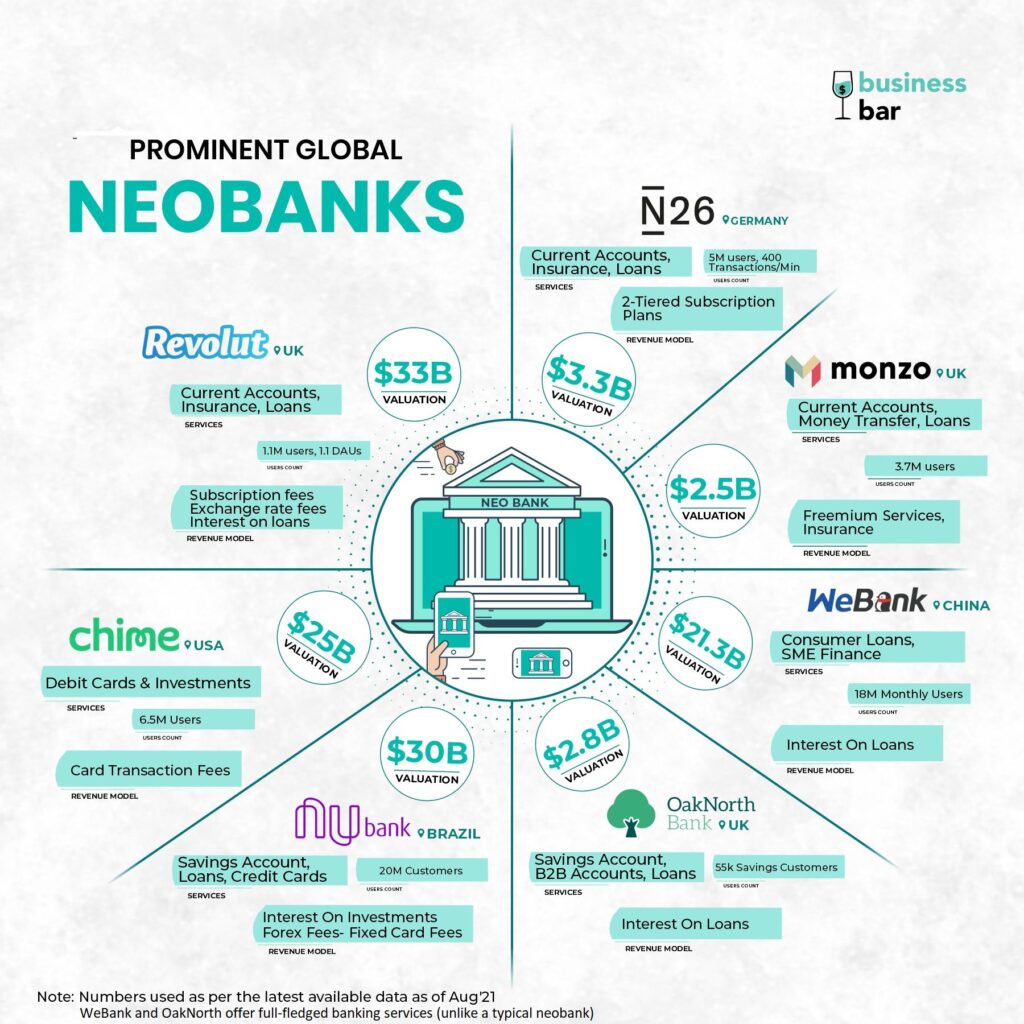

The pain points are worth solving and represent a vast addressable market. Hence, it is no surprise that activity and chatter in the neobanking space have taken off, as they do just that! The optimism is also partly due to the success of neobanking in other countries such as the UK, China and USA. Globally, neobanking is expected to grow at a CAGR of 47% and is on track to become a $330 billion market by 2026. In India, neobanks have raised $250 million and attained significant traction in all segments, including enterprises, startups, and individuals.

Banking beyond walls: Indian Neobanking landscape

With increasing digital literacy and huge opportunity to cater to the underserved population, business model innovation is sprawling in the sector. The products that Neobanks are building can be divided into three broad categories based on the stakeholders they serve: Enterprises, Retail users, and Banks.

1. Enterprise Segment

Neobanks offer the easiest way to integrate banking, payments, accounting, expense management, and budgeting. These integrations can improve the efficiency of the business process multifold in many ways. Imagine being able to make vendor payouts and salary payments by uploading an excel containing a list of accounts and amounts without adding beneficiaries manually. Moreover, plug-ins with accounting software can auto-update your accounts and auto-categorize expenses. In addition, you can create multiple virtual cards with pre-set limits and rules for each team or individual working in your company. It is as simple as it gets.

Open, a neobank founded in 2017, acquired 3,000 businesses in 3 the first months itself and has raised over $35 million to date. Currently, with 1crore+ businesses as its users, it claims to be the world’s fastest-growing neobank. RazorpayX, the neobanking arm of the payment firm Razorpay launched in 2018, claims to reduce the time taken to process payments by 95% while achieving a 30% reduction in payment and refunds related customer support tickets for its users. It integrates with Zoho, Tally, and Quickbooks to offer a great experience to its users.

2. Retail Segment

Let’s take an example of a typical millennial or GenZ, who orders frequently on Swiggy or Zomato. To calculate how much she spends on food monthly, she must open the payments app and manually add all transactions. Not surprisingly, she is unaware of how much she spends on food. As she has entirely stopped using cash, her bank account is also full of small-ticket transactions and is very cluttered. Neobanking apps provide insights that users didn’t know they needed and help them take actions they never could before.

In this case, a user can set rules for herself such as creating different pots like ‘Ladakh trip,’ ‘Birthday,’ etc. She can thus automate saving into these pots each month and experience gamified savings. Neobanks nudge their users to save more (and thus increase deposits in their balance sheets) by giving them rewards for saving and meeting their goals. One can also create rules for self such as “Each time I order from Swiggy, move Rs. 100 to the savings pot” and get AI-generated personal insights such as “You spend 20% more in the second week of the month compared to other weeks of the month.” If this was not enough, you also get an insightful spend dashboard, easy credit, and a sleek brag-worthy card.

Neobanks are basically tapping into the tech-savvy market segment that is highly underserved, due to the need-supply gap and hold potential to disrupt the financial services sector in the coming future. Jupiter, for example, targets salaried millennials and offers services like spend analysis, auto-saving, smart cards, wealth management and many others.

3. Banks

Traditional banks in India are more proactive in digital products compared to global banks. Their investments in technology, however, cannot keep pace with consumer expectations. Consumers have gotten used to the convenience, personalization, and user experience offered by Swiggy, Flipkart, and the likes. They are looking to discover what they want. They want seamless onboarding, hassle-free account opening, personalized debit and credit cards, and much more. This is what neobanks in India are aiming to deliver.

A significant obstacle, however, is that RBI doesn’t issue virtual banking licenses yet. Thus, neobanks must partner with traditional banks to offer banking services. Not surprisingly, banks have been forthcoming in partnering with neobanks. Initial analysis suggests that neobanks significantly reduce acquisition costs and risks. An end-to-end digital product has low marginal costs, can scale up easily, and lending models built on bank-account transactions can boost risk-adjusted returns. A further look, however, reveals that banks partner with neobanks not only to reduce costs but also to drive propositions. Banks can increase adoption, engagement, and retention of consumers by delighting them and cross-selling to them. Neobanks can combine banking and finance, including expense management, personal finance management, automating recurring transactions, and improve users’ savings and spend behavior. The relationship between a bank and a neobank is symbiotic. Neobanks can learn about managing regulation, compliance, KYC, and risk assessment, while banks can learn to be customer-centric and agile.

Banks play a passive role in the models stated above, and the neobank owns the user. Another exciting business model in the boundaries of the neobank space is selling tech stack to a bank. For example, Zeta offers banks an Omni-stack with customizable modules including credit and debit processing, mobile applications, virtual cards, expense management, loans, and a family hub where families can share funds and expenses. Banks can pick and choose the features it wants to offer to its users. This allows banks to provide their users a neobanking experience without giving away control to partner neobanks.

Neo-age business models

Having discussed all the cool stuff about this space, one may be tempted to ask this question “how do they make money?”. Well, the answer is still unclear since the industry is still in its nascent stage and business models are continuously evolving. However, looking at the more mature markets in the developed countries, we can at least talk about the potential sources of income that may be relevant for the Indian market today.

The subscription-based or freemium model offers a slew of free services to the user and charges subscription fees for the premium features that users would want to use on the platform. This is more relevant for the companies that offer a one-stop shop for financial needs which opens gates to monetize service integration. Revolut, UK’s most valued neobank ($33B), has subscription plans which offer additional services such as free ATM withdrawals, custom cards, unlimited forex transactions, etc.

Instead of directly catering to the customer, some companies work on the Banking-as-a-Service (BaaS) model where they offer digital services to other fintech companies and traditional banks.

Another popular model is catering to the businesses, which includes simplifying their payments, accounting, budgeting, and expense management experience. Business banking is a sweet spot in this category as measuring the credit quality of businesses, especially SMEs, is much easier than that for individuals. The UK’s neobank OakNorth is a good example of a highly profitable company operating in this segment. It became the first neobank in the UK to breakeven within just 2 years of its operations and earned £78M of pre-tax profits in 2020.

The space is constantly evolving with high sensitivity to the customers’ needs and technology. Adjusting to these demands has necessitated many companies coming up with their niche offerings different from the models we discussed above.

Despite the variety of business models and ways to monetize, it’s not very easy for neobanks to achieve profitability. Neobanks face a growth vs profit dilemma. In the UK, for example, in order to achieve 3-digit user growth, an average neobank spent £20-50 against the revenues of £5-15. Though aggressive spending in marketing can be cut to move towards profitability, it may hamper its growth in a highly competitive environment.

The space has great potential as it addresses a pressing problem and promises a drastic improvement in user experience. However, there are also some risks associated that are worth considering to understand the space. Let’s discuss some of the pertinent risks.

Key challenges and risks

Firstly, Neobanks are reliant on their relationship with banks, and how it evolves will define the space. Secondly, The regulator has been accommodative of fintech innovation so far and is likely to remain. Yet, one bad actor in the neobanking space can make dealing with the regulator more challenging.

Thirdly, neobanking is not a sector where an individual is a multi-app user as in payments or food ordering. Users typically have both Ola and Uber installed on their phones (similarly Zomato and Swiggy, and Paytm and Google Pay); this makes adding users easier. In neobanking, there seems to be a hard-line divide between users, making competition harder, as more and more neobanks crop up.

Fourthly, there is a business-model innovation risk, as well. In Europe, the neobanks started by solving cross-border payments. In the US, initially, they solved for credit. In Latin America, they offered full-fledged banking services. In India, traditional banks have a decent digital presence, and other fintechs have crowded most segments. Additionally, the third segment (offering tech-stack to banks) directly competes with the other two. It remains to be seen if neobanks can find their thin edge of the wedge.

Given the complexity of challenges in the space, investors have primarily backed very seasoned founders (serial entrepreneurs or experienced executives). It is still early days for the sector, with business models and products being refined each day. It is, however, safe to be bullish on neobanks. The question is which firm will get it right at the right time.

What lies ahead for the banking space?

When this article was being written, Jupiter (India) raised $44 million, a month into beta testing, in a Series B round led by Brazil’s Nubank and USA-based Chime raised $750 million valuing it at $25 billion! These events have brought several neocards and neobanks into the limelight. Neobanks have become the torchbearers of the new wave in the Indian startup ecosystem and the competition and acquisition efforts are expected to intensify in the coming future. Some of the brightest growth marketing and product development minds in the country will be working to get the smart neocards and applications in our hands. This is justified for two reasons: a) switching bank accounts is a hassle and b) covid-19 is a powerful tailwind that has accelerated digital adoption.

Moreover, the market potential is huge, India has over $2 trillion of deposits. Beyond SBI, which accounts for 24% of deposits, the market is extremely fragmented and is ripe for disruption. With Jan Dhan accounts, nearly 80% of Indians are now banked, creating an opportunity for the co-existence of varied banking players. Customers today want personalized services. And neobanks have the power, in theory, to transform India’s problem-ridden banking sector but with great power comes great responsibility. A small outage or a technical glitch can push back the industry. Neobanks must also carefully manage relationships with a mirage of players including banks, insurance companies, lending firms and more.

Whatever happens, one thing we can be sure about is we, as a customer, are going to benefit from the fundamental changes in the way we bank and neobanks are certainly going to play much bigger role in this transformation.

This article is co-contributed by Rahul Jain

4 comments