Athleisure is a relatively new fashion trend that has taken the apparel industry by storm in the last decade. An industry that started with designing “leisure” clothes that only resemble fitness (“athletic”) wear, is now a significant growth contributor so much so that you can find dedicated Athleisure brands propping up.

Globally, the desire for practical and comfortable sportswear dates back to the late 1800s. Initially, sports or active wear were merely functional that allowed greater freedom of movement. Chanel was among the first designers to mainstream sportswear in the 1920s, while Claire McCardell’s designs in the 1930s focused on practicality and functionality. As sportswear became more mainstream, the structure of dress codes began to loosen, and the trend toward casual, active styles continued into the mid-20th century.

The boom in fitness during the 1970s and 1980s increased the demand for practical and utilitarian activewear. The increased influence was felt more and more outside the sporting world into general daily wear, lounges and travel wear. Today, athleisure is described as “casual clothing designed to be worn both for exercising and for general use”. With a focus on casual utility wear that is stylish and high performance, athleisure is in the gym, on the street as well as in airports.

We wrote about Luxury Fashion at the start of 2022, and by the end of year the Indian athleisure market crossed $1 billion in net revenue for the first time. Let’s get into it 👇

Market opportunity

Athleisure (or activewear) is a ~$330B market globally and is expected to grow at a rate of 8~10% annually. This is roughly 20% of the apparel market which stands at $1.5 – 2 trillion today globally.

India is the 3rd largest apparel market in the world, after China and USA. The Indian market is ~$70-80B and growing at 9-10% YoY. Of this, men account for ~$30B, women for about ~$25B, and the remaining ~$15B coming from the little ones.

India is well poised for growth in the athleisure segment due to a large and relatively less tapped market. Strong tailwinds from rising e-tail penetration, cost advantage in textile procurement and manufacturing, and upsurge in youthful & sporting activities are some major macro factors contributing to this.

Seven leading brands in sports and activewear in India – Decathlon, Puma, Adidas, Nike, Reebok, Asics and Skechers – sold over $1B combined in 2022, 50% higher than that in 2021.

Fashion at ~$15B is the second largest category in e-commerce. Overall, the organised sector stands at $40B and constitutes ~50% of the industry. Online sales account for~40% of it, while a large 60% of the industry is still unorganised. This presents tailwinds for growth of new-age D2C apparel brands in India.

Lulumelon, a forerunner in athleisure, did $8B+ in sales last year. While 84% of its sales is from North America, sourcing of fabrics and production is largely dependent on Asia. With ~70% of the fabrics sourced from Taiwan, China and Sri Lanka, and ~80% of the production is done in Vietnam, Cambodia, Sri Lanka, Bangladesh and Indonesia.

Asia has a large cost advantage as compared to the west in procurement and production costs, which creates a conducive environment for athleisure brands to flourish.

India has also seen an upsurge in sporting activities across sports beyond cricket such as Kabaddi, soccer, volleyball, hockey, etc. with professional leagues now being host in most of these.

Competition

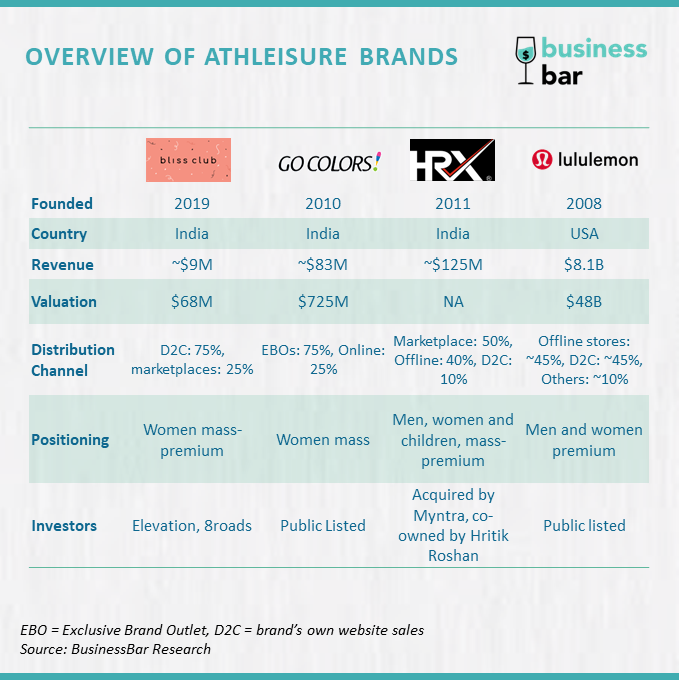

There are a slew of global brands tapping the $330B market opportunity. In India, bliss club has emerged strongly as a dedicated athleisure brand for women in the last couple of years.

Many apparel brands have also ventured into the athleisure space, especially the sportswear brands like Nike, Puma, Adidas, etc. Underwear brands like Jockey and fast-fashion brands like H&M, Zara and Marks & Spencers also now hold athleisure in their portfolio.

Despite many global brands in the space, Indian athleisure brands are filling a huge demand gap. The homegrown brands are more conducive to Indian audience as it takes into account different weather conditions and different body shapes/sizes of Indians.

What does it take to make a successful athleisure brand?

For any consumer product, the brand has to essentially figure out four things – branding, sourcing, manufacturing, and distribution.

Branding: Let’s start with branding, perhaps the most important yet the toughest.Celebrity partnerships and the athleisure industry go hand in hand. The athleisure industry has been able to capitalise on influencer and celebrity marketing in a way that no other sector has been able to achieve. Athleisure brands work with sports megastars and popular Instagram influencers to build their niches and become dominant players in the sector.

Leading pop singers and celebrities have also established their athleisure brands, partnering with leading brands like Puma, Adidas, and Nike to launch limited edition collections. Puma recently announced pop-star Rihanna as their creative director. In India as well, celebs have opened their own activewear/athleisure brands – Hritik Roshan’s HRX, Virat Kohli’s Wrogn, Jacqueline Fernandez’s Just F and Shahid Kapoor’s Skult.

Sourcing: The fabric for athleisure is characterised by breathability, odour control and quick drying which makes it unique. Most of the fabrics used today – polyester, spandex, nylon – are synthetic. Asia is the largest producer for polyester with China leading the charts. India, Indonesia, South Korea, Taiwan follow the lead. This puts India and South Asia at a massive cost advantage.

Manufacturing:

With a 7% share, India ranks 2nd in textile exports and with a 3% share, it ranks 6th in apparel exports. Overall, India ranks 4th in global exports with a 5% share. In 2021-22, India’s textile and apparel exports reached $43 billion, and this sector has experienced a CAGR of 3.7% since 2010-11. The Indian government is also trying to make India a global hub in the industry with a 5F approach – Farm to fibre to factory to fashion to foreign.

Brands are also investing in manufacturing in India. Puma India has already reduced its dependence on imports and is investing in local manufacturing. Domestic sourcing increased from 31% to 40% in the last two years.

Distribution: As we discussed above, the Indian apparel industry has been revolutionised by e-commerce in the last decade. So, this goes without saying that for any brand to make big waves, an online first approach would be pivotal to its success.

If you are a regular mall goer you’d have noticed athleisure is taking more and more space in mannequin showcases. Decathlon has championed the offline first approach for the sports and fitness category. Brands would also need to build offline distribution and experience centres. Sketchers has already begun the first phase of its 1.1 million square feet distribution centre outside Mumbai.

Why are we bullish on athleisure?

Large sports brands – giants – like Nike, Puma, Decathlon; fast fashion brands like H&M, Zara, Marks & Spencer; celebrity owned brands and early movers like Bliss Club – everyone is looking to get a pie of the athleisure market. However, the Indian market lacks one or two category defining (purely athleisure focused) brands.

As the world moves towards fitness and lifestyle, the opportunity is large, and that too with whitespace. Having said all this, the internet consumer brands are going through a rough patch right now. The fashion brands are even more affected due to high return costs and lack of differentiation. The consumer discretionary spend has also reduced due to macro headwinds. This also presents an opportunity for athleisure category to pick up – as the consumers can use the same clothing for sports as well as leisure.