“Google is not a conventional company. We do not intend to become one.” –Larry Page, co-founder of Google in 2004

In a world where the internet reigns supreme, Google is the ruler of the online kingdom, the queen of search engines, and the oracle of all things digital. From its humble beginnings in 1998 as a research project of Larry Page and Sergey Brin that started in a Stanford dorm room to its current status as a trillion-dollar tech giant, Google has made a lot of history (not just on your browser!).

In this article, we will explore the financial workings of this behemoth of a company and try to make sense of its many faces, its cash raining business model, and its ever-expanding empire.

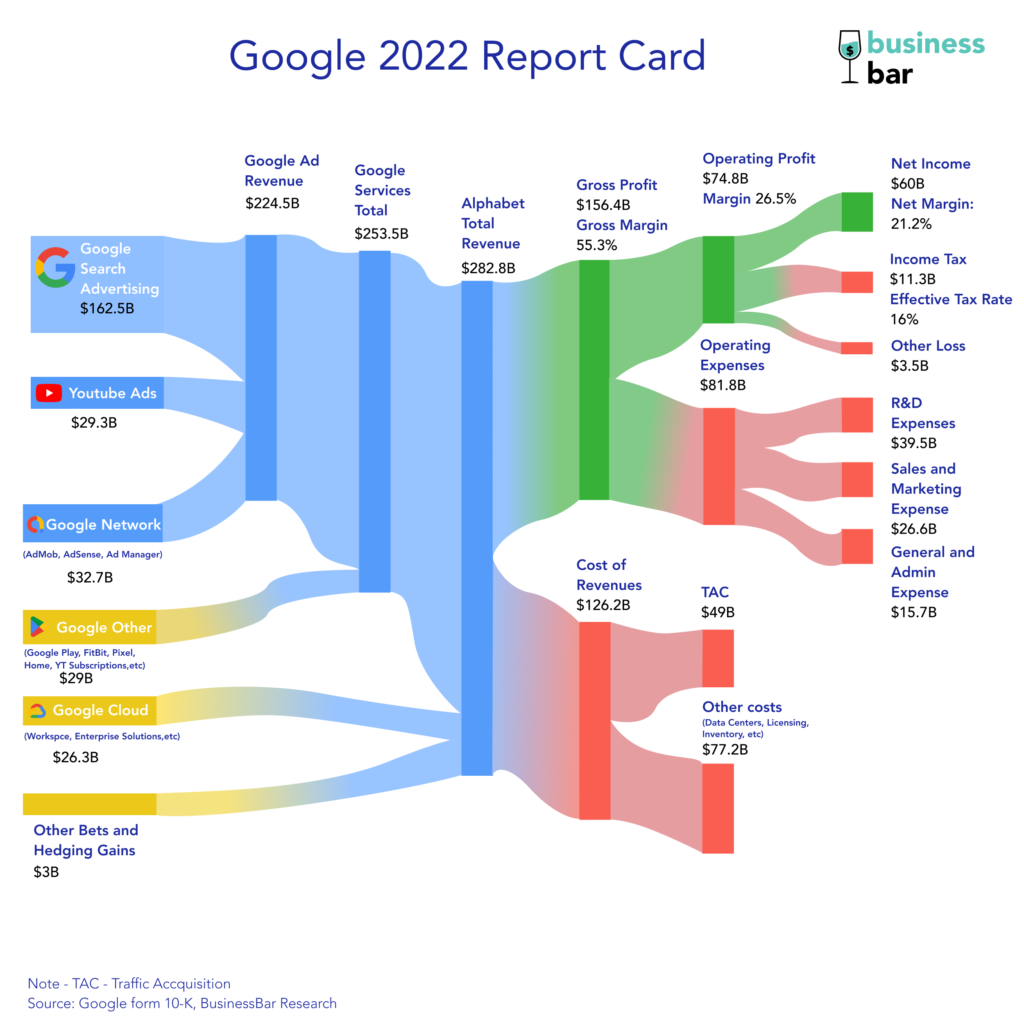

In the year that ended on 31st December 2022, Alphabet – the parent company of Google made $282.8B in revenues. For context, if it were a country, it would make it to the list of Top 50 nations by GDP alongside the likes of Finland, Portugal, and New Zealand.

The US Dominance!

Google is used pretty much everywhere in the world, almost half of its revenues come from the USA alone. It is not surprising when one realizes that despite forays into hardware devices like Pixel, FitBit, and Google Home; cloud computing business Google Cloud and ‘other bets’ like self-driving Waymo, much of Alphabet’s revenue still comes from advertising.

Given that USA is still the largest overall market in the world, metrics like transacting users, as well as Cost per Click (CPC) and Cost per thousand impressions (CPM) paid by advertisers, are the highest in that region. The CPM is $0.68 in the US against the total average of $0.24 globally.

Since its IPO in 2004, Google (interchangeably used in this article with the parent company’s name Alphabet) saw its financials expand as far as space. Its revenue increased 63x and profits ballooned 150x by 2022. An unmatchable CAGR of 26% and 32% respectively for 18 years!

But the stats above fail to uncover one thing, the ride wasn’t as smooth as simply growing profits by 32% every year. Even with the sharpest minds being given the finest environments to work on the most advanced technologies and a business moat so strong, there were still bumps in the ride.

Be it the multiple antitrust investigations over the years, including one by the European Union that resulted in a $2.7B fine, or the criticism over its handling of user data and privacy. The company has faced unrest among its workforce when thousands of employees staged a walkout to protest the company’s handling of sexual harassment claims, while the handling of fake news and misinformation has been a persistent issue.

And issues like this coupled with global tailwinds are starting to surface out on the financials of Alphabet as well. In January 2023, Google announced its largest-ever layoff of 12,000 googlers, cutting its workforce by 6%.

This isn’t the first time they’ve done it. In fact, an interesting trend seems to appear through the numbers.

At Google, an annual drop of more than 15% in Profit Per Employee has been followed by a reduction in headcount the next year!

However, it’s worth noting that layoffs are a difficult decision for any company to make, and while profit per employee can be an important metric, it’s not the only factor that determines a company’s decision to lay off employees.

ChatGPT: A new threat to Google?

Moreover, in November 2022, the latest and possibly the most worrisome threat to Google’s monopoly to date emerged from the release of ChatGPT – an AI-powered chatbot. ChatGPT is owned by a company called OpenAI which was founded in 2015 as a non-profit organization by technocrats including but not limited to Peter Thiel, Sam Altman – the current CEO of OpenAI, Reid Hoffman – the founder of LinkedIn and Elon Musk (Yes, this guy is everywhere!).

In 2019, OpenAI switched from a non-profit to a capped-profit company. Well, can’t really blame someone for a move like this when the product has the capacity to be a serious threat to a business like Google! Although, Musk parted ways with the company in the same year.

Microsoft, one of the early investors in OpenAI, has committed to invest $10B over the coming years. This move would help Microsoft secure integration of ChatGPT into its search engine Bing – the second largest player in the search engine market after Google. This would also help OpenAI with Microsoft Azure – the cloud computing infrastructure needed to scale ChatGPT and other AI models like it.

Although it is noteworthy that Google is not just a market leader but rather a market dominator in the search engine market with a share of 90%, compared to that of Bing at just 3%.

As per the book The Everything Store: Jeff Bezos and the Age of Amazon, Bezos once famously said:

“Treat Google like a mountain. You can climb the mountain, but you can’t move it.”

The mountain stands tall today, but there’s an old boy in town with a new earthmover who intends to build a tunnel through that mountain.

In the meantime, you don’t have to go searching for the best business content anywhere else as we at BusinessBar will ensure to deliver it directly to your inbox.

You may surf our vast library of interesting articles such as The Rise and Business of Formula 1 or learn concepts such as Understanding Venture Debt.

Written and Researched by Abhigyan Joshi