Venture Debt has recently become a popular source of funding among early-stage startups raising $538M of venture debt in 2021, double the amount in 2020. While in the USA, startups raised $68B of venture debt capital in 2021.

Venture Debt – the oxymoronic sounding words are now found in every nook and corner of the startup ecosystem. The instrument is increasingly becoming a choice of funding for many startups due to cheaper form of financing, quicker execution of fundraising, and availability at the early-growth stage.

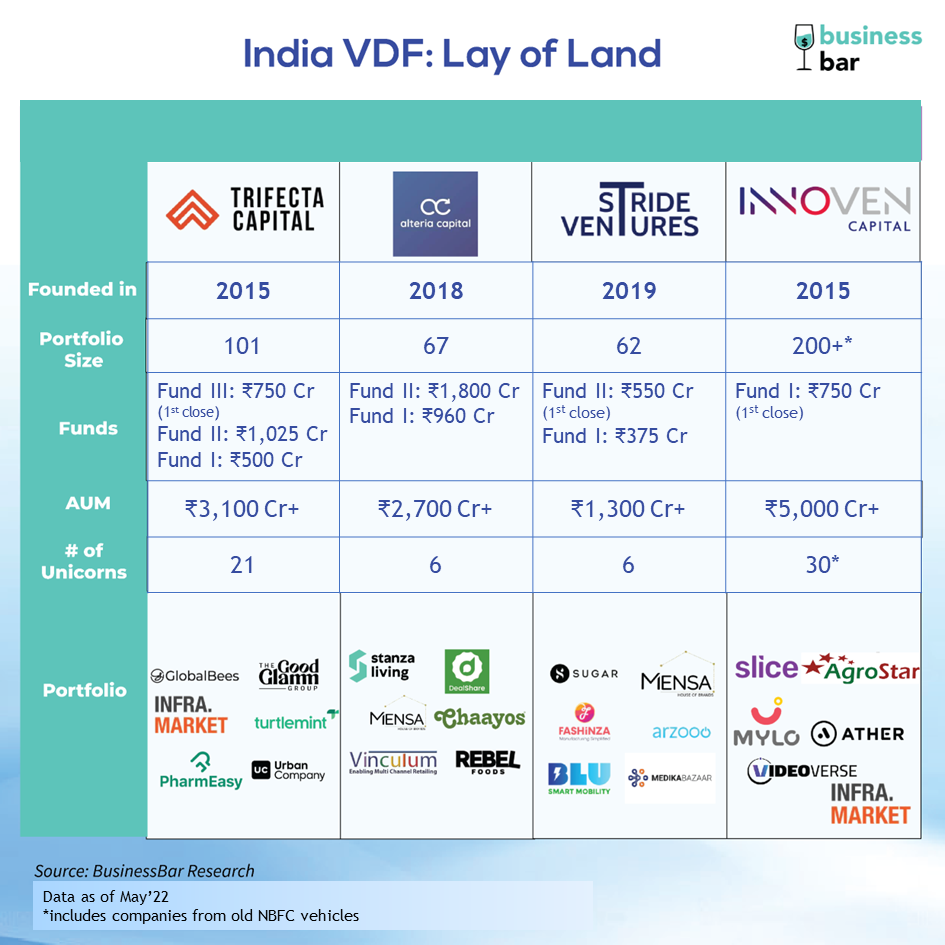

Venture Debt has been an old practice earlier done by NBFCs but a surge came with an entry of new age Venture Debt Funds (VDFs): Trifecta Capital (2015), Alteria Capital (2018), Stride Ventures (2019). These funds joined Innoven Capital, an old practitioner of venture debt that transitioned legacy NBFC operations to VDF with the launch of ₹1000 cr target in 2021. Blacksoil, a structured and real estate fund has identified that “asset and venture-backed debt are an integral part of startup fundraising” and joined VDF club in 2020 and has been actively investing.

What is Venture Debt? How does it work? And why is it becoming increasingly popular? In this article, we answer these questions and take a look at the colour of Venture Debt money.

Venture Debt Explained

Debt is a cheaper form of financing than equity, as the construct of the instrument makes it lower risk. Security and covenants play an important part in forming this low-risk construct. Security is basically assets the lender can claim charge of in the Event of Default (EoD), debt lender has a senior charge than equity investors. Covenants are certain operational & financial terms that are used by the lenders to prevent situations of EoD.

Startups these days have intangible assets in form of products, IPs, brands, etc. contributing to a larger share of their value. Securitization of these intangibles demands a VC lens to value this. Venture Debt Funds (VDF) bring VC lens to address this. Covenants for startups with a non-linear growth trajectory are highly unconventional and demand a higher risk appetite than what traditional debt funding can offer. VDFs understands early-stage startups on such non-linear growth trajectory and are able to support their borrowing needs.

Venture Debt construct has both debt and equity components. Debt component is raised through a mode of Non-Convertible Debentures (NCDs). And equity components (aka equity sweeteners) are tied in the forms of warrants, preference shares, rights, options, etc. Preference Shares are generally issued in form of Compulsorily Convertible Preference Shares (CCPS) or Optionally Convertible Redeemable Preference Shares (OCRPS). These sweeteners offer higher upside returns from the company’s growth to lenders. In this regard, a venture debt instrument has similarities to both traditional debt (interest payouts) and VC (warrants, CCPS, etc.).

Basics of a Venture Debt Deal and Term Sheet

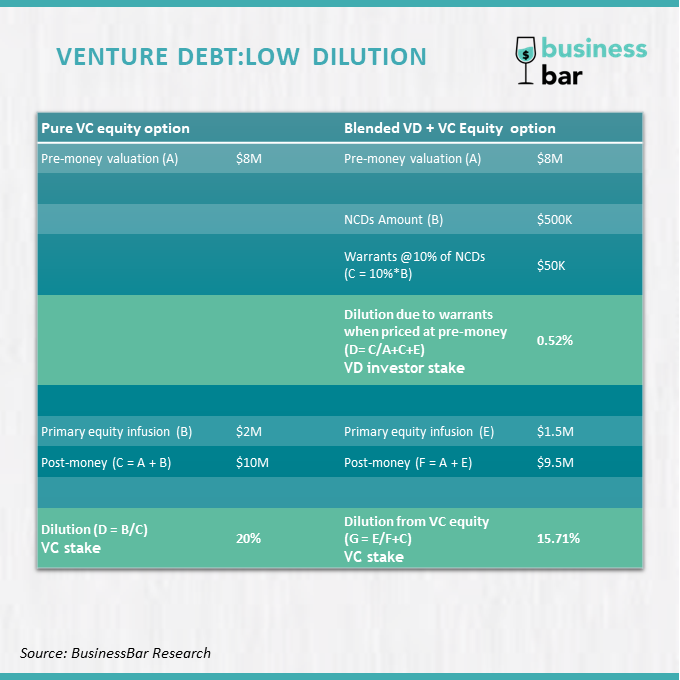

While VDFs get equity to compensate for the extra risk, equity dilution here is much lower than compared to VC funding. Let’s take an example. Consider a Series A funded company is at a pre-money valuation of $8M and is looking to raise $2M of capital.

Option 1- Pure-equity: $2M in primary equity infusion: Founders and existing investors here face a dilution of 20% ($2M infusion against $10M post-money valuation).

Option 2 – Blended equity & VD: $1.5M primary equity infusion & $500K in VD.

Let’s consider VD deal has $500K of NCDs in debt and equity component in form of warrants of the value of 10% of NCDs ($50K). These warrants are typically priced anywhere between last-round closing valuation and next-round valuation. For this example we consider warrants are converted on $9.55 post-money valuation.

Equity components in VDs are priced based on previous and subsequent equity fundraise valuations. This brings in a much quicker deal execution as compared to equity deals involving the valuation of intangibles, bringing in other investors, etc. Venture Debt requires VC money on the table as they provide cushioning to ensure repayments. Due to this, the quality of existing investors becomes very crucial for VDFs.

With quicker deal execution VDFs have built out a massive network of portfolio companies that offer a different colour of money as compared to other traditional sources. More on this is discussed below. For now, let’s take a look at Venture Debt Term Sheet Structure.

VDFs make borrowing available to early-growth stage companies. Venture Debt capital is used for attaining short-term value creation milestones. Once companies achieve a certain scale they have evidence of a non-linear growth trajectory. The non-linear trajectory is when startups are able to carry out growth while expanding margins to unlock certain economies of scale. VDs are fuel to this growth of attaining value creation milestones on a non-linear growth trajectory.

Venture Debt Funds in India

In the 1980s, when Silicon Valley Bank (SVB) and a few other entrants started off the Venture Debt Industry through venture leasing products, many questions were raised about the model as there was no playbook to structure or underwrite these kinds of instruments. But the dot-com boom gave the industry a boost as it allowed borrowers to avoid their equity dilution in slowed market momentum.

Although post the 2008 crisis, the VD industry evolved into what we see as a “modern venture debt market”. This was made possible because of the improving sophistication level of the industry due to the entry of market enablers and new competitors. Around the same time, venture debt made its first entry in India when SVB India Finance started venture lending in 2008. This entity then got rebranded as Innoven Capital in 2015, when Temasek Holdings acquired this from Silicon Valley Bank. Since 2015, the VD market was built by the new-age VDFs Trifecta, Alteria, and Stride.

In 2021, about half a billion dollars were invested through VDs across 111 deals in India’s startup ecosystem. While the average deal size is ~$5.85M (~₹40 crores), there is a wide range of cheque sizes from 1st tranche as low as ₹2-5 crores to, the biggest VD deals of ~₹250 crores in GlobalBees by Trifecta, ~110 crores in GoodGlammGroup by Alteria, and ~₹125 crores in Udaan by Innoven Capital. LPs continue to grow their trust in VDFs, as Alteria Capital raises ₹1,800 crores for its 2nd VDF. investment commitment in this round came entirely from domestic investors hitting 2x of its ₹1,000 crore target.

In 2021, for every 1 dollar disbursed by a VC in the US, ~22 cents were disbursed by a VDF. Whereas, in India, this was close to just 1 cent. This gap in penetration is expected to inch narrower as VDFs become a choice of investment for LPs and fundraising for startups.

A typical venture-debt fund has a life of 7~8 years, and a venture debt deal has a tenor of 2-3 years, and repayments begin even earlier. This allows VDFs to recycle capital at a much higher pace resulting in a ~2x investing appetite than the funds raised.

There is a lot of growth potential in Venture Debt Funds’ growth in the Indian ecosystem. As startup and funding ecosystems mature, funding is available from multiple sources in multiple forms. One might think that funding is commoditized in such an environment, however, this is not the case. Every source and form of funding bears a different colour, and identifying the colour of money and picking the one best suitable becomes an integral part of fundraising. To answer this question, let’s explore colour of venture debt money.

Colour Of Venture Debt Money

Venture Debt offers a different colour of money in this funding frenzy Indian ecosystem where there is no dearth of capital available to the startups. This different colour of VD money is what has made it increasingly popular among startups these days.

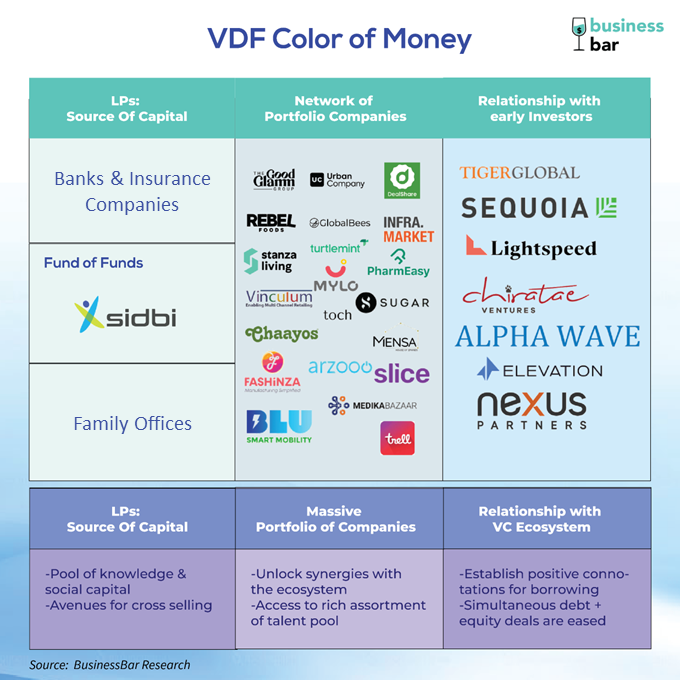

The colour of Venture Debt money is commercially different due to the VD instrument construct. VD disciplines the startup in managing their cash while traversing a non-linear trajectory, something which has become crucial for the startups. Over and above the lender role VDFs bring with them a rich colour of VDF money is derived from LPs: Source of Capital, Network of Portfolio Companies, and Relationship with early VC investors.

LPs: Source of Capital

VDFs follow VC-like LP-GP structure where VDFs raise funds from LPs and invest their money in startups through the way of venture debt. Who are LPs in these VDFs and why are they interested in investing in VDFs? LPs are majorly HNIs, family offices, Fund of Funds, Celebrities (yes, celebrities are big-time startup investors), and financial institutions like banks, NBFCs, etc.

According to, Innoven Capital 2022 Report, among early-stage domestic VCs, capital is largely sourced from domestic sources. About 60% of these domestic funds are sourced from large family offices and HNIs. On the other end, Fund of Funds like SIDBI account for 15% of the total domestic capital, and financial institutes like Banks, NBFCs, etc. account for 5% of the domestic capital. SIDBI, a Fund of Funds (FoFs), set up in 2015 under Startup India Action plan, has been a major contributor to the formation of Venture Debt Funds. As of this article, out of over ₹7,200 crores invested by SIDBI’s fund of funds over ₹900 crores have been invested across the VDF board: ₹348 crores in Trifecta, ₹333 crores in Alteria, ₹150 crores in Innoven, and, ₹85 crores in Stride Ventures.

VDs are designed to be hedged by:

- Predictable returns: A larger share of returns are from fixed coupons bounds VD returns in the range of mid-to-high teens

- Low Risk: Higher seniority instrument providing safety in event of default

- Returns Realisation: VDFs payout returns to LPs on a regular (quarterly/bi-annual) basis and begins these payments much earlier than equity

An additional hedge is rooted in the broader adoption of VDFs across the startup ecosystem. So when LPs invest in VDFs they are basically betting on 10s of companies that are in their early-growth stages. The coverage of VDFs on India’s first 100 reported unicorn board is highest among the domestic investors, only behind a bunch of high-velocity foreign-based VCs like Tiger Global, Sequoia, Softbank, and Accel according to inc42, 2022 report. As Domestic Institutional Investors (DIIs) have limitations on investing in foreign VC funds, VDFs offer a broader startup index to invest in via a hedged instrument.

LP consortium governs the colour of VDF money, as by onboarding such a large set of institutes on the growth journey of a startup there are multiple possible avenues of cross-selling with these institutions. Additionally, startups now have access to the knowledge capital of the grey hair of India’s businesses if required.

Network of Portfolio Companies

VDF portfolio has built out a massive network of startups, this adds to a different colour by unlocking the enormous potential of synergies by forming strategic partnerships among this network. Along with this there are avenues for cross-selling across the startup ecosystem. The network brings an assortment of talent pool which helps in seeking advisory, growth hacks, winning contracts, sharing knowledge, recruiting talent, etc.

As VDF portfolios are maturing more and more companies are showing signs of success. More than 1/3rd of India’s unicorn board is now covered with VD-funded startups. These early successes are setting a strong precedent for the next wave of VD-funded startups. This precedence of success in the equity market across the massive network further opens up for higher penetration of VD among early-stage funding.

Relationship with VCs

VDF work closely with VCs across their investment journey from sourcing, to diligence and contributing to the startup growth journey. As VD becomes widespread the portfolio overlap of VDFs with VCs becomes even larger, and hence a strong VDF-VC symbiotic relationship develops. This relationship adds to the colour of money for both VDF and VC, as the common interest of both is to grow the company they’ve invested in.

VDFs fundamentally trust VCs to price the rounds fairly, which contributes to the equity upside returns of VDF investments. On other hand, VCs get higher returns from VD-funded startups, as equity investors’ returns multiply when a company is levered (taken debt). VCs here trust the VDFs to calibrate the lending structure in a way that is accommodative to business.

Traditional lenders (bank, friends & family, etc.) have inflexible structures that may limit the business from taking certain exposures. These limits may have adverse effects on the non-linear growth trajectory of startups. VCs therefore, at times down weight startups with such debt structure on their books. VDF solves this through mutual trust with VCs along with accommodative structures of VD. Overall this builds a strong positive connotation for borrowing in the VC ecosystem.

In strategic planning business growth, both debt and equity have use cases in attaining short-term milestones as well as long-term visions. Collaboration of all the VCs and VDFs play a vital role in a company’s fundraising as investing occurs across multiple rounds for all the players. VDFs have developed symbiotic relationships with various stages of investors which helps in easing simultaneous debt + equity deals. This paves a gateway for startups in establishing trust as it advances in the fundraising journey.

Venture Debt vs VC – Which is better for a startup?

For any business, the two main sources of external funding are equity and debt. Sure there is some flavour of debt in VC equity transactions or equity components such as warrants in Debt. RBF (Revenue Based Financing) and Special Purpose Acquisition Companies (SPAC) are some examples of such tweaked debt-equity transactions.

But broadly – the two extremes remain the same – Equity and Debt!

On one hand, debt comes with the pressure of timely interest payments and principal repayments, while ownership dilution makes equity the costliest form of funding.

As a founder, which one is better for your startup depends on, well, you and your startup!

For instance, it might not be extremely prudent to raise debt at an extremely early stage where even the revenues are uncertain. Whereas, at later stages, expansions can be fuelled with debt given a reliable forecast of demand and positive unit economics. Just like the stage, your startup is at, the industry you operate in, your P&Ls ability to service debt instruments, and your cap table’s available room for dilution are a few angles to consider.

As we touched on earlier, every source of capital has a different color attached. It is best to understand the nature of the transaction you’re entering into, the expectation of the investor and you’re obligations towards it. This piece is an endeavor on the same front, and the idea is you can create your own playbook after reading this!

Follow and keep reading BusinessBar to understand the numbers and narratives behind the business world!

We have captured the information best available in the above article, feel free to write to us in case of any data correction.

This article is written by BB Bartender, Nevil Kathira. We thank Yash Goyal, Ashita Patodia and Amit Kumar for their insights about the space