RIL became the first Indian company in history to cross a market cap of $150 Bn. At the same time, Mukesh Ambani entered the world’s top 10 richest person list.

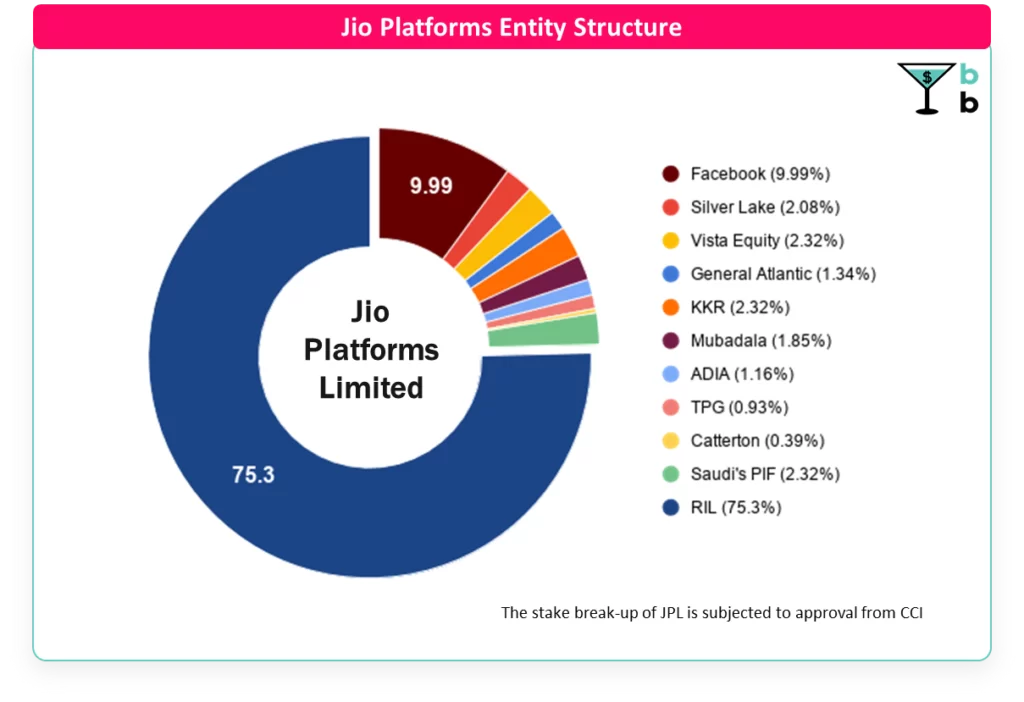

For some time now, the Indian stock market, news, social media, everything has been dominated by one company – Reliance. Reliance Industries Limited (RIL) raised around $22 Bn in just 3 months. To put this number in perspective, it is more than the amount raised by all Indian startups in 2019. Investors ranged from tech giants to PE firms and from sovereign wealth funds to retail investors.

But all the social media buzz and news noise leave a lot of questions unanswered – Why does everyone want a pie of Jio? Why does Mukesh Ambani want to make Reliance net debt free?

Before answering these questions, we’ll take you a few decades back.

The Godfather – Dhirubhai’s Era

The year is 1980. The entire demand of Polyester Filament Yarn (PFY) in India was 6,000 tonnes per annum. Dhirubhai Ambani set up a new PFY plant with an initial capacity of 10,000 tonnes per annum. Now, this is some serious market disruption.

Another thing which has been at the core for Reliance is integration – vertical and horizontal. Dhirubhai started with trading in textiles and then went on to manufacture textiles and then the polyester yarn. The polyester yarn comes from petrochemicals. He continually integrated backward the entire supply chain from manufacturing petrochemicals to petroleum refining and oil exploration. This makes Reliance one of the most vertically and horizontally integrated companies on the planet. Now, there can be debates around the synergies of this and perhaps this whole integration business actually lessens the overall efficiency. But, one thing we can’t rule out is that Reliance’s and Dhirubhai’s intention was not to be just another manufacturing company but to rule the market.

We’ll see how with these two core philosophies – Market Disruption and Vertical-Horizontal integration from his father, Mukesh Ambani built Jio and put it onto the center of the world stage.

Launch of Jio & Rise of the Empire

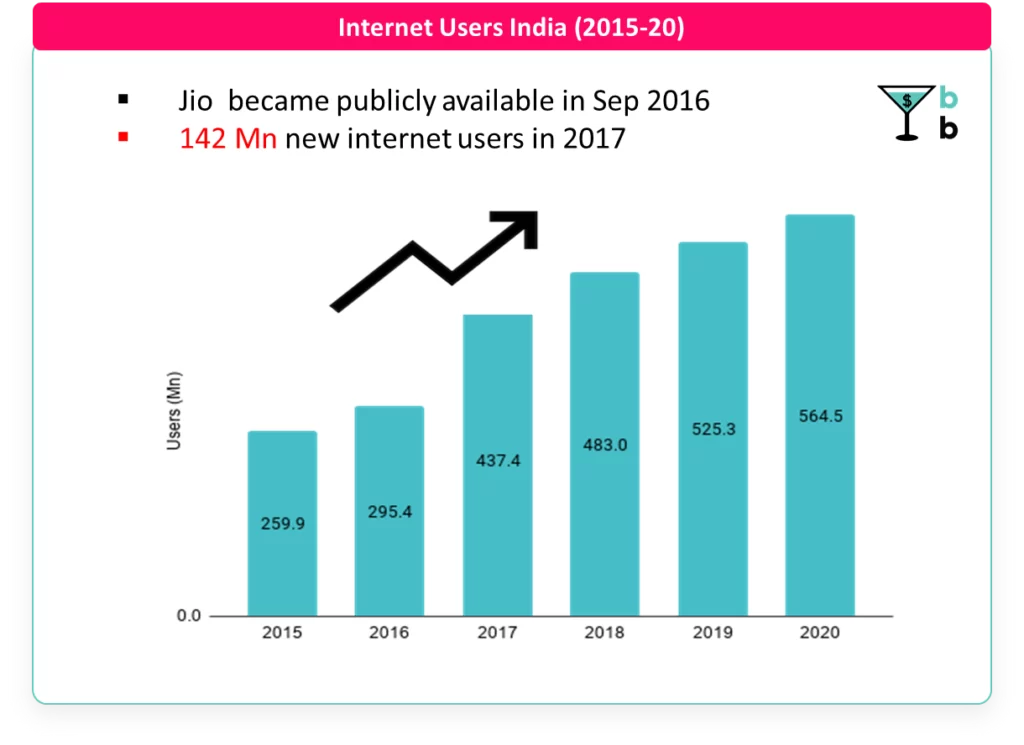

Following his father’s shoes, Mukesh Ambani disrupted the Indian telecom market in 2016 with the launch of Jio.

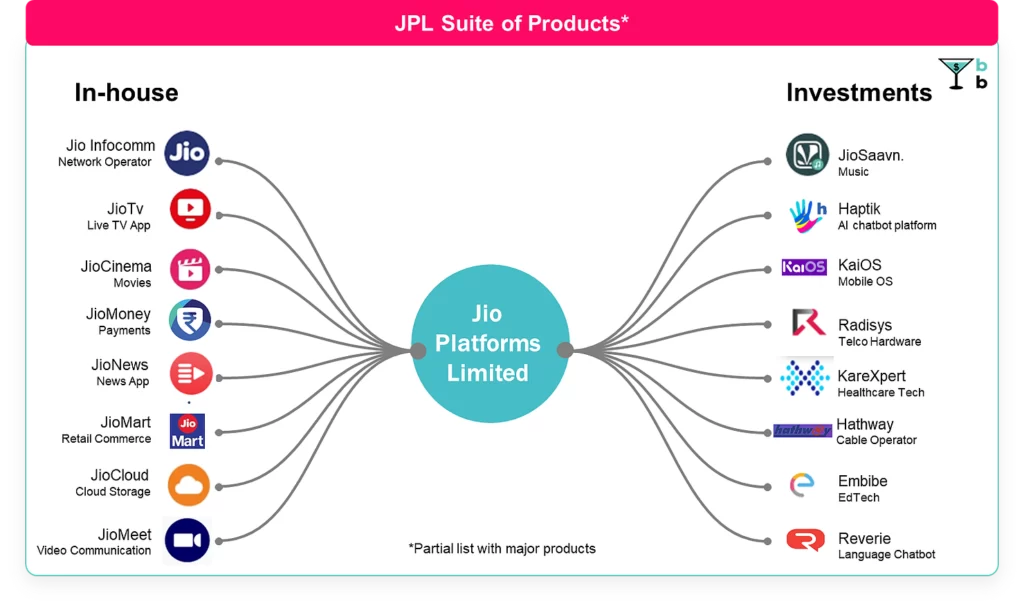

The disruption in the mobile network space was just a start. Reliance was in a long game. In 2019, they established Jio Platforms Limited (JPL) – a digital subsidiary of RIL. JPL owns Jio Infocomm (or Jio) – the telco business and the digital platforms.

If JPL were listed on a stock exchange, it would rank fourth highest in terms of market cap today – bigger than HUL, Infosys and Airtel!

With JPL, Reliance wants to digitize services for 1.4 billion Indians. They are creating an ecosystem around the consumer – allowing him to shop, pay, watch content, listen to music, use the cloud – everything on his phone. So, JPL is much more than the telecommunication business. The reason why Facebook and PE firms have lined up to get a piece of JPL is that they know this type of ecosystem is ‘super’ successful. It is called a super-app. Think of it as a bunch of services and apps bundled under an umbrella of the super-app.

Super-apps have enjoyed massive success in various regions of the world – Amazon (US), Alipay (China), WeChat(China), and Gojek (Indonesia). Major Indian startups – Paytm, Hike, Flipkart, Ola – have also tried their hands and invested a lot with a dream of becoming the first Indian super-app. The reasons are simple. Super-app gives a powerful ecosystem to keep customers hooked to the platform. It gives a lot of avenues for cross-selling and up-selling. Customer acquisition becomes easier due to the range of services available. In short, super-app is the decade-old formula of horizontal and vertical integration packed digitally.

But no Indian firm has seemed to crack the formula of building the super-app. Though Paytm has enjoyed some success, they still have miles to go before becoming the WeChat of India. In this race, we are betting on Jio which is riding on 388M users. Look at the range of services that they currently have.

To build this ecosystem, Reliance has invested close to $3 billion in content, music, e-commerce, EdTech, health-tech, AI. With Jio Mart, Reliance is poised to conquer the retail game for India.

The Facebook-Jio deal is a win-win for both the companies. Facebook is trying for many years to enter the Indian market. First with Free Basics and then with WhatsappPay. Both the times, they had little success navigating Indian regulations. Perhaps partnering with a strong local player would have helped. And this is exactly what they did this time.

The Rocky Road to Zero Net Debt

For starters, the word “net” is very important. Net Debt is a metric of how well a firm can pay all of its debt (both short & long term) if they all were due tomorrow. RIL is going net debt-free, it will still have total debt.

Net debt = Total Debt – Cash & Cash like assets

The rollout of Jio needed a very large infrastructure i.e. very large investments. In the past 10 years, Reliance’s total debt increased by 420% and the interest expense increased by 691%. And at the same time, the profits increased by just 63%. The company’s net liabilities had risen to Rs. 3.63 trillion (~$50 Bn). Reliance decided to transfer liabilities of Rs 1.1 trillion ($15 Bn) to two investment trusts (InvITs) – Tower and Fibre infrastructure. These InvITs are separate entities managed independently. Jio is paying lease rentals to these entities, thus increasing the operating expenses of Jio. Even after this RIL had a net debt of Rs. 1.6 trillion ($21.5 Bn) at the end of March 2020.

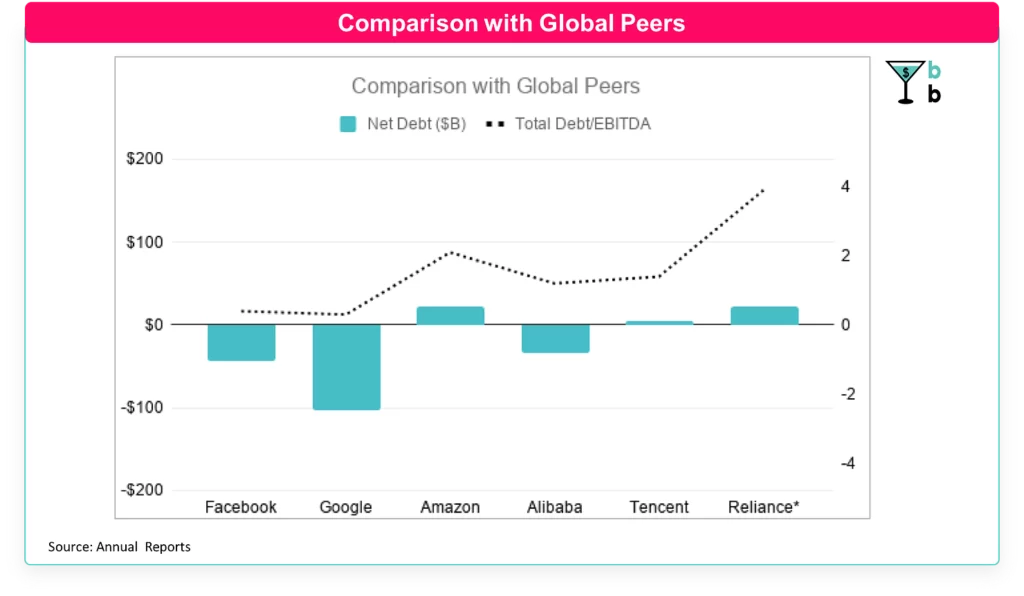

Since, with the creation of JPL Reliance wants to be in the digital endgame, it’ll be apt to benchmark its debt levels with global counterparts. In comparison, both the total debt and net debt are higher for Reliance. Net Debt is negative for the likes of Google & Alibaba. It means that the companies have more cash (plus cash-like assets) than the debt they owe. Total Debt to EBITDA ratio for Reliance is close to 4 compared to close zero ratios for other counterparts.

*These numbers are for RIL (FY20), a conglomerate operating in multiple businesses

This massive debt was becoming an issue for Reliance as the interest costs for the company had increased by 16% of EBITDA to 32% EBITDA in just 5 years. The shareholders were getting spooked by the debt levels. Credit Suisse downgraded RIL’s stock from ‘neutral’ to ‘underperform’ in 2019.

In Aug’19, at RIL’s AGM, Mukesh Ambani promised shareholders this:

“We have a very clear road map to becoming a zero-net-debt company within the next 18 months, that is by 31 March 2021.”

This came with another mega announcement to sell a 20% stake in refining and petrochemical business to Saudi Aramco for $15 Bn. The sale was expected to close by March of this year. Due to the sheer complexity of the deal and covid-19 impact on the industry it got delayed. Well, if you are Mukesh Ambani, you can’t allow these ‘earthly things’ to affect your plans.

RIL raised around Rs. 1.68 trillion ($22.4 Bn) from global investors and rights issues. The rights issue (offer to existing shareholders to purchase new shares at a special price) was oversubscribed 1.59 times and got an overwhelming response from the investors.

With this exercise, RIL became net debt free 9 months ahead of schedule! Saudi Aramco deal is expected to close by the end of this year and will fetch another $15 Bn (as per the initial announcement).

We are now at the end of this piece, but with Jio there is no end. Thus, this will be an ever-evolving article. With the Ambanis, the possibilities are endless and opportunities are infinite.