Video games have been around since the 1970s when Atari released Pong and Computer Space in arcades. Video games have come far from their humble beginnings in the 70s. In 2020, the gaming industry generated $159 billion in revenue and analysts predict the industry will generate more than $200 billion in revenue by 2023. To put this into context, this is larger than the music and movie industry combined. Thus it comes as no surprise that tech companies like Google, Apple, Facebook and even Netflix are looking to get a slice of this pie.

The advancements in the video gaming space haven’t just been in terms of market size and technology, but akin to other industries, we have seen the video gaming industry go through several types of business models as well. Initially, legacy video game companies generated revenue only from the sales of their physical discs. The total return on a given game was based solely on how many physical units were sold.

As internet penetration increased worldwide, in the 2000s, companies began experimenting with different business models. These new business models involved extra paid downloadable content (DLCs) and microtransactions that came after the sale of the game to the users. This is widely regarded as the Web 2.0 model and this brought continued revenue streams to video game companies.

This Web 2.0 model also gave birth to Free-to-Play (F2P) games, where users could play the basic game for free but if they wanted to access some premium features or purchase some in-game items then they’d have to pay for them. This model has become immensely popular in the last few years with the rise in mobile gaming and this genre of gaming generated $88.7bn in revenue in 2020 alone.

For a more comprehensive read at how this business model is serving the mobile gaming industry rightly, you may refer to our earlier piece: Mobile Games are finally playing it right!

However, an issue with the F2P model is that only 2.2% of gamers actually spend money on F2P games. There are several reasons why only a small percentage of this large base actually spends money on these games. Some of these reasons include the fact that in-game purchases in current F2P games don’t actually give you ownership of the items purchased.

What we mean by that is that the items purchased on one game are usually non-transferable to other games, so if you want to start playing a different game in the future, you’ll have to start all over again. You wouldn’t be able to make use of any of the investments you’d made previously in the old game. Simply put, the money a player thinks they’re ‘investing’ in the game becomes ‘sunken cost’ as soon as they lose interest in the game.

Enter Web 3.0 and Gaming on the Blockchain

Issues such as above are being solved with the advent of decentralized gaming. This takes advantage of the innovations in Web 3.0 which brings cryptocurrencies, NFTs and blockchains into the world of video games.

Blockchain technology has multiple use cases and there are numerous startups around them which you can find here. But in the context of gaming, Blockchains by acting as immutable ledgers, cryptographically record all transactions on the network, and in doing so, allow for the generation of NFTs. NFTs, in their most basic form, represent data that can be verified as unique from all other data and can be tied to nearly anything — including in-game items.

As such, every costume, avatar, parcel of virtual land, or anything else in-game can be created as an NFT, which means they would be effectively unique, tangible, and retain value. They could be moved across multiple titles and even resold to other players on secondary markets. This makes all these transactions less like a sunk cost and a lot more like an investment. And thus, gamers don’t need to spend money on items that effectively become worthless if the player loses interest in the game or if the game shuts down.

This Web 3.0 model is not only a win for gamers but also for video game developers as developers can still offer the same kinds of in-game products, but they could now offer them for a much lower price to gamers and bring in additional revenue by running in-game secondary markets and take a small fee of each transaction instead.

This Web 3.0 model could thus solve the issues of low penetration of paying users in the Web 2.0 model while also bringing a better product at a lower price to gamers – an ultimate win-win to both gamers and developers! In many ways, this could enable exponential growth in the gaming industry.

How do blockchain games actually work?

One of the first, popular blockchain games was CryptoKitties. The game was developed on the Ethereum blockchain and released in 2017 by a Canadian company called Dapper labs. The game allows players to buy, sell, collect and create virtual cats. Each of these cats was a unique NFT on the Ethereum blockchain.

The game was so popular upon its release that, in December 2017, the game’s users congested Ethereum’s blockchain and accounted for 25% of the network traffic at the time. This caused Ethereum to slow down significantly.

Since then, Crypto Kitties’ parent company, Dapper Labs, has gone on to release its own blockchain, Flow, which is built specifically for blockchain gaming. They also signed an agreement with the NBA and developed NBA Top Shots, which is an NFT marketplace where fans can buy, sell and trade NBA moments, which are packaged highlight clips that operate like trading cards. The platform has over 1.1 million users and over $780 million has been traded on its platform. The most valuable NFT ever sold on the marketplace was LeBron James dunking against the Houston Rockets which went for a reported US$387,600.

The biggest crypto game, in terms of market capitalization, currently is Decentraland. Decentraland is a decentralized metaverse that consists of 90,601 parcels of land. These parcels of land are NFTs that can be bought by the platform native token MANA, which is based on the Ethereum blockchain. The game’s native token, MANA, currently has a market cap of $8.28 billion at the time of writing.

Amidst all the latest buzz on metaverse, if you are confused we have got you covered. Let’s look at what Decentraland is doing with it. Recently, a virtual property on Decntraland that was 6,090 square feet in size sold for 618,000 MANA or approximately $2.4 million! This is the largest acquisition in the Metaverse space and it was made by The Metaverse Group, which is a virtual real estate company for the Metaverse economy.

This plot of land was located in the heart of Decentraland’s fashion district and the company plans to develop that piece of land for virtual fashion shows and commerce. This may turn out to be a wise investment as luxury fashion brands such as Gucci, Burberry, and Louis Vuitton have entered the Metaverse with designer NFTs. Nike also plans to release digital sneakers in its own digital metaverse named ‘Nikeland’.

Another crypto game that is gaining massive popularity lately is Axie Infinity. It was developed by a Vietnamese game development company, Sky Mavis. It is a blockchain-based game that is built on the Ethereum blockchain and is available for Android, iOS, Windows, and macOS. The game resembles Pokemon, where players have teams of three Axies which they use to battle other teams led by other players or the computer.

The game incorporates blockchain technology into its mechanism as the Axie monsters are each unique NFTs present on the blockchain that can be tracked. This allows players to verify that these monsters took real-life time and work to make and thus have value based on this. The game is termed to be a Play-to-earn game as players can earn money by playing, collecting and selling Axie NFTs on marketplaces.

Sky Mavis, the developers of this game, earn money from the game in two ways. First, they get a cut from monster breeding fees, which is basically the fees charged by the game when a player chooses to breed their Axie with another player’s Axie to give rise to a brand new Axie NFT. The company also earns 4.25% of each NFT sold in the NFT marketplace.

This game has not only made Sky Mavis a rich company, but several of their users have gotten rich playing the game too. For example, in the Philippines, Axie Infinity emerged as a popular way to pass the time for the people of the country amidst the COVID-19 pandemic. Its ‘play to earn’ model allowed people to pay the bills and put food on the table after losing their jobs as the economy came to a standstill. There’s even an 18-minute documentary about this phenomenon called ‘Play-to-Earn’.

Thanks to its Play to Earn nature, Axie Infinity has seen incredible real-world traction lately. As of July 2021, the game has over 1,000,000 Daily Active Users with a monthly growth rate of 30-40% for every month in 2021. The company also generated $342mn in revenue in August 2021 and $220 million in revenue in September 2021.

Another positive metric for Axie Infinity is that among the new Axie Infinity users, the retention rate after 1 day is close to 60%, and 40% after 7 days. A good 1D/7D retention rate in the gaming industry is 30%/10%. The game’s governance token, $AXS, which is comparable to a company’s shares in traditional finance, has exploded from $4 in June 2021 to $135 now, which is a 33x increase in just 6 months. The total market cap for $AXS, which can be seen as a good proxy for the company’s value, is currently $8.23 billion dollars.

Investments in Blockchain Gaming

No doubt the space around blockchain gaming is currently hot as far as investments are considered and even traditional institutional investors have gotten in on the action and have begun investing in this space.

Dapper Labs, the company we mentioned earlier, has raised over $857 million in funding to date and is currently valued at $7.6 billion. They have over 50 institutional investors on their cap table with the most notable ones being Andreessen Horowitz (a16z), Venrock, Google’s GV and Verizon One Ventures.

The Sandbox, a Hong Kong-based gaming platform that allows users to build a virtual world using NFTs, has raised $93 million from investors led by SoftBank’s Vision Fund 2. SoftBank also led another round of investment in another crypto game named Sorare, which is a fantasy football (soccer) platform based on NFTs, where each digital card is registered as a unique token on the Ethereum blockchain. The French company raised $680 million in Series B funding and this round valued the company at $4.3 billion.

The largest round of funding seen in this space came recently in the company Forte. Forte is a platform that allows game publishers to integrate blockchain technologies into their games and enable features such as embeddable token wallets, NFT minting and selling, and an array of other services designed for blockchain technologies and the management of digital assets. They raised $725 million in Series B led by Sea Capital and Kora Management. Other investors in this round included Tiger Global, a16z, The Warner Music Group, Polygon Studios and Solana Ventures.

How well the bet on crypto gaming will pay-off?

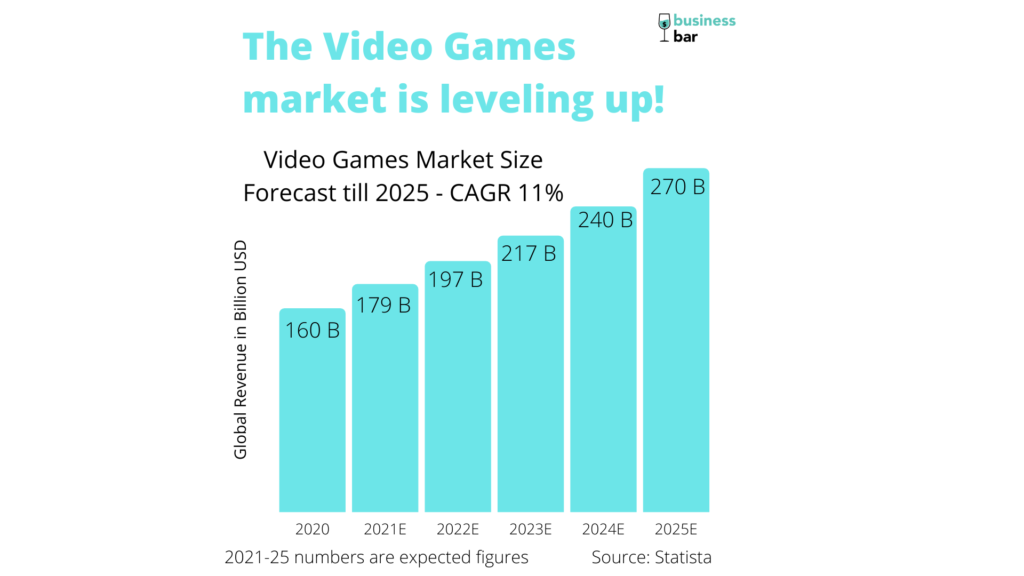

The video games market is a big and growing one with a CAGR of nearly 11% as shown below.

But there is much more than the 11% CAGR that’s up for grabs here because of the way blockchain and crypto are transforming the industry. The current crypto gaming market is only a sliver of its full future potential. We can expect the next decade to be massive for this space as the push to Web 3.0 continues and more and more companies invest in this space.

The biggest company to invest in this space has been Facebook, which rebranded to Meta. The idea of Facebook’s metaverse will only help grow the decentralized gaming market and bring more attention to it in the coming years. Games like Decentraland and The Sandbox could have a massive role to play in the Metaverse, as players can buy and sell virtual parcels of land in the Metaverse through such games.

Thus, like all big revolutions, the Crypto gaming wave will have multiple heroes. That is, advancements are being made by various players on different fronts. Some will solve the marketplace problem better than others while some may improve on the immersive experience with AR-VR tech. These could be big companies like Meta or Microsoft, or smaller projects started during the cryptocurrency boom. If it is the latter, they do face a risk of facing the heat of consolidation when the Big Tech comes after them for acquisitions.

This brings forth one of the paradoxes regarding the decentralized future. The companies that are at the best spot to foster innovation in industries such as crypto gaming are the ones most accused of user data manhandling – the very thing that decentralized tech promises to eliminate.

It is safe to say that technologies such as blockchain are here to stay. But interesting will be to see how they’ll shape the behemoth of Big Tech. Is it going to be amalgamation or annihilation, do share your thoughts!

This piece has been authored by Shaswat Ghosh.

Good Going .. very informative though I am not in that zone but block chain technology ignites interest and I , in my field of work , am also studying how and where to apply the technology ..

This is the start .. waiting to read more from you ..

Very nice and informative, hope you continue to brief about further developments in future