Polygon is an Indian startup founded in 2017 by Jaynti Kanani and Sandeep Nailwal which has recently raised $450 Million at a $13 Billion Valuation making it one of the most valuable Web3/Crypto Startups in the World. Here we decode for you, what makes Polygon so valuable.

History of the Web and what is Web 3.0 ?

Tim-Berners Lee invented the World Wide Web in 1989. That was Web 1.0 which lasted till around 2004 and was used mostly to host static websites where you could only read stuff. Then came Web2.0 which we currently inhabit where you can read and write on the web which was used as a platform. It definitely led to the democratization of content where anyone could start a blog or post a video, but over the two decades these content platforms became concentrated in the hands of the Big Tech which owned the content platforms. Then came Web3.0 based on blockchain (invented in 2008), where you can read/write and own a piece of the web (via an NFT or just any of the various tokens). This was made possible by the fundamental (1/3) decentralization of a blockchain. As Matt Levine describes it in his popular newsletter, Money Stuff:

“A basic premise of Web3 is that every product is simultaneously an investment opportunity. If you sign up for a Web3 social network or chat room or trading venue, you will get some of that project’s tokens, which will entitle you to use the project’s app or exchange, and which will give you some notional say in the decentralized governance of the project. Also the tokens will appreciate in value if the project takes off and more people want to use it. It’s as if being an early user of Facebook or Uber also automatically made you a shareholder of Facebook or Uber, and when those services got huge you got rich.”

In simpler terms, all users of a decentralized social network would collectively own it and would have a proportionate vote on how to run it. This is thanks to the consensus mechanism, again fundamental (2/3) to a blockchain, where only the longest chain or the one with maximum votes, in a way, survives. Unlike the current system where a small group of majority shareholders decide the direction of a company, it would be based on a larger group of shareholders each with voting rights proportional to how early they were a customer or user of that company.

There is also no scope of manipulation or tampering with this as the algorithm or contract which decides who gets how many votes is open to the public and a part of the blockchain as a smart contract. The blockchain automatically gives out the rights. This is because of, you guessed it, the fundamental(3/3) immutability of a blockchain where once something is part of it, nobody can change it (unless you control >50% of computing power globally).

Now that we have the basics of Web3.0 out of the way, we can come to the interesting stuff going on to build it’s (our?) future. The Ken in its newsletter, The Nutgraf, said :

“Polygon is the world’s most important crypto company.”

What is Polygon? And why do we care?

Earlier known as the Matic Network, Polygon is a layer 2 network (explained below) that powers the scalability and infrastructure of the Ethereum blockchain by reducing costs and making it easier for anyone to build decentralized apps (DApps) on its blockchain.

Shailesh Lakhani, managing director at Sequoia India, gave his approval for this , “Polygon has become what we see as a platform of choice for folks who are trying to build and scale low-cost applications that we think could actually get adoption. Probably 70-80% of the startups that we run into in crypto are using Polygon today.”

He put his money on the table too. Polygon raised eyebrows and $450 million in February 2022 led by Sequoia when the net market capitalization of its MATIC tokens was $13 billion. Even more surprising, this funding was through a private token sale where investors were given MATIC tokens at a 40% discount when it was trading at ~$2 – speaking of the liquidity that their tokens have. Softbank, Tiger Global, Galaxy, Republic Capital and even Kevin Leary also participated as they didn’t want to miss out the opportunity to invest in what is touted to be the next big thing in crypto world

Problems with Ethereum and how Polygon solves them

As Ethereum grew in popularity, the number of transactions (recording any data on the blockchain) on it also grew exponentially. Now to record each such transaction on the chain, you have to pay what is called the “gas” fees. The gas fee that you are willing to pay determines how quickly your transaction will be mined (jargon meaning becoming a part of the blockchain). The average fee went from 11 Gwei (1 billionth of 1 ETH) at the start of 2020 to 90 Gwei today.

Hence transacting directly on Ethereum can be either slow or expensive, or in some cases even both as “gas” fees regularly spike due to increased activity. You can think of this like you telling Swiggy the delivery fees you are willing to pay to get your order first. Obviously Swiggy will pick the ones in the order of who pays them highest. This can be a highly frustrating experience.

This is where Polygon acts as a layer between the Ethereum network (Swiggy) and the DApp developers (Users) and says, “I will pay Rs X for the delivery of all Y orders to my house”. It then delivers all the Y orders to Y customers, and collects a smaller fee from them. Because of this, Polygon can afford to pay the higher Rs X gas fees as compared to what an individual could pay. Of course, on the blockchain there is no physical address of the order, and Polygon is much more successful at this than Swiggy/Zomato in delivering multiple orders together.

Polygon does this via their Layer-2 blockchain built upon Ethereum which is the first layer. It is essentially a scaling solution that makes it cheap for all decentralized applications to use it. Imagine this as a sidechain that groups and records its transactions on Ethereum (main chain).

Major Decentralized Finance (DeFi) apps like Curve Finance and AAve and the popular NFT platform OpenSea have already shifted to Polygon. As more DApps move to the Polygon chain, traffic on the Ethereum main chain reduces, while still ensuring that all the transaction details are safely captured.

Polygon’s Solutions & Ecosystem

Polygon is probably leading the race for a wider and mainstream adoption of Web 3 in the future. It has already built out a great suite of solutions around its Matic Network. With its primary offering, the Matic Network, or what they call Polygon PoS (Proof of Stake) already providing arguably the best way for anyone to launch their web 3 project, Polygon has become kind of a de-facto choice for developers. Clearly stating their target for becoming the “AWS for Web 3” in its blog, Polygon rapidly added more solutions to its suite to provide developers all the flexibility to use their infrastructure while also ensuring the security that comes from the Ethereum blockchain.

Some of these are Polygon Edge which allows anyone to build their own blockchain, somewhat like a sidechain to a sidechain, and Polygon Hermez , a Zero Knowledge rollup that promises high scalability.

Polygon considers Zero Knowledge cryptography to be the end-game for blockchain scaling. No wonder, it is going all in on it, committing over a billion dollars to zero knowledge technology. Of that 250M Matic or $650 million dollars alone was to acquire Mir to develop Polygon Miden.

Polygon also earmarked $100 million for blockchain gaming and in December 2021 announced a partnership with GameOn to develop NFT-based blockchain games for the masses. We also wrote previously about Gaming in Web 3. Interestingly, Decentraland, the biggest Web 3 game also runs on Polygon

More than 7000 decentralized apps (DApps) are currently running on Polygon, as it has become the platform of choice for the developers. Polygon also invests continuously into its developer ecosystem, which is very important if it is to actually become the AWS of the future. Ultimately it’s the people of their community, whether it be developers or their users transacting with them, that will decide whether Polygon will be able to sail through. After all, there are big network effects in play here. The more DApps hosted on Polygon, the easier it is for any new DApp developer to choose Polygon as that makes it much more convenient to interact with other DApps on the same network. And this value of its network also contributes to the value of the token

And this is reflected in Polygon’s investors which looks like a who’s who of the VC world. There are the usual suspects, Sequoia , Softbank and Tiger Global, who usually take competing bets, coming together in this. There’s also Mark Cuban who is also building his venture Lazy.com on Polygon. During the last 2 years the prominent global investor Andreessen Horowitz has taken a massive lead in Web 3 and all other investors were left playing catch up. a16z is already into their dedicated Crypto fund, with a massive $3 billion worth of investments across crypto startups. Further, it makes sense that if Polygon is hosting a majority of DApps, backing it is equivalent to taking a blanket bet on Web 3 in the future which is much more simpler than betting on DApps all of which might not be successful.

Economics of Web 3.0 or Tokenomics

The first question that comes to mind is – What actually is a token? Tokens can be thought of as Enablers. They can represent value, rights, privileges, or anything that the issuer of the token wants them to be. A key is a token that enables you to unlock your home, a currency note is a token that enables you to obtain any item, and even match tickets are a token that give you access to a stadium. All of these tokens can also be exchanged for each other (for example the amount of money you need to get the key to your house) which determines their relative value. Of course it might seem weird to exchange a key for a match ticket, but that is because the INR token is much more exchangeable than others, and so much that it is the currency of our nation.

If you think about it, a very good analogy of tokens in Web2 are the stocks of publicly traded companies. You exchange them for the INR token, and you have a vote (albeit negligent) in how that company operates.

Tokens act as a means by which a Web3 Project can capture and transfer utility value when the users make use of their products/services. Each such token of a Web3 project has a utility value and a speculative value.

- Utility Value : Value created by using the token for performing an action.

- Speculative Value : Value assigned to the token because of the demand for it in the market of buyers and sellers for it.

It is very important to differentiate between the speculative value and the utility value of a token.

All the prices that we see on different cryptocurrency exchanges of different tokens are speculative value, not the utility value. The speculative value might fluctuate quite wildly as compared to the utility value of the token. In the long run, it is expected that the speculative value would be equal to its utility value. So if a token doesn’t create any utility, its speculative value will also go down to zero.

For example, on the Polygon PoS Chain, you’ll have to pay MATIC (Polygon’s token) as fees for adding transaction data. On Filecoin, a decentralized file storage project, where the user has to pay FIL (Filecoin’s tokens) to store and retrieve file data. The utility value of a FIL token would depend on what benefit do you derive from storing the file on blockchain and the convenience that Filecoin can provide.

Similarly, Chingari, the short video platform that surged after the TikTok ban, also launched its token GARI in October 2021. It rewards creators and viewers with GARI (Chinagri’s tokens) for using the platform and even allows creators to create NFTs for their work and viewers to fund the artist.

The Blockchain Trilemma

Not only scalability, there are actually 3 aspects that every blockchain project has to consider –

Security, Decentralization and Scalability (or Speed).

First termed by Vitalik Buterin, the co-founder of Ethereum, blockchain developers often have to make trade-offs that prevent them from achieving the maximum in all three aspects. The Blockchain Trilemma is that when we try to optimize for any 2 of these, the 3rd one would decrease. It is not actually a theoretical law, but just a model that helps think of the challenges of building a blockchain project.

For example, achieving more decentralization where each transaction (any action/record on the blockchain) is approved by consensus from different groups is a key aspect of blockchain technology, without which it would be no different from centralized companies that we have today. But that comes at the cost of speed because each transaction would require multiple approvals.

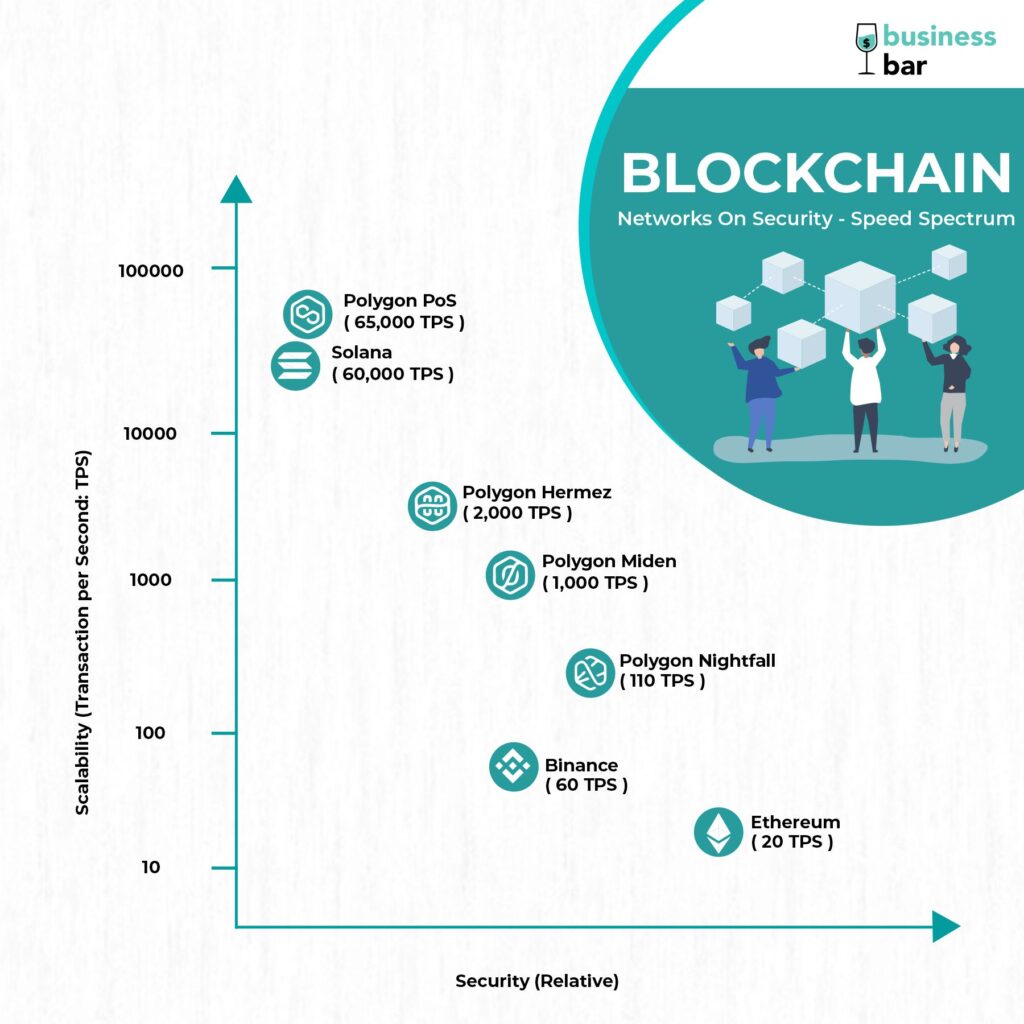

The card network Visa processes around 1700 transactions per second (TPS), whereas Bitcoin can manage only around 5 TPS, and Ethereum around 20 TPS. A new blockchain network of a few nodes can easily outperform Bitcoin, but that would hardly be decentralized.

The Polygon PoS chain claims to do nearly 65,000 TPS, which is astonishing. It must definitely be compromising on either decentralization or security, right?

Kind of, but no. It is fairly decentralized (semi-decentralized) but definitely not as much as bitcoin yet. It takes care of security by actually using the Ethereum chain (most secure) as the base and builds its sidechain in parallel. This is a debated point where the trilemma can also be thought of as a pyramid, with Security as the base and real trade-offs existing between decentralization and speed.

The different solutions of Polygon cater to different needs on the security-speed spectrum. A gaming application for example, needs a lot of speed and can compromise on security, whereas a Decentralized Finance (DeFi) app, would not like to give up any security for speed.

What is Polygon doing on the Security front

For all the talk around cryptography and how it secures all blockchains, any blockchain technology will have security issues of its own. The Bitcoin and Ethereum network are secured by a huge amount of computing power that is spent by all systems in the network to verify transactions before they are made part of the blockchain. Requirement of large computing power is a hurdle for scale, and companies have to be careful how they tackle that.

The recent hacks like the $320 million heist on Wormhole, and the highest ever $600 million hack in Poly Network (platform that connects different blockchain networks to be interoperable) where hackers exploited a vulnerability in the code, have dented the secure reputation that was enjoyed by Bitcoin and other Web3 projects for a long time.

The blockchain systems are dependent on the security of their underlying code. Compounded by the fact that Web3 Projects are open-source projects i.e. all their source code is available online and anyone can view their source code (Polygon). This means they especially have to maintain very tight security on everything they implement, as they are a very lucrative source for hackers.

Polygon does this by employing validators and security experts across the globe, who monitor the network and identify vulnerabilities, which are fixed by Polygon spontaneously.

But that’s not all

After Scalability, the next biggest hurdle for Web3 is privacy. Privacy plays a very important role in our existing financial system as well as many digital systems (messaging, e-commerce, etc.) that we use everyday. If the transactions or actions that we perform were public, we won’t perform a set of them.

This is roughly the state where Web3 systems are. The transaction data is publicly available on the blockchain. So, only those transactions take place in which the transactors have no issue having the transaction information public. Each legal transaction that is not performed on Web3 because of lack of privacy results in loss of economic value that could have been generated on it. Intuitively, we can imagine that the economic value loss because of lack of privacy can be huge as those who care about privacy are usually the big ticket transactions.

If Web3 systems have to gain mass adoption, then they need to have a solution to provide privacy which satisfies the constraints of all the concerned stakeholders (Users, Service Providers, Governments, etc.) And turns out, providing privacy in decentralized web3 systems is a very difficult problem.

And a strong potential solution for this problem is Zero-Knowledge Proofs.

What is that?

Zero Knowledge Proofs are a way to allow you, the Prover, to prove to someone else, a Verifier that you know some data without actually revealing that data, by sharing a Proof. I know this might sound impossible if you are hearing about them for the first time, but it’s real and has a huge amount of scientific work backing it. Instead of revealing the data, you share a Proof with the Verifier which is generated using your data, which the verifier can use to check the validity of your data. There is no way to decode your data from the proof that you have shared because the proof contains 0 knowledge of your data.

“Zero Knowledge Proofs are potentially for Web3, what Neural Networks are for Artificial Intelligence”

Polygon & Zero-Knowledge Proofs

In August 2021, Polygon released its Strategic Thesis, in which it laid out its plans to allocate $1 Billion in resources towards Zero Knowledge Technology Development. It acquired Hermez (rebranded to Polygon Hermez), a ZK-based scaling solution in August 2021 and Mir Protocol (rebranded to Polygon Zero), another ZK-based scaling solution in December 2021. I would recommend reading the thesis to anyone interested in knowing more about its plans.

It also announced Polygon Miden, another ZK-based scaling solution in November 2021 which is led by Bobbin Threadbare, former Facebook’s core ZK researcher.

Through the acquisitions and hiring, Polygon has built a team consisting of the best researchers and engineers in the field of Zero-Knowledge Proofs in the world. 6 out of 10 best scaling solutions are part of Polygon

Combining this amazing talent pool with its resources, we can expect some great ZK-Technology breakthroughs and innovations coming from Polygon in a short time.

These breakthroughs will play quite a significant role in bringing the next billion users on Web3, and it is very likely that these users would be onboarded on the ecosystem built on top of Polygon.

In conclusion, Scalability is solved to a decent level with Polygon and it is investing heavily to ensure the ecosystem thrives

Polygon PoS chains can process 65,000 transactions per second and do it at a cost of $0.002 per transaction. This cost and speed is good enough for a lot of Web3 applications to be built on top of Polygon, which would create value for the users in the near future, drive more capital in the system, thus making the system more efficient and cheaper as time passes, driving more adoption. Or in short, the flywheel effect..

In Web3 systems, a token acts as the value capture mechanism. The more value a Web3 project creates, the higher the value of the token would be. The value of a token also increases when users hold the token and make use of it.

Web3 projects that are built on top of Polygon need to pay the MATIC Tokens (Polygon’s token) as fees for doing transactions on Polygon Blockchain. As the time progresses, more and more Web3 projects will build on top of Polygon, the more the MATIC token would be used and the demand for it will increase (The supply of MATIC tokens is limited to 10 Billion). And the MATIC Token will be kept on using until all the projects built on top of Polygon become defunct or move to some other network. The probability of this occurring would be very less, thus making the probability of Polygon being around for a very long time, very high. Thus making Polygon very valuable.

Led by Yashvardhan and Co-written with Owais for BusinessBar