Amazon-Flipkart, Ola-Uber, Swiggy-Zomato, MakeMyTrip-Ixigo – we’ve started relying on these applications much more. What’s common between all these platforms is that they are all marketplaces. In today’s article we discuss these consumer facing marketplaces, and many more marketplaces that are working in the background across various industries.

In 2016, the Government of India permitted 100% FDI in online marketplaces. Fast forward to 2022, marketplaces are the top-funded e-commerce sub-sector, accounting for around 59% of the total $29B funding raised during 2014-Q1 2022. Further, marketplaces have minted 12 of the 103 unicorns in India. But what are marketplaces, and what makes them so appealing to government, investors, and entrepreneurs alike?

What are Marketplaces?

Marketplaces are companies that act as the connecting fiber between suppliers /manufacturers and buyers. Flipkart, which is every Indian household’s startup success story, is a marketplace that connects you (buyer) to sellers of electronics, books, etc., from all over India.

From the POV of buyers/sellers, marketplaces provide suppliers with easier access to erstwhile inaccessible buyers and vice-versa. People who weren’t cab drivers started driving post-Uber/Ola. People who wouldn’t usually take a cab started taking it after Uber/Ola. This resonates across marketplaces, and you can easily spot this in the likes of Swiggy/Zomato and AirBnB/OYO.

Easier access to the network of buyers and sellers offers a much more competitive market that allows for the discovery of fairer prices. Marketplaces, by being digitally integrated, enable online interactions between market participants, thereby facilitating transactions between them. Transactions are now carried out in a span of a few minutes against hours of offline interactions in traditional markets. With these convenient interactions, transactions have increased tremendously across markets. The size of the Indian E-Commerce market in 2022 is estimated to be ~$75B, growing at ~21.5% YoY.

From an investor’s point of view, marketplaces have asset-light models as the inventory need not be bought or built, just connected. As they scale, marketplaces build defensibility by virtue of the network effects that develop. More suppliers bring more buyers, who in turn get more suppliers and the cycle continues increasing the value of the network for each incremental customer that joins.

Further, by providing large demand to the suppliers, marketplaces get volume discounts which they can forward to the buyer, thus lowering prices. Hence, it is tough to displace an incumbent marketplace player since the incumbents already have the virtuous cycle of attracting more supply and demand to the platform by virtue of the existing massive network that provides direct monetary benefits to market participants.

New marketplaces are now being formed that are creating moats for themselves by providing a rich experience to both buyers and sellers – consumers of marketplaces. Marketplaces in pursuit of providing a rich experience are increasingly adopting a specialization strategy (vertical) over a generalization strategy (horizontal). Some are even adopting a hybrid approach like our favourite food marketplace duopoly – Swiggy & Zomato. Head to our earlier edition on Why Are Food Delivery Giants Diversifying to learn more. Before deep-diving into marketplace strategies, let’s have a look at other categorizations and types of marketplaces.

Types of Marketplaces

The most generic marketplaces (traditional) are lead-gen marketplaces like Justdial, which primarily assist in connecting marketplace participants across multiple categories (Justdial Bangalore has >300 categories), with the remaining interactions being done off-platform. On the other end, we have fully managed (or full-stack) marketplaces like Zomato that handle discovery-adjacent parts of the value chain like fulfillment, customer service, payments, checks, verification, etc.

Marketplaces differ at the crux based on who the market participants are, irrespective of goods/services transacted. Take, for instance, groceries. While you probably get your groceries from BigBasket, you probably don’t get them from Udaan, even though both are large marketplaces selling groceries. (In 2021, BigBasket hit Gross Merchandise Value (GMV) of ~Rs.8,000 Cr, and Udaan attained a GMV of Rs.6,000 Cr.) What makes them different is the way they connect different stakeholders in forming their markets. There are basically 3 forms of stakeholder interactions: Business to Consumer (B2C), Peer to Peer (P2P), and Business to Business (B2B).

- B2C: The most common type of marketplace is where a business (brand/seller) sells directly to a consumer. Common examples include – Amazon, Flipkart, Myntra, Nykaa, etc.

- P2P: Sometimes, B2C marketplaces start off as P2P where a Peer sells to another Peer. Some common examples of this category are Olx, Quickr, AirBnB, Upwork, and Etsy. However, as they gain traction, the seller base, on realizing the profit potential, formalizes it into a business, and the marketplace transitions to a B2C model.

- B2B: When a Business sells to another Business. Examples include Udaan, Infra.Market, ofBusiness, Moglix, Zilingo, etc.

So, while theoretically, you could buy groceries from both BigBasket and Udaan, you choose the former since it offers services geared towards end consumers (no minimum order quantity, at-home delivery, etc.) while Udaan is geared towards selling to retailers (working capital lending, bulk order delivery, etc.)

Marketplace Revenue Engine

Marketplaces operate via a straightforward revenue model, similar to any typical business. They source supply, add a margin on top, and then finally sell it to customers. Within the marketplace ecosystem, this is referred to as the Take rate. However, there are other, more innovative ways to make money, as illustrated by the newer age marketplaces. Let’s look at a few commonly used revenue models :

- Take Rate: It is a percentage of sale value charged as a fee by the marketplaces for facilitating the connection and transaction between a buyer and a seller. The buyer or the seller can be charged this fee, but it is usually the seller who is charged. It is seen as a ‘fair’ method of monetization since a seller only has to pay if they have made a sale. However, this has a flip side too. Many times, to keep the take rate for eating into their margins, sellers end up increasing prices on the marketplaces. For instance, your favorite Biryani would cost more on Zomato than if you order directly at a restaurant. Marketplaces that use take rate include Amazon, Flipkart, Uber, Swiggy, etc.

- Listing Fee: Suppliers/Buyers are charged upfront for listing their stock/requirement. It is not seen as ‘fair’ from suppliers’ POV as the fee will be charged irrespective of the turnover/margins made. This hits the smaller suppliers more due to the listing fee biting into their already thinner margins. However, this revenue model enables better curation since people will only list products that are likely to sell and of high quality and will not flood the marketplace with everything they have. Some marketplaces have introduced different tiers in the listing fees: no charges until a certain number of listings are hit (Amazon), no charges for certain geographies or categories (Craigslist), etc. This makes their model similar to a freemium model. More on that below. Examples of marketplaces that use listing fees include Justdial, IndiaMart, Craigslist, etc.

- Freemium/Value Added Services: Since the listing fee/take rate revenue models incentivize price competition via the lowering of it by new entrants, some marketplaces instead charge a very low/no transaction rate and rely on selling Premium/Value Added Services such as ad placements, providing credit/working capital, logistics, fulfillment, sales analytics, etc. to a select group of customers opting for it. In 2021, Amazon’s ad revenues ($31B) were higher than Youtube’s ($28.8B) and, in fact, higher than the entire global newspaper industry’s. However, you need to ensure that you have large volumes of customers to ensure that at least some use the Freemium/Value Added Services you provide to drive your revenue. However, this model has fundamental flaws, especially for early-stage marketplaces: Cash reserves get burnt fast in supporting a large base of non-paying customers. In addition to being resource intensive, free tier users also need to be converted to paying users. A process that requires more resources and cash burn. E.g., Etsy

- Membership/Subscription fee-based: Amazon Prime and Supr Daily, also seen in recruiting (Linkedin) and dating (Bumble), and Lead Generation based : commonly seen in re-commerce and services marketplaces (Urban Company, Quikr).

Before we dive deeper into marketplace models, let’s take a look at the e-commerce enablers – the backbone of marketplaces.

E-commerce Enablers – the backbone of marketplaces

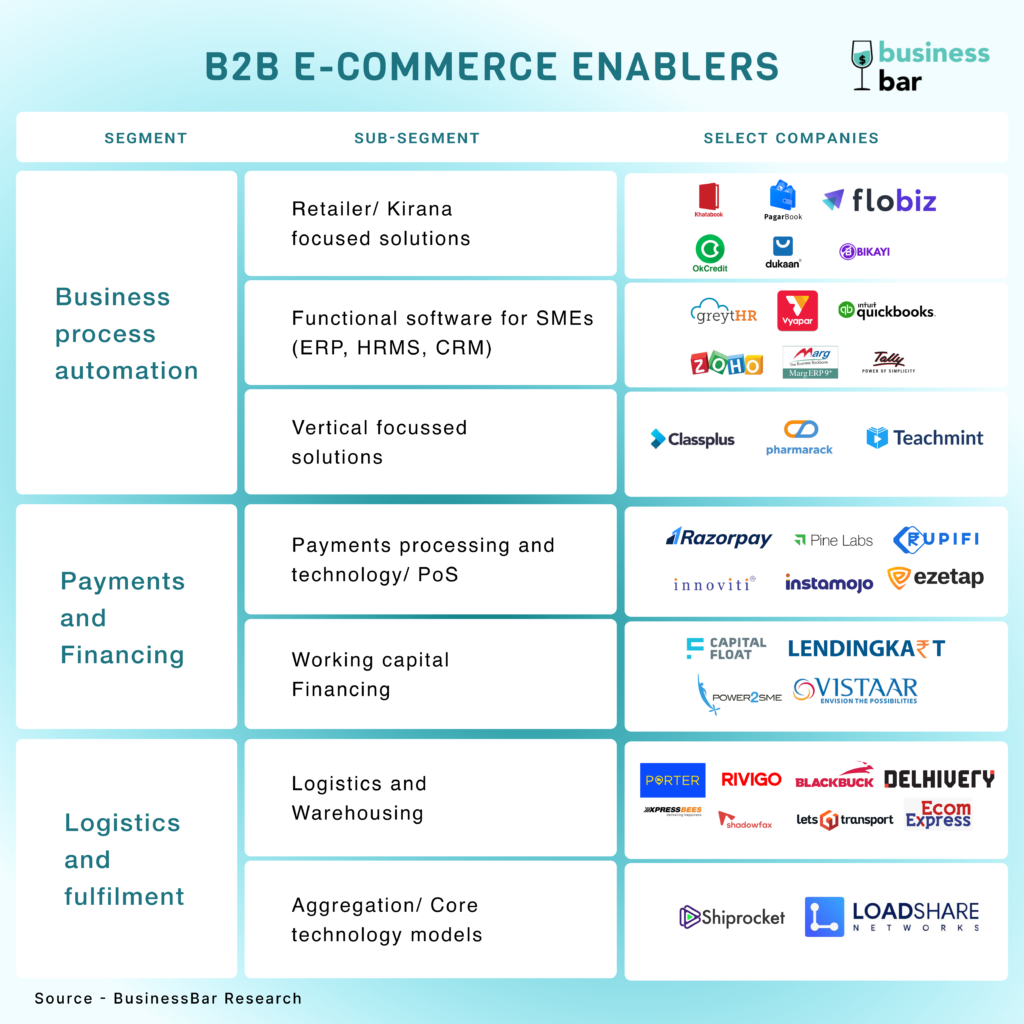

India’s e-commerce has become huge in the past decade. But every Batman needs a Robin. And that’s exactly what the e-commerce enablers do for the marketplaces.There has been a rise of many enablers which help the marketplace players in various parts of their business: automating business processes, payments and financing, and providing logistics & fulfilment support. Demand for such solutions is only bound to increase as the sector further expands. India’s largest marketplace Flipkart has also acquired an e-com enabler ANS commerce.

- Business Process Automation: The solutions range from horizontal ERPs/SaaS like greyTHR, Zoho, Quickbooks to vertical focused players like Khatabook, Bikayi, Classplus etc.

- Payments & financing: India’s rise in digital payments and the growth of e-commerce are tightly coupled. Players like instamojo, Razorpay, Innoviti, Pine Labs have enabled the transactions. Capital Float, LendingKart etc. are providing working capital and trade fianning to various players in the value chain.

- Logistics & fulfilment: Fulfilling an order requires a sturdy logistics network which reaches to 95+% of pin-codes and can fulfil 1-day deliveries. Players like Delhivery, Xpressbees, Cogoport are enabling the system right from ports to last-mile.

Horizontal marketplaces

As a marketplace company, you can choose to either specialize (grow vertically) or generalize (grow horizontally).

The marketplace wave in India started with the likes of Indiaplaza (ex-Fabmart), Flipkart, and Snapdeal, who, after starting with a single category (Music CDs, Books, and Coupons, respectively ), quickly sought to grow horizontally to encompass as many product categories and industries as possible to cater to the greatest number of people possible. Even now, 81% of the total marketplace funding goes to horizontal players.

The fundamental reasons to grow horizontally are very sound. By growing horizontally, marketplaces enable the buyer to fulfill all their requirements on the same platform, thus increasing the AOV and, as a consequence, boost the marketplace’s commission.

Further, by increasing the range of products and services offered, marketplaces increase fragmentation across both the buyer and seller bases. This helps avoid consolidation risk inherent in a marketplace model. A consolidated seller base would avoid intermediation by a marketplace and avoid sharing their economics. A concentrated buyer base can significantly reduce your revenue if they churn. Further, they too can lobby for lower prices.

Lastly, horizontal marketplaces can quickly become monopolistic by virtue of their scale. Udaan has ~50% market share in eB2B, and RIL comes second with ~25%. By establishing deep relationships with buyers and sellers across product categories and vast logistics and warehouse networks. Udaan makes it tough for a new marketplace competitor to displace it since Udaan is able to bundle orders of multiple categories to make warehousing, logistics, credit, and pricing much cheaper than alternatives. This almost monopolistic power of companies like Amazon and Flipkart has caught the eye of the Government of India, which has begun to initiate projects and policies like ONDC to control it.

It is clear that horizontal marketplaces are the Goliaths of the e-commerce market. However, we are also seeing the rise of Davids in the form of vertical marketplaces. These marketplaces focus on one specific sector and serve a niche product category to a highly targeted audience to become the brand authority for that product category. Let’s look at how our Davids are putting up a fight.

Vertical marketplaces

The logic chain goes something like this: For certain categories, the TAM is large, there are multiple branded and unbranded items available, and there are very few cross-sell opportunities. For example, in a B2C setting, when one goes shopping for beauty and personal care items (TAM for BPC in India is $16B with fragmented supply), there is a very low chance that they plan on buying books and stationery as well, so why should a marketplace sell both? Instead, one would prefer a wider range of available skincare products. This is the Nykaa story. Similarly, on the B2B side, a Kirana retailer (TAM for food and grocery is $500B with multiple branded and unbranded products available) would not want to procure electronics to sell regularly. So, why, as a B2B marketplace, sell both? This is the Jumbotail story.

Vertical marketplaces focus on the high-touch customer with specific needs and service demands. B2B buyers are very particular about the quality and price of supply since it directly affects their business and, as a consequence, their livelihood. Focusing on one specific category allows for exhaustive coverage of items which leads to the matching of the long tail of SKUs/niche services with the long tail of customers looking for niche products/services.

Verticalization also facilitates accommodation of Service Level Agreements (SLAs) for order fulfillment and quality of service. Some products like Pharmaceuticals, Poultry, Meat, etc., require custom logistics and fulfillment involving cold storage, expert handling, etc., which is tough to accommodate into a large supply chain made for multiple categories of products. By focussing exclusively on a single industry and owning the entire supply chain, vertical players can improve the quality of service and reduce wastage (Licious, using its custom supply chain, reduced wastage from the market standard of 40% to 3%).

The razor-sharp focus enables marketplaces to offer bespoke value-added services such as credit, working capital, marketing, concierge services, etc. (ReshaMandi launched ReshaMudra, providing invoice financing and Capex loans exclusively to suppliers and associates of weavers, fabric manufacturers, and retailers).

As discussed earlier, marketplaces build defensibility by building deep relationships and stickiness among customers (both buyers and sellers). By going deeper into an industry, vertical marketplaces build deeper moats by offering more conducive credit/working capital terms from financing partners, curated offers from payment gateway & suppliers, and superior customer service & quality of service.

Vertical marketplaces also could expand to different geographies easily due to sharp business focus and replicable GTM playbook. While none of the top five funded horizontal marketplaces were profitable in FY21, three out of the top five funded vertical marketplaces were profitable during that period. These reasons have caused many to start their own vertical marketplaces and many more to root for them.

Some are taking a hybrid approach to growth. Head to our earlier edition on Why Are Food Delivery Giants Diversifying, to learn about how Swiggy & Zomato – the classic food marketplace duopoly is growing vertically and horizontally in search of profitability.

Playbook From Greats Of Vertical Marketplaces

Globally and domestically, we have seen that some vertical marketplaces have gone on to become category creators and have now become household names. If you, our beloved reader, are an imminent category creator, here are a few lessons from the greats that might come in handy :

- Start with SaaS: Building a SaaS tool that is useful to the user’s specific pain point and provides standalone value to users is a good way to start building out a vertical marketplace. Once you aggregate enough supply side or demand side users on your tool, open it to the other side as a marketplace. For example, OpenTable started by offering a SaaS tool to restaurants that offered booking and PoS apps. This was then aggregated, opened as a marketplace, and used to allow table booking by consumers.

- Offer unique inventory and support the power sellers: Capture the long tail of a category assortment and offer unique SKUs that are either not provided or not provided sufficiently by the incumbent horizontal players. For example, Etsy provides a marketplace for crafters, artists, and collectors to sell their handmade creations and vintage goods to compete with the incumbent mass-produced items on horizontal marketplaces.

- Prevent leakage/disintermediation early on: There is always a very high likelihood that a buyer might buy via the marketplace once but reach out directly to the supplier for repeat purchases to skip paying the marketplace’s commission. What’s also possible is that the marketplace is used only for discovery,with the further interactions and transactions happening off the platform. This is called disintermediation or leakage. A well-designed rating system where the future value derived from the product depends on the rating is a good way to prevent disintermediation. Suppliers would prefer to stay on the platform and get a good rating at the end of the transaction to drive more sales down the line by virtue of the reviews. Thus, preventing leakage. Another way is to solve the entire set of needs of at least one side of the marketplace by virtue of being vertical. This way, there is a very high incentive to stay on the platform for the downstream benefits such as better payment modalities, logistics, or quality of service. Other ways include restricting direct contact and masking key information.

- Use Freemium model: Freemium revenue model, by charging no/low fees to the average user, works extremely well for acquiring new/small sellers who are sensitive to costs. The revenue is driven both by the small/new sellers who start deriving more value and by larger players who need and can afford the paid features. For example, Etsy balances its free-listing, commission, and listing fee model with paid upgrades like direct checkout, Ads promotion, shipping labels to power sellers, etc.

Tailwinds for Verticalization

The modern Indian buyer is maturing rapidly. They have preferences and expect a wide range of available products within a category. This evolution of the consumer base necessitates a fatter long tail of available products. Thus, vertical marketplaces, by focusing on depth, are better positioned to satisfy this demand. This is why PharmEasy, with a 50% market share, has become the de-facto choice for online pharma purchases. A similar narrative holds true for Nykaa and Purplle. Further, running marketing campaigns is getting costlier by the day (FB and Google Ads CPC and CPM saw a 60-75% increase in the last 1 year). This makes running horizontal marketing campaigns across categories and target audiences very expensive. Vertical marketplaces, with an industry niche and easily segmented and defined customer groups, can hit the ground running with a smaller, targeted marketing investment. Further, API-driven architecture, which is increasingly becoming the norm among software architects, enables different decoupled parts of the business value chain to be independently developed and then joined seamlessly. This modularity enables taking on more parts of the value chain, either upstream or downstream, easier. This has also given rise to paradigms like embedded finance, where working capital and credit can easily be disbursed and collected right from the marketplace. Marketplaces like Udaan (via Udaan Capital) and Amazon have incorporated this into their workflows in India.

Vertical marketplaces have arrived and continue to expand relentlessly. With distinct value additions and strategies, they fill in the gaps that were erstwhile unfilled and epitomize the famous saying by Jeff Bezos: “We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.”

We have captured the information best available in the above article, feel free to write to us in case of any data correction.

BusinessBar team thanks Aadith Ramesh for his contribution to the article.