While Tatas and Birlas shaped India’s growth story in the decades after Independence, the 21st Century has seen Ambani and Adani writing an entirely new wealth creation story. Both Mukesh Ambani – chairman of India’s most valued company, and Gautam Adani – the country’s infrastructure tycoon, are part of an elite centi-billionaire club (individuals having a net wealth of $100 billion or more), along with just seven other business moguls at the time of writing this piece.

The meteoric rise in the wealth of a 59-year-old Gautam Adani, now Asia’s richest and world’s fifth wealthiest individual, from $8.9 billion to $128 billion in just two years is quite astounding. What makes his story more remarkable than his fellow competitor Mukesh Ambani is the fact that he is a first-generation entrepreneur and has built a fortune in just three decades. (Read our piese about how Mukesh Ambani transformed the petrochemical company into a global tech giant here.)

So what is his secret sauce? How did he manage to build an empire from zero? Or you might also be wondering if this is just a bubble about to burst? How long can this trend continue, and what lies ahead for the Adani group? Before we delve into these questions, it is worth spending some time to know more about the man himself.

Adani’s journey to create an empire

Born in Ahmedabad, Gautam Adani dropped out of his undergraduate commerce program when he realized academics wasn’t for him. So he then moved to the city of dreams in 1978 to work at a diamond company and at the same time, he also started his first venture – a diamond brokerage firm. He went back to Ahmedabad 3 years later when his elder brother asked him to manage his plastics manufacturing business. There Adani started a new commodity trading business to import raw materials for his brother’s factory and founded Adani Exports (today known as Adani Enterprises Limited) in 1988, marking the start of the journey for the Adani group.

The favorable business environment due to economic liberalization and reforms of 1991 enabled Adani to expand his business into trading power, textiles, agricultural products, and metals. One of the most important elements in trading is the Port. And that’s why when the government of Gujarat invited private companies to operate Mundra port in 1993, which is India’s largest private-sector Port, Adani grabbed the contract to start what is now known as Adani Ports and Special Economic Zone Limited (APSEZ), which is also the Adani group’s cash cow today.

Under the umbrella of AEL, Adani Power was started as a power trading company in 1996, which started power generation in 2009. Around a similar time, the Adani group also started its journey in the power transmission sector in 2006, necessitated by the need for their thermal power plant in Mundra. The enormous potential in the power transmission and distribution sector led to the formation of Adani Transmission in 2015.

While a major part of Adani’s existence has been focused on infrastructure and the development of fossil fuels, he realized that Green is the future and added these businesses to the portfolio. Adani Gas was started in Ahmedabad as early as 2005, and it spread its wings when French energy giant Total invested in it to form a joint venture Adani Total Gas in 2019. Starting with wind power projects in 2015, Adani Green Energy quickly added solar to its portfolio and took less than a decade to become the largest solar developer in the world.

This brings us to the next question: How big is the entire Adani group?

How big is the Adani group?

The group’s core philosophy, according to their website, is “nation building,” which has enabled them to build more than two dozen successful businesses, many of these being the largest in the country. Today, the empire boasts a combined market capitalization of $228 B of its seven listed companies.

The first-ever business, Adani Enterprises, has grown to become the largest coal trader and mining contractor. With Mumbai airport (India’s second busiest) along with seven others in its kitty, it is also the biggest private airport operator.

Adani Ports, which operates across 13 domestic ports situated on both eastern and western coastlines, accounts for nearly one-fourth of India’s cargo movement. Adani Power is the biggest private sector thermal power producer, and Adani Transmission is the largest private sector power transmission and distribution company in India.

With a last-mile distribution network spread across geographies, Adani Total Gas is the largest city gas distributor in the country. Adani Wilmar, a recent addition to the portfolio of public companies of the group, owns the country’s biggest edible oil brand – Fortune oil.

And drumrolls for the start performer – Adani Green Energy, the biggest contributor to Adani’s wealth gain. With a portfolio of 20+ GW, the company is also the highest valued on the bourses among other listed group companies.

Apart from infrastructure and power businesses, the giant is also present across various sectors, such as defense, financial services, data storage, real estate, fruits, and (of course) media – the sector that almost every billionaire wants to own nowadays.

What makes this feat even more remarkable is that this isn’t some tech firm that has grown exponentially, but this is a group that has triumphed in the infrastructure sector – where many have burnt their hands. Let us briefly discuss some of the important factors that enabled the wizard – Gautam Adani, to perform this magic.

Key enablers to the success of the Adani group

- Political proximity

Gautam Adani is known to have a knack for spotting the right opportunities at the right time, and this is quite evident from his business journey. Entering the infrastructure space just when the government liberalized the economy and the recent push for renewable power are just a few examples. And one thing that is common in almost every decision by the Adani group is that its focus aligns very strongly with the government’s vision, especially with our incumbent prime minister Mr. Narendra Modi.

As quoted in The Print, “Melding corporate strategies with government priorities — that’s the way of doing business in India.” And Adani seems to have mastered this exceptionally well

Adani’s initial expansion in Gujarat happened when with Modi was the Chief Minister of the state. The group’s rapid diversification and expansion started in 2015, right after Modi came to power. In fact, there have been multiple instances where Adani entered and conquered new sectors that the current government was pushing to develop. These sectors range from defense manufacturing and gas distribution to airports and local data storage. We are not claiming that Adani gained unfair support from the government. But his perceived political proximity, as well as the strong alignment between the group’s philosophy of “nation-building” and the government’s vision, has undoubtedly helped him bag some of the biggest contracts from the government. And everyone would agree that this is very important for the businesses in the infrastructure and power space.

- Inorganic Growth Strategy

While many of Adani’s portfolio companies have strong synergies, it is pretty impossible to achieve the scale without inorganic growth so quickly. Since 2014, the group has been among the most active in India’s M&A circle and has completed more than 20 M&A transactions across ports, power, transmission, logistics, and airports. Not to forget the recent news about the group bidding to acquire ACC and Ambuja for $10 B to enter the Cement sector.

- Scale and Execution

This unique ability is something the group is known for – expanding the scale of businesses and doing it quickly with a strong focus on execution! This has given it a significant advantage over its competitors and enabled it to grow from being a Gujarat-based firm to a multinational giant.

Scale also brings with it the ability to grow even more quickly. Consider Adani Ports. The business took 14 years to achieve its first 100 MT capacity, doubled it in the next five years and zoomed from 200 to 300 MT in the next three years. The scale and diversification into related businesses have also enabled the subsidiary firms to cross-subsidize each other.

It is a no-brainer that this kind of aggressive expansion would require cash, a lot of it. Well, the cash the group gets from its businesses in terms of profits is highly inadequate to fund the expansion (and we will discuss this in detail later). This leaves them with the only other option, external funding.

- External Funding: Fueling the Expansion

It won’t be an exaggeration to say that the investors, whether private or institutional, domestic or global, debt or equity, are pouring their money into the Adani group. But isn’t it perplexing to see that Adani has raised so much money and taken huge bets in the infrastructure and power space, something that most of its competitors could not do?

Let’s take an example. During the times when debt-strapped power generation companies were selling their assets, Adani kept infusing money in its similar-conditioned Mundra power plant and emerged out of the crisis even stronger, with double capacity. Why on earth would any investor give their money to the struggling company in a sector as dull as traditional power? Notably, the money comes from “related party transactions” thanks to the complex group structure, which allows the money to circulate between the group companies. The investors in such cases are often placing their bets on the group as a whole and not on these individual companies. And all the factors discussed above, political proximity, scale and execution, and decline of competitors in the infra space make the group quite an attractive bet for its investors.

Let’s dig deeper into how these transactions are carried out.

1. AEL acting as an incubator:

With a series of demergers post-2015, the Adani group now has multiple sister companies of Adani Enterprises (AEL). Although AEL mainly deals with coal now, it still functions as an incubator for the group. Its subsidiaries invest in other group companies to fund expansion plans or new ventures.

2. Group companies lending or buying equity in other firms:

This happens in multiple ways and can sometimes get very complex. Consider this, for example. A subsidiary or step-subsidiary can borrow money by pledging its assets or the shares it holds in one of the listed group companies. This borrowing can, in turn, be used to lend to or buy equity in another sister company, which may even be in unrelated business. As strange as this may sound, banks lend the money to buy equity. This is usually a strict NO from the creditors’ side since this would further reduce promoters’ skin in the game, but equations change when that promoter is Adani since they are now betting on the man, not the project or a subsidiary.

3. Assist struggling group companies

This would explain the case of Adani Power Limited (APL) we discussed earlier. During 2013-18 when many power companies, including APL, were in distress, a closer look at its old annual reports shows the related party transactions done for its survival. Thanks to AEL making a series of loans to APL through subsidiaries like Adani Infra, APL was able to see the sunlight after 2018 even as its peers fell into the debt traps.

As far as the funding is concerned, overseas funding is another critical variable in the equation. The global capital market is, in fact, among the largest funding sources for the group and is a part of the group’s strategy to reduce its dependence on the Indian banking system. And with a bigger global profile than ever, the group is able to raise global debts at attractive rates. Compare the 14-15% commercial rate of borrowing in India with 1% of Japan, 2.5% of the USA and 3-4% of the European Union charged annually on billions of dollars of loans, and you will realize the huge difference it can make on company’s financials. While foreign loans carry a risk of currency fluctuations, dollar-linked revenues of some of its businesses like Adani Ports make the hedging even simpler.

“For international investors, they can’t miss Adani, who is already sitting on cash-generating assets in a growing market like India.” – Bloomberg

Not only debt, but other global marquee investors and even energy giants see Adani as a lucrative opportunity to enter the Indian market. Since 2018, French energy major Total SE has invested a total of $2.5 B in both Adani Green and Adani Gas. Italy’s Snam has recently announced a strategic collaboration with Adani to explore and develop hydrogen and other cleaner fuels. Very recently, as Adani mulls forming a strategic alliance with Aramco, Abu Dhabi’s IHC has announced a $2 B investment in 3 of the Adani group’s companies.

Well, all the discussion so far might make you think of Adani as some magician for whom steering the business wheels is a mere bagatelle. But we are not here to paint a rosy picture when it is NOT.

Challenges

- Mountain of debt

As we have seen earlier, Adani has relied heavily on raising money through debt to fund its expansion in the capital-intensive sectors. The group’s listed companies have a combined outstanding debt of $20 B. But the current cash flows aren’t enough to pay for these loans. Net debt for the conglomerate stands at around 5.23x of EBITDA.

What’s even more worrying is how it secures and uses funding – the risk of evergreening of loans. Thanks to the high-density related party transactions, it is able to raise debt through the subsidiaries with good leverage ratios to invest in other stressed companies. Not surprisingly, controversial BJP leader Subramaniam Swamy called Adani the “biggest NPA trapeze artist” when it employed a similar strategy to save debt-strapped Adani Power.

In essence, the group appears to be funding its expansion plans by expanding continuously and swiftly. But given the already massive size of the conglomerate, it cannot continue forever, and the group will have to improve its financials. This brings us to our next point.

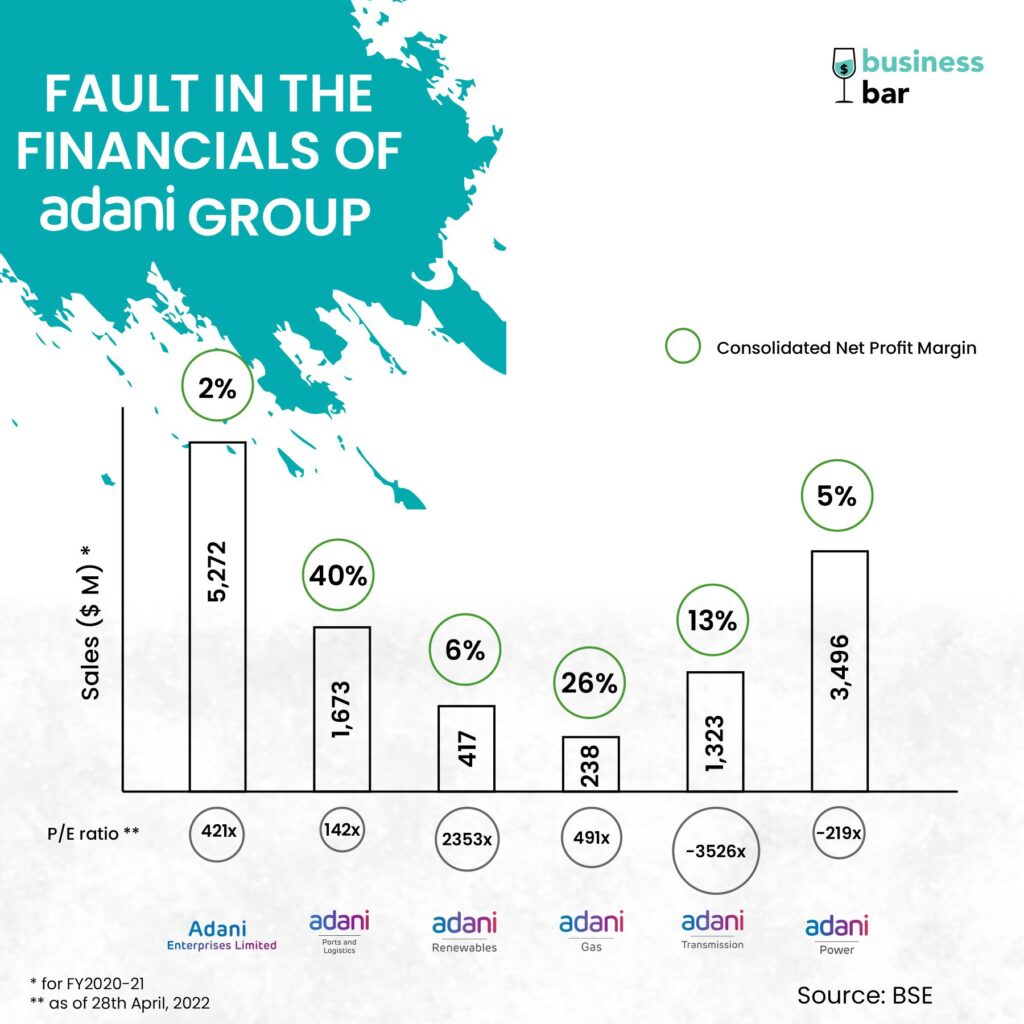

- Fault in the financials

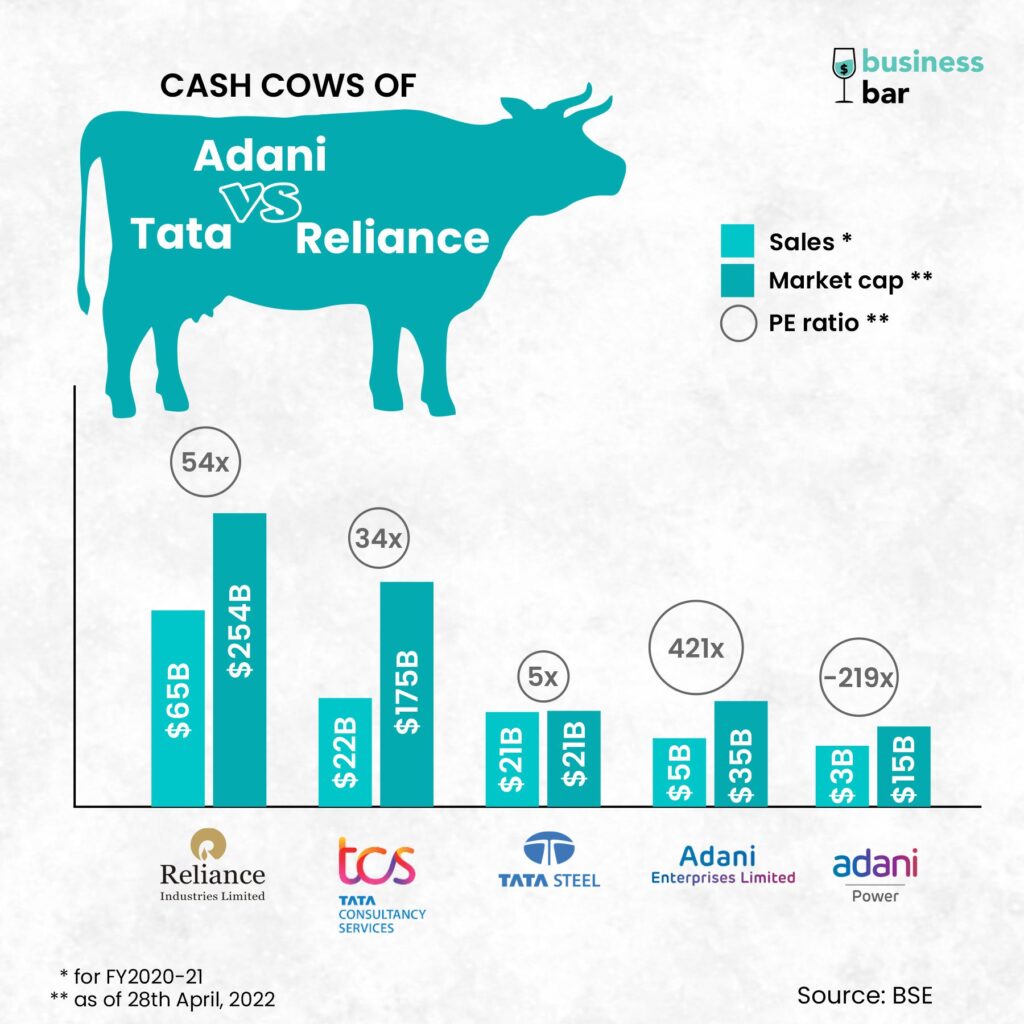

Reliance group has Reliance Industries, and Tata group has TCS and Tata Steel which generate large revenues and profits, but the Adani group lacks such a cash engine. Looking at the financials of the group’s six listed companies (excluding Adani Wilmar), 12-month trailing revenue of $14.5 B and profits of $1.14 B does not even compare with its market cap of $214 B (P/Sales 14x, P/E 187x). As contrasting as it may sound, the stock prices have only risen exponentially in the past couple of years (read how investing has changed recently in India and how it has impacted the stock price movements in the market here).

Compare Adani Total Gas which has a PE ratio of 491x with Gujarat Gas’s 29x, which interestingly earns 5 times more than Adani Total Gas in sales. Let’s not forget the star performer, Adani Green, with its absurdly high multiple of 2353x, way more than 34x of Tata Power. Only exception here seems to be Adani Ports, which has sound financials with healthy profit margins of 40%, dominant position in the logistics space – a sector that is also mirroring the country’s growth. Interestingly, it is also the slowest growing stock for the group, 230% in 3 years and 18% in the last year.

Why are the prices so exorbitantly high for a group operating in the infrastructure sector? Investors are betting on the group’s future. While the stock prices may seem detached from the current fundamentals, investors hope that the new ventures will start to show positive cash flows soon. However, comparing the financials of the new businesses such as Adani Total Gas and Adani Green with those of the legacy businesses such as Adani Ports and Adani Enterprises, the reality seems more distant than these hopes.

Adani Total Gas bagged the last-mile delivery contract from the government, but the lack of a gas distribution network in cities raises a doubt about whether the firm can generate the projected cash flows. A similar risk applies to the group’s other investments as well; how long will these huge bets by the group take to materialize?

- Political risks

While Adani’s political connections may be helping the group to expand, some of its biggest projects are awarded by the current government. This gives rise to the question of whether these connections could become his liability. What will happen to Adani if the government changes in the coming years?

- Adani’s Green story: Not so Green

While Adani touts itself as the world’s biggest solar developer, it is also one of the world’s largest private developers of fossil fuels. Developing countries like India and China still heavily rely on coal as a source of power, and there’s nothing wrong with Adani fulfilling this requirement, but it does so discreetly. It has stopped publishing exact numbers of coal mined recently, and also, the mentions of coal in its ESG report are all historic.

The Adani Group operates as a conglomerate, but when convenient, it uses its structure to greenwash certain parts. – Capital Monitor

And such corporate sleight of hand seems to have worked well for Adani. Adani Green’s $750 M green bonds, $750 M sustainability-linked bonds by Adani Ports, and skyrocketing stock prices are a testimony of public markets financing coal.

But this cannot continue forever. Adani will have to deliver on its Green promises considering the growing opposition to the use of fossil fuels among governments and global investors. Deutsche Bank recently walked away from participating in the sustainability-linked bonds issue due to similar concerns. Controversies around the Carmichael mine in Australia which involved the “Stop Adani” campaign by environmentalists, resulted in Adani shrinking its mine development plan from 60 M tonnes per year to 10 M tonnes per year.

An estimated $12bn of the group’s assets are at risk of becoming stranded under a beyond 2°C scenario – Carbon Tracker, a London-based think tank.

What lies ahead?

In conclusion, everything is not hunky-dory for the group. It will still lead the coal sector for the decades to come. The infrastructure businesses will still have to rely on the government for expensive contracts. The only hope is that the new ventures start generating enough cash to fund further expansion, which is not very clear again.

So does that mean it is a bubble about to burst? If history is anything to go by, the picture seems to be quite opposite of that. Adani can be likened to the mythical creature Hydra, a snake-like monster that would spawn multiple heads after being cut off. And it will be interesting to see in which direction does this monster grow.

We shouldn’t be surprised if the next venture from the Adani group comes in the tech-related field. Reliance has shown this to the world by conquering the telecom and retail space. And Adani is quite competent in breaking the stereotype of it being an infrastructure player. In fact, the group has already started moving in that direction. Adani has partnered with Flipkart to leverage and improve its logistics and data center capabilities. It also invested in Cleartrip, a leading online travel aggregator (OTA) platform, to strengthen its foothold in the travel industry (read our interesting analysis on the Travel Super App – MakeMyTrip and OTA industry here). And as India’s leading conglomerates Tata and Reliance are gearing up to achieve their B2C dreams, Adani doesn’t want to be left behind. It has already announced its plans to make a Super App, to onboard around 400 million Indians who are using its services in one way or another.

Will Adani succeed in going beyond mines, roads, and power plants and become the Ferrari of the digital world (in his own words)?