ideaForge, India’s biggest drone company, launched its INR 567 Cr IPO last week. The IPO includes INR 240 Cr fresh issue and rest offer-for-sale securities. The IPO was subscribed more than 100 times and it became 10th most subscribed IPO with issue size over INR 500 Crores. You can’t blame the investors’ enthusiasm. ideaForge is a market leader in a hot & sexy sector, with founding team from IIT Bombay, 130%+ revenue CAGR for last two years, and is a highly profitable company – which is contrary to the bulk of loss-making startup ecosystem.

Today’s issue on drones is a continuation of our earlier piece on manufacturing in India (‘Can India become factory of the world?’). We will look at the budding drone sector in India, the ideaForge story and the challenges and opportunity in the ecosystem.

Disclaimer: This piece should not be used for making any investment decisions.

Drone industry: Market Size in India

The sector has opened recently when the Civil Aviation Ministry released Drone 2021 rules, were it liberalised manufacturing and simplified ease of doing UAV operations. In Feb 2022, the government put a blanket ban on import of semi-knock-down (SKD) and completely-knock-down (CKDs) drone kits. Indian drone startup industry grew 5X to INR 319 Cr in FY22. The industry is expected to become 1500 Cr by FY24.

However, the industry is dominated by defence contracts, making ~70% of the market. The government is also using drones for SVAMITVA Scheme, a large-scale surveying and mapping project under which the government aims to create digital twins of India’s 6.62 lakh villages.

The Drone Industry Landscape

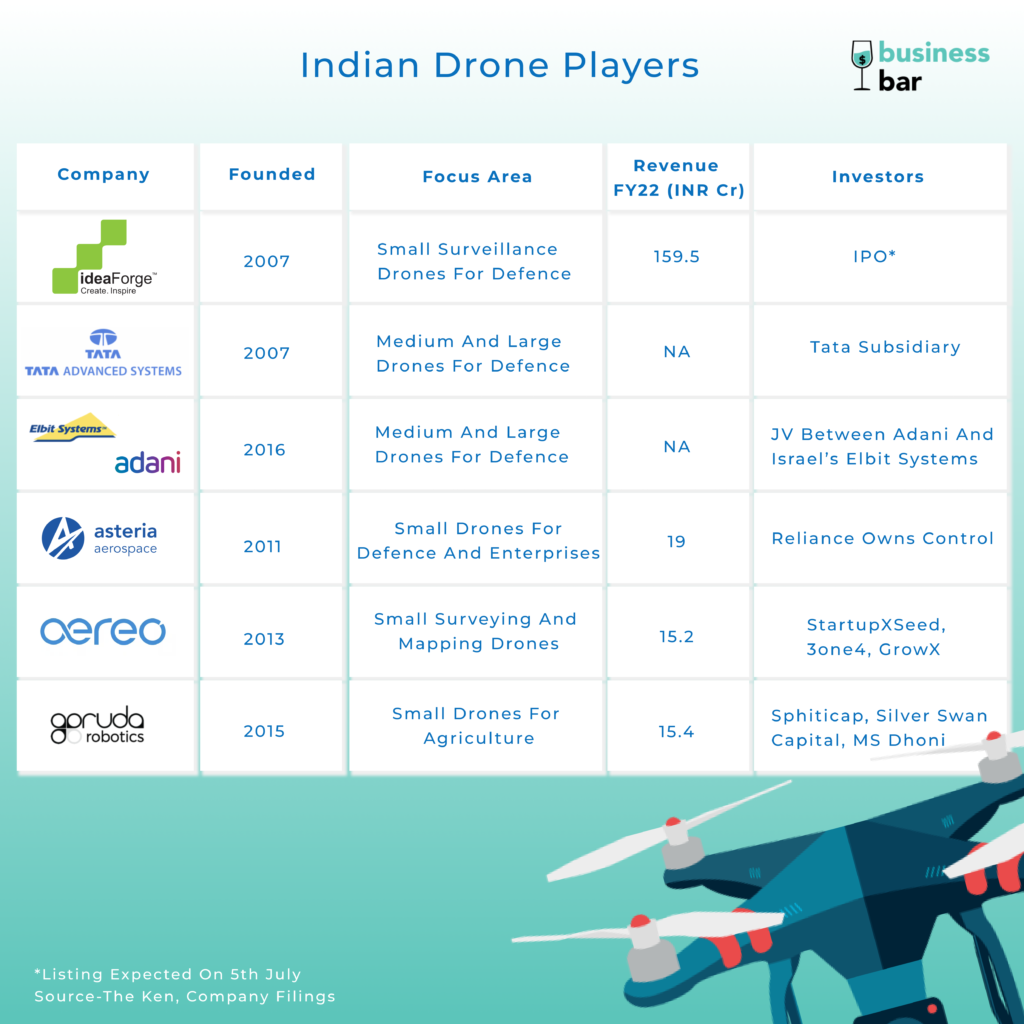

As per Tracxn, there are 250+ drone startups in India. For FY22, ideaForge had a market share of 50% of the total market. However, the market has also seen entry by big players. Reliance has acquired a majority stake in Asteria Aerospace. Adani Group has acquired majority stake in General Aeronautics and launched a joint venture with Elbit Systems. Tata Advanced Systems is also in the race with its defence focused subsidiary – Tata Advanced Systems.

The ideaForge Story

Three techies from IIT Bombay, Ankit Mehta, Ashish Bhat and Rahul Singh along with Vipul Joshi started ideaForge back in 2007. The drone sector was almost non-existent back then. The company has come a long way from lending its drone for the 2009 Bollywood movie 3 Idiots to hitting Indian public markets in a week from now.

The company launched its first market ready drone in 2009. Over the years, the company continued to build its R&D and auto-pilot, bagged small contracts from defence and homeland security forces and continued to raise money from investors. The real turning piece came when the company won the world’s largest mini-UAV contract from Indian forces for its hybrid VTOL (Vertical Take off and landing) Switch drones.

ideaForge raised an INR 60 Cr pre-IPO round at ~INR 2500 Cr equity value. Post IPO, equity value is expected to be ~INR 2800 Cr at upper band. This translates to ~88X Price to Earning ratio, a lofty valuation to say the least.

Challenges faced by the drone sector

The government is very bullish on the sector and aims to create India a global drone hub by 2030. EY-FICCI report puts the drone market opportunity at $10 Bn by 2025. However, the sector still faces lot of challenges.

Firstly, most opportunities are government contracts. This poses a challenge on certainty of revenues, customer concentration and collection cycles. Take ideaForge for example. As per the filings, ideaForge revenue grew only 17% in FY23 to INR 186 Cr from INR 159 Cr in FY22. At the same time, the Profits Margin dipped to 17% in FY23 from 28% in FY22. Despite generating profits, Net Cashflow from Operations was -ve 53 crores in FY23.

Secondly, the drone ecosystem in India is still small. India depends largely on China and Europe on sourcing of batteries, cameras, and other key components. It’s a chicken and egg problem. Since the ecosystem is small, creating large scale local manufacturing units in India becomes difficult.

Finally, the industry and government have over-estimated the market opportunity. The recent success that the startups have seen is in the small drone segment which cater to surveillance use cases for defence and homeland security and surveying/mapping use-cases for government bodies. However even within defence, the real juice is in the large drones and the loitering drones.

During the 2023 state visit of PM Modi to US, India is set to procure 31 MQ9B drones from General Atomic. These are HALE – High Altitude Long Endurance – drones with an estimated price of ~$100 Mn for each drone. In comparison, a small quadcopter drone used by government costs ~$10k. Kamikaze and attack drones have changed the nature of warfare forever. The Azerbaijan-Armenia conflict and Russia-Ukraine conflict are the two biggest examples.

Enterprise segment in India is still very small. It faces the challenge of long sales cycle, enterprises’ hesitance in adopting newer technology and regulatory hurdles. Case in point, India still doesn’t have BVLOS (beyond visual line of sight operations) rules, which is crucial for logistics and delivery operations.

Having said that, we are optimistic on India’s drone bet in the longer term. With a large and budding ecosystem, pro-active government policy, ideaForge success story, and huge engineering talent pool, India can become a lower cost and high-quality supplier to other South Asian and African countries.

This article has been written by Abhigyan Joshi