DUH, GET THE FACTS RIGHT!

Cannabis – hemp, marijuana, pot, weed, hashish, reefer, dope, ganja, Mary Jane and whatever the hell one would like to call it, is a taboo topic. Mostly because in a lot of countries around the world it is illegal to consume, has health implications and evokes strong emotions among researchers, clinicians, healthcare workers, policy makers and the public. The subject is further hotly debated because cannabis is one of the most widely consumed substances, by almost 250 million people, 3.6% of the world’s population.

To understand the complex and convoluted cannabis industry – let’s start with some basic facts, shall we? Many years of toiling in botany class while memorising god awful botanical names can finally be put to use now. Cannabis is a genus of flowering plants that belong to the Cannabaceae family. It contains more than 80 biologically active chemical compounds, but the two crowning jewels are THC and CBD.

As ill defined as it may sound, Marijuana and Hemp are both broad classifications of cannabis. Legally speaking, Hemp refers to varieties of cannabis that contain 0.3% or less THC content (aka more CBD), while marijuana refers to those that contain more than 0.3% THC (aka less CBD). In simple words, Marijuna is cannabis that is psychotropic (‘the one that gives a high’), while Hemp is cannabis that does not yield the usual euphoria. Both of them have varying degrees of medical use implication. Still, to date, the US Food & Drug Administration (FDA) has approved only one cannabis-derived and three cannabis-related drugs, available with a medical prescription.

Hemp is regarded with a level of acceptance because it has been widely cultivated since 8000 BC and has a variety of applications in industrial, food and wellness products. Digging deeper, we see that CBD from hemp is perhaps the least controversial extract as it elicits pain management properties, along with providing relief to individuals with sleeplessness, anxiety, stiff muscles and a specific form of childhood epilepsy, with no intoxication. On the other hand, Marijuana, due to its nature, has borne the major brunt of questioning. While finding answers to these is beyond the scope of this article, we were curious as to why the business world is riding on the cannabis high.

EVERY DOLLAR HAS ITS OWN SHADE OF GREEN

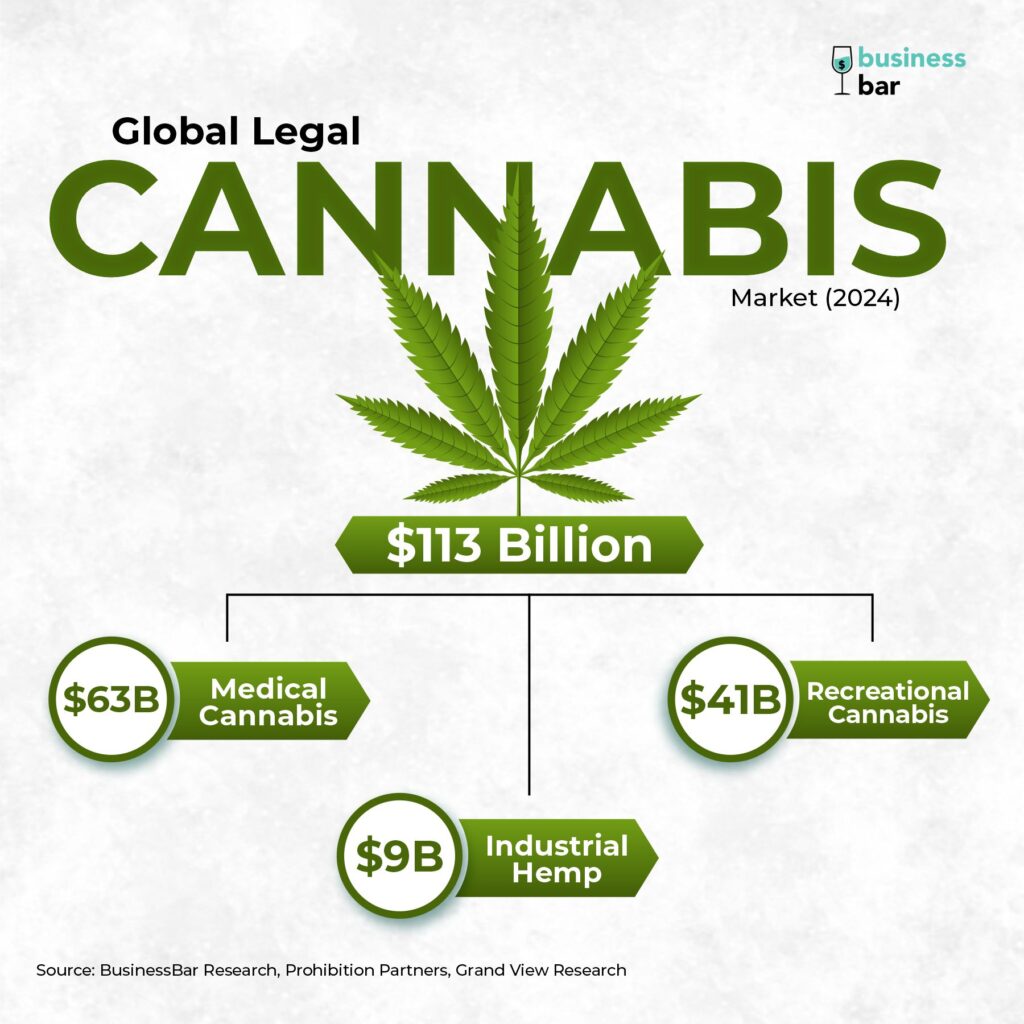

The global legal cannabis market size is anticipated to be $113 billion by 2024. It is made of sub-sectors like medical cannabis, recreational cannabis and industrial hemp. Recreational cannabis refers to consumption of cannabis for enjoyment. More often than not, it is consumed via smoking as cigarettes or via a pipe/bong. Most of these also have carcinogenic substances (cancer-causing) and thus can be lethal to users. Industrial hemp refers to hemp used in making fabrics, food products, construction material, bioplastics and biofuels.

Among these, medical cannabis will represent the largest market opportunity of ~63 billion, followed by recreational at $41 billion and industrial hemp at ~$9 billion by 2024. Believe it or not, for medical and recreational cannabis, Europe is expected to grow at a significantly faster pace to $39.1 billion market, than the historical heavy hitters (U.S.A and Canada) which will account for a $37.9 billion worth market by then. On the other hand, the U.S.A and Canada are expected to further solidify themselves as the leaders of global recreational cannabis.

| Drivers -Increased research on the medical applications of cannabis -Legalization of cannabis -Growing social acceptance of Marijuana -Improvement in R&D and Technological innovation | Brick Walls -Severe and complex regulatory structure -Lack of sufficient information on long term health risk caused by cannabis -Opaque and confusing language associated with cannabis |

| Blue Ocean -Better Product development -Unique Product delivery solutions -Potential emergence of new cannabis legalized international markets | On Ground Challenges -Cultivation of cannabis -Maintaining Product quality and control over distribution -Price standardization |

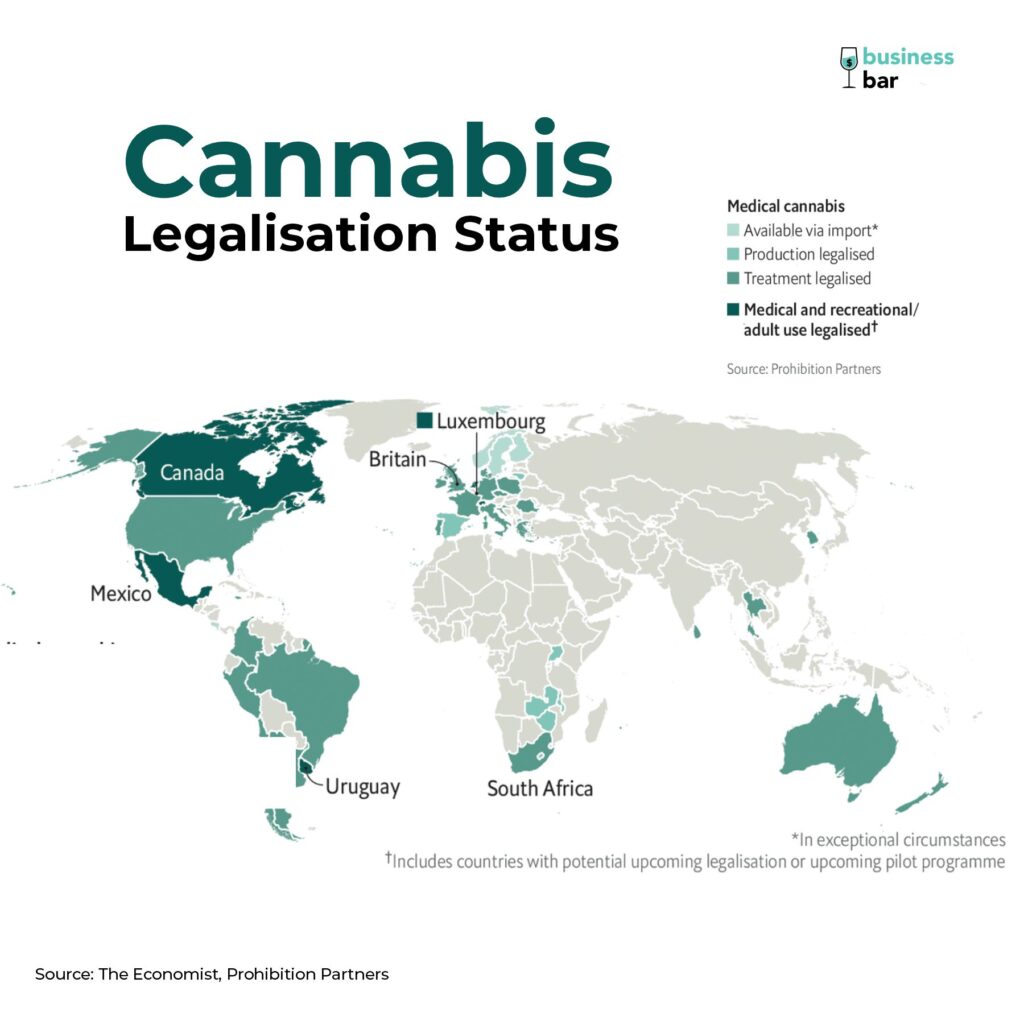

The growth of the global cannabis market can be attributed to key levers such as increasing legalisation, growing social and medical acceptance. However, regulations are still largely severe around production and usage of its various derivatives. Globally, about 40 countries have legalised cannabis for medical use. In the U.S.A, currently one of the largest markets of cannabis, regulations are in all shades of green. It is legal for medical use alone in 36 states. In more than 16 states adults can legally buy and use the drug also for recreational purposes. Thus, it comes as no surprise that today, almost 67% of Americans believe that cannabis should be legalised.

However, this is only the tip of the iceberg – since much of the cannabis market today is largely illegal and all estimates point towards a wild triple digit billion dollar global market. By some statistics, the U.S.A illegal cannabis market saw $66 billion in sales back in 2019, almost ~5x of legal medical and recreational sales in the states. As per the Cannabis Price Index of 2018, two Indian cities, Delhi and Mumbai combined consumed 70 metric tonnes of the banned narcotic, falling just 7 metric tonnes behind the highest consuming city in the world.

The historical and traditional medicine tale of cannabis affinity in India is well known. However, post 1985, the Narcotic Drugs and Psychotropic Substances (NDPS) Act barred the cultivation, possession, transportation and consumption of cannabis. But these regulations are ambiguous, as they do not apply to leaves and seeds of cannabis, hence opening up an access door to Bhang. India is among the few countries that have a well defined distribution system for Bhang, which is purchased by individual states from government warehouses and then sold at licensed stores. Recently, India at the 63rd session of UN Commission on Narcotic Drugs, also voted with the majority in favor of removing cannabis and its resin from the Schedule IV list of the 1961, which means that cannabis will no longer be listed alongside addictive opioids like heroin.

Interestingly, the most resounding voice in India with respect to legalisation of cannabis can be attributed to an yet-to-be leveraged opportunity in the industrial Hemp market. As of date, India’s market share is less than 0.1%. Given, appropriate regulatory framework, India stands to benefit from the upward wave, as Asia Pacific accounted for the largest market share (32.6%). Trying to benefit from this, way back in 2016, Uttarakhand had the foresight to grant a license to Indian Industrial Hemp Association for commercial cultivation of industrial hemp on 1,000 hectares of land.

All in all, India has the right ingredients in place to allow for cultivation and exports of cannabis and its various produce to fuel growth in cannabis markets of the world, where it will be widely used by stakeholders in the pharmaceutical industry, textiles, construction, food and beverage and automotives. It’s more than obvious that for good or bad, the global cannabis market is burgeoning rapidly into a force of nature that cannot be ignored. Sooner rather than later, it looks like India needs to make a choice on how to structure regulations around jumping on the cannabis bandwagon.

IS SOFTWARE EATING CANNABIS WORLD TOO?

The cannabis startup constellation is diverse, dynamic and like a lot of other sectors, is seeing ‘software eats the sector’ phenomenon – ranging from typical business models like recommendation engines and e-commerce sites, delivery enabling tools, fintech platforms, B2B marketplaces to point-of-sales (PoS) tools. Other captivating business models around regulatory tech, compliance, marketing and retail intelligence are further trying to tackle the not-so-subtle complexity associated with the cannabis industry. Apart from these, the sector mapping itself is incomplete without including cannabis production and the intended utility of its end product.

The existence of numerous startups and the conspicuous nature of opportunity has seen increased momentum of investor interest in cannabis startups. Globally, since 2014, VCs have deployed ~$5.3 billion into 500+ cannabis startups. The funding reached a new euphoric high in 2019, when ~$1.9 billion was injected across 150+ cannabis companies. While the deployment saw a 68% dip in 2020, it seems to be on a rebound, as ~$560 million has been injected into 60 companies so far in 2021, 35% of which went into Dutchie. A few distinguished cannabis investors include: Navy Capital, Casa Verde, Thrive Capital, Phyto Partners, Poseidon, Entourage Effect capital. Alcohol and tobacco companies have also been ardent investors/ partners of cannabis companies. For example, way back in 2018, Constellation Brands invested $4 billion in Canopy Growth, Altria invested $1.8 billion in Cronos Group and Tilray partnered with Anheuser-Busch Inbev for the development of non-alcoholic drinks for the Canadian pot market (Read more about Beer industry here). Despite what might seem like a huge investor interest, for most part institutional investors are largely absent and the sector remains undercapitalised.

As of 2019, ~410 cannabis companies had been listed on global stock exchanges. Most of these are concentrated in North America. A few well known ones are GW Pharmaceuticals (listed in 2013 and recently acquired by Jazz), Aphria (listed in 2014), Trulieve (went public in 2018 through a reverse merger), Green Thumb (listed in 2021) and so on.

INDIAN STARTUPS & THEIR TRYST WITH CANNABIS

A closer look at the Indian cannabis market sheds light on the prominence of hemp. Majority of these early stage cannabis startups are focused towards consumer and industrial hemp products. Almost all these companies find navigating rules around sourcing of hemp, distribution and marketing of their products a huge challenge. In India, for most part the investors remain skeptical about the cannabis market, which is marked by extremely low levels of capital injection into cannabis startups.

THE FRINGE BECOMES MAINSTREAM

While some investors are still sitting on the fence about investing in cannabis startups, others identify with fringe sectors such as cannabis as being a formidable force of innovation at inflection point and are excited about playing a pivotal role, in literally shaping up a recession proof new market. The biggest validation for a fringe sector on the verge of transformation into mainstream, is when incumbents take a hard look at themselves and identify with niche products as their avenues of organic and inorganic growth. In the last 5-6 years, the moguls of the alcohol, tobacco and pharmaceutical industry have actively invested in cannabis companies. Celebrities like Snoop Dogg, Jay Z, Wiz Khalifa, Seth Rogen among others swear by cannabis and have launched their own cannabis lines. Nuanced cannabis VC funds, with a laser sharp thesis, are further deepening the startup ecosystem. There is a strong track record of cannabis companies raising external capital and exiting via acquisition or an IPO.

The winds are definitely blowing in the direction of cannabis, as countries around the world become more open to it, especially for its use in medicine. At this juncture, a couple of things are abundantly clear. One, the voice of dissent, will definitely come face-to-face with problematic and complex regulations along the way. This comes in diverse forms of challenges around setting up legal frameworks, policies, large scale acceptance in established markets, openness in untouched nations, maintaining compliance, establishing control over the entire distribution chain and pricing. For many stakeholders, progress in the cannabis domain is akin to taking four steps ahead and three behind, at every single phase of market evolution. Nevertheless, two, quoting Bethany Gomez, despite all these challenges, there is simply too much momentum, too much demand, and too much potential for this industry not to explode!

This article is co-contributed by Keerthana Sreekanth Rao