In Indian families, homes hold a deep emotional value. A new home is a huge life milestone for many and a sign of stability. Indian families strongly believe in hosting social gatherings at their homes, making homes something that people like to make an impression on. Big or small every house has the potential to make an impression when designed intelligently.

“A house is made with walls and beams; a home is built with love and dreams.”

– Ralph Waldo

Owning a house is a big deal to say the least. Taking cues from the old Bollywood movie: Roti, Kapda and Makaan (food, clothes, house) form the bottom of Maslow’s hierarchy of needs. We would, however, argue that owning a house strongly correlates with higher needs in Maslow’s hierarchy as well.

In India, 95% of rural households own a house compared to a national average of 69%. In urban areas with more than 4Mn+ population, only 60% of households own a house/flat. This is not surprising given the fact that many of the urban residents are migrants. The top 7 cities in India are selling 25~30K homes every month, and most of these homes are delivered as bare shells to homeowners with doors, walls, and windows only. This leaves new homeowners with the huge task of doing interior decoration, which acts as a huge tailwind for the design market.

The new homeowners especially in the urban cities are increasingly from the gen-z/late millennials pool. This group of population is digital-savvy and would prefer going through a platform over traditional routes. The new age design tech platforms are addressing these groups of people while solving the conundrums of existing traditional systems.

In this edition of BusinessBar, we will take a closer look at these design tech platforms which are disrupting the interior design industry.

Market Opportunity for Home Interior Design-tech Platforms

Various research studies estimate the residential (both new and renovations) interior design market size to be in the range of ~$20-30B, and is growing at 7%+ CAGR. However, let’s run some numbers to see the real market opportunity for these design-tech platforms which are mainly operating in new residential homes of urban cities.

- New homes sold every year in the top 7 urban cities (A) = 300K

- Avg. cost of home (B) = ~$100K

- Spend on interiors (C) = (B*25%) = ~$25K

- Home interior market in top 7 cities = (C * A) = ~$7.5B

Design-tech companies are now operating in many more cities beyond top 7, however, still the major portion of the revenue comes from the urban cities. These design-tech companies have offerings for renovations, refittings, or stand-alone room/kitchen – but the majority of their business is focused on new homes in urban cities as they are high-ticket value projects.

In home interior business there are ~70% margins; for example, a. Rs. 10,000 sofa, actually costs ~Rs. 3,000 to be manufactured in a factory. These margins are then split among design margin, manufacturing margin, lead-gen margin, logistics, installation, and so on.

The earning potential of the market is therefore ~$5B (~7.5B * 70% gross margin).

These design-tech platforms start with tapping into lead-gen and design margins (with their in-house team of designers). As the platform matures it starts tapping into other margins as well. Manufacturing and fulfillment are key to customer success, and therefore close integrations with manufacturers are seen in the space.

Pioneers of Home Interior Design-tech in India

Home interior design in the traditional format includes a lot of conundrums – from finding the designer, to finalizing the design after multiple iterations, finding the right vendor (carpenter, painter, etc.), getting it installed and then any maintenance post that. Design-tech platforms have redesigned the design industry where digital platforms are replacing the conundrum with a convenience-first platform.

The new age design tech companies are providing the convenience of selecting among a wide assortment of designs provided by a team of designers working at the backend. These platforms either partner with existing vendors or have started in-house manufacturing of certain items. With this tech infrastructure, platforms are able to provide consumers with an immersive experience of designing their homes.

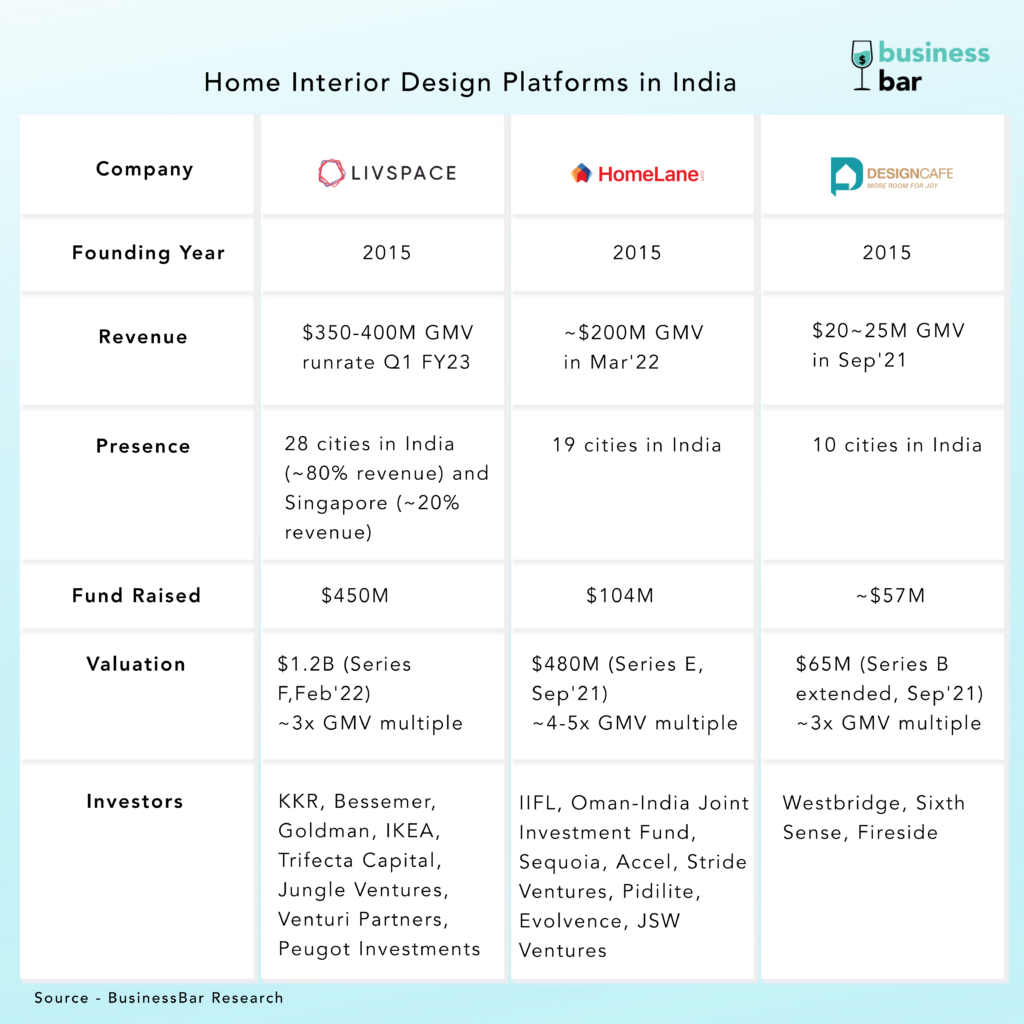

Interestingly 2015 was the year when it all began – Livspace, Homelane, and DesignCafe – all three leading design-tech platforms had started in the same year and pioneered the Design-tech industry of India. Though the scale attained by the 3 platforms significantly differ – the overall market is much larger and leaves enough room for growth for each of these players and the entry of new ones.

Design-tech platforms operate currently in limited geography with a narrow focus, concentrated to serve the more densely populated areas of the country – as it helps attain better unit economics and also provides better customer satisfaction.

As the platforms mature, they are found to vertically integrate upwards in order to capture a larger share of margins and maintain control. In this pursuit of growth, both LivSpace and Homelane took a brownfield strategy of partnering with traditional manufacturers. DesignCafe on the other hand has integrated vertically upwards with in-house manufacturing. (more on the strategic partnerships below)

Conundrum of Interior Designing

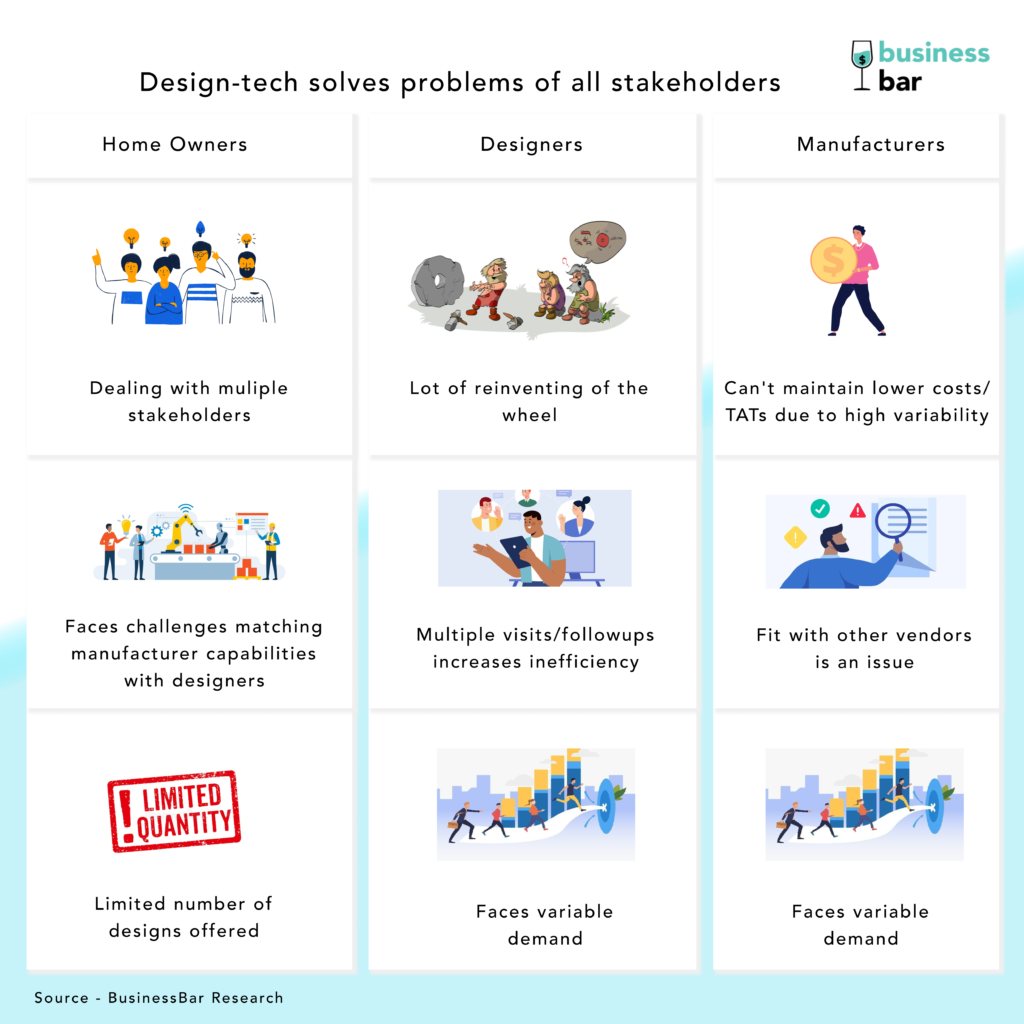

Home interior design is a complex process where homeowners have to deal with multiple parties – designers, manufacturers, vendors, and service providers. To better understand the value proposition of the design-tech companies, we need to understand the problems of the key stakeholders of this space.

Homeowners go through a rigorous process of finding the right designer – through references/multiple meetings with various designers. The designer does recce and gather information. Then the designer takes inputs from homeowners about their preferences. Homeowner usually refers to some online design or pictures/videos of other’s homes (at times even verbally) for presenting their preferences. Designer presents a few designs to the homeowners and takes feedback to make changes – this iterative process goes on till a design is finalized. This process takes a long time as every iteration needs at least a few days.

Homeowners then have to deal with multiple vendors to procure the right material, and get it manufactured, transported and installed in their homes. Among multiple stakeholders, no one really takes the onus of post-installation services.

As one can see the design process involves a lot of interaction between designers and homeowners. Therefore, for a designer to be successful they also need to be a good salesperson. They need to do continuous follow-ups and multiple visits for every project. Additionally, the designers are restricted to explore their creativity only till the extent to match the preferences of homeowners. More often, designers end up reinventing the design wheel by creating the same designs that were created before by someone else. Eventually, the outcome of their designs are highly dependent on the skill of the manufacturer and the materials used. This provokes designers to also deeply engage with the manufacturer in order to get the desired outcomes.

Design-led manufacturers in the industry work on a job-process model where they procure materials and manufacture only once the designs are received. This leads to high TATs and costs of manufacturing. Due to high level of variability in each customer’s demands, maintaining inventory is difficult. However, there are certain manufacturers that operate on inventory-led models but they have limited designs. Also, multiple vendors have to collaborate among each other as a certain level of fit needs to be present between the goods they manufacture. Eg. to make a sofa one needs to collaborate with both carpenter, tailor and cushion artist, leading to high dependency among the stakeholders and the pertinent need for streamlining.

The inherent nature of the home design industry does not involve repeat customer behavior and therefore there is a huge variation in demand for both the designers and the homeowners.

Design-tech platforms become the face for both designers and manufacturers. These platforms usually hire designers on payroll or gig (freelance) and provide them with direct projects. Revenue per designer is an important metric that these platform track to measure their efficiency. These platforms partner with both inventory-led and design-led manufacturers. The level of partnership or bringing manufacturing in-house helps in further improving the efficiency of the platform.

Strategic Partnerships

We’ve seen that a client agreeing on a design is just the start of the process, executing the vision is where the labor, material, and eventual success of the design lies.

Naturally, that’s also where the next revenue and margin opportunity lies. And Design-tech platforms are well aware of this.

DesignCafe has its own 35k sqft factory near Bengaluru from where they turn their designs into products.

But Strategic partnerships is another way these companies are trying to approach this backward integration of the value chain.

In 2019, global furniture brand IKEA invested in Livspace. The synergies of this deal are apparent, such as IKEA products being made available in Livspace catalogue. IKEA is also serving as a gateway to Livspace’s global ambitions.

Deep dive into what The IKEA experience is all about here.

Global materials provider Saint-Gobain also picked up a minority stake in Livespace to enter the Indian and SEA market.

Homelane on the other hand in its investor list has Pidilite – the maker of Fevicol among other home building materials. It also acquired a home interior marketplace by the name of Capricoast in a $13.8M deal in 2017.

Interior designing is a business about getting into the house of the customer, and what better ambassadors than household names like MS Dhoni to do the job. This probably might be the narrative Homelane tried to build when it onboarded MSD as both an equity investor and Brand Ambassador.

Curious why celebrities are picking up equity stakes in startups? Here’s our piece on Celebrity Investments – Fame, Fortune & Funding – Celebrity Business World

Way Ahead

This space is evolving very fast and multiple startups have cropped in the last 12 months from a specialized B2B marketplace for architects and interior designers like Material Depot and Depo 24 to providing DIY design tools like Superbolter to help visualize the design in real-time for end consumers. Instead of following the age-old task of flipping through lengthy outdated catalogues and calling vendors – these new-age marketplaces are search engines for architects. Along with simplifying the discovery process, architects can also create collections for their 3D models or even order samples. Recently, Material bank raised $175M in similar space in the US, in Series D funding led by Brookfield Growth, the technology investment arm of real estate company Brookfield.

Not just residential spaces, even commercial spaces are embracing the tech-enabled design startups like Flipspaces, which offers one-stop solution for discovery, visualization & ordering of furniture/fittings/construction material. The market for commercial space is fragmented as well and holds incredible untapped potential. But that’s a story for a different time 🙂

“House is just a space, but a home is where you belong”

– Brian Chesky

Note: We have captured the information best available in the above article, feel free to write to us in case of any data correction.