VC funding for start-ups is at record highs in India, with YTD funding of $16.9 billion in 2021. It is already up 52% from the $11.1 billion raised by Indian start-ups in the entire calendar year of 2020! But while the unprecedented wave of unicorn creation and VC funding has grabbed the headlines, a relatively new trend has quietly emerged within the Indian start-up funding landscape. And that is the rise of Revenue-based Financing (RBF).

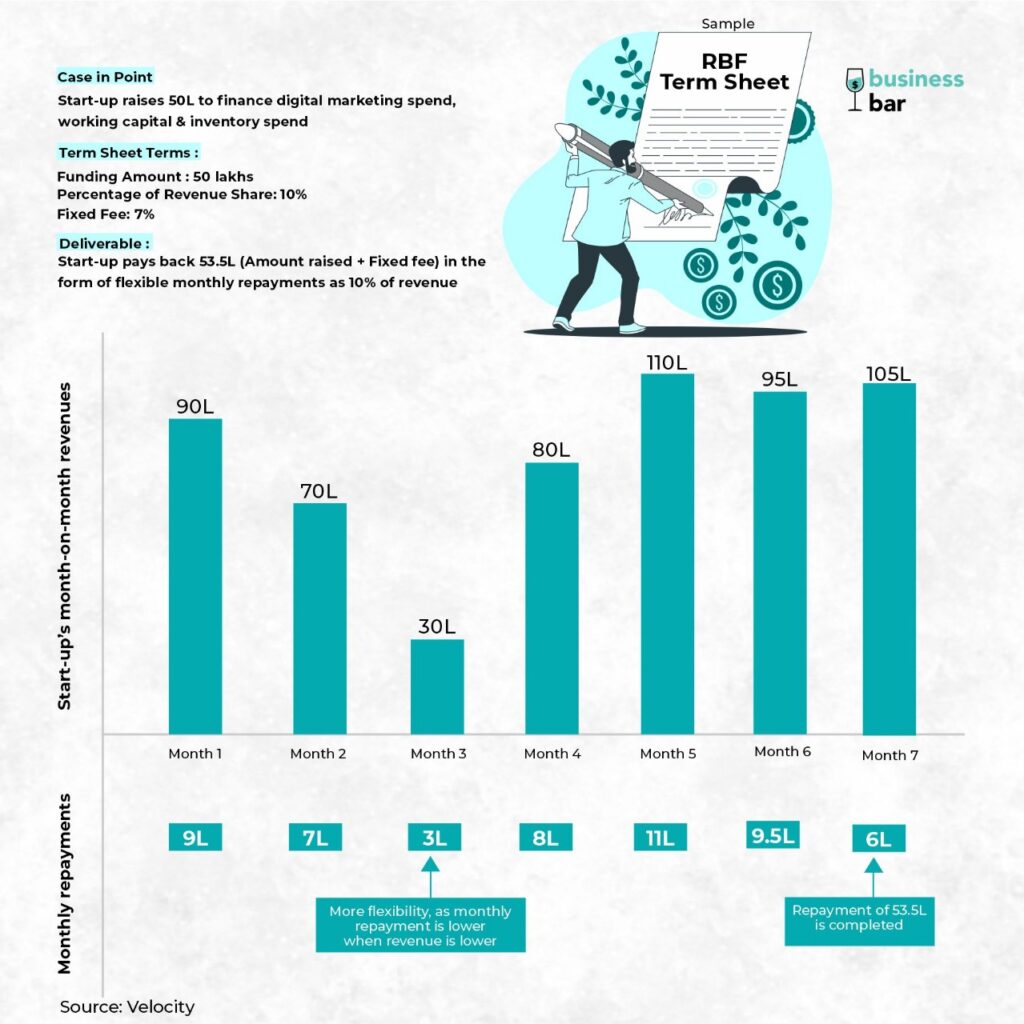

So, what is Revenue Based Financing? It is essentially a way for companies to raise capital, by committing to pay a fixed % of future revenues, until a predetermined return on the original investment is met. A sample RBF term-sheet could look a little something like this –

The global RBF market is relatively nascent and has only meaningfully emerged in the last five years, but is growing rapidly at a CAGR of 61.8% and projected to be a $42.3B market by 2027. RBF has already emerged in the US as a highly popular means of growth financing, especially for emerging digital-first DTC (direct-to-consumer) brands. Some of the frontrunners in the RBF space in the US are Clearco (formerly known as Clearbanc), Lighter Capital, Bigfoot Capital & RevUp Capital among others.

Closer to home, in India, revenue based financing firms are only emerging in the last couple of years, with new players like Velocity, Klub and GetVantage getting into the act.

How do RBF firms make money?

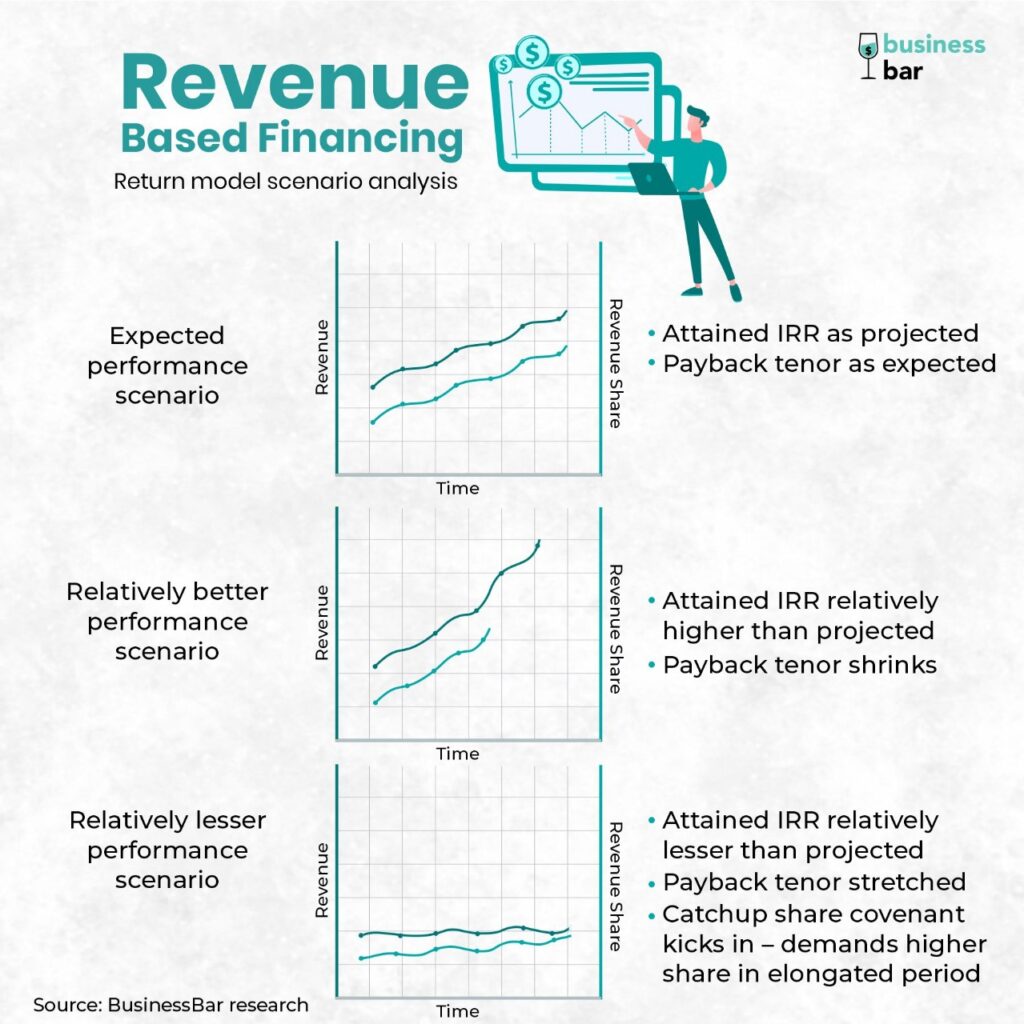

RBF firms generally raise capital as a mix of equity and debt. They give out cheques to finance companies’ growth, and earn a fixed fee in the form of revenue-linked repayments. This capital is essentially being recycled and constantly redeployed into more companies, hence the average repayment period is also a very important lever that drives the IRR (internal rate of return) and profits for an RBF firm.

We will dig a little deeper into the various RBF players both in India & globally, but first, it is important to understand – How is RBF different from equity & debt financing? And what are the key advantages for start-ups raising capital via the RBF route?

Benefits of Revenue Based Financing

There are several differences between RBF and other modes of financing. For example, when companies take on RBF as opposed to traditional debt from banks or NBFCs, they repay the capital raised in the form of a percentage of their revenues as opposed to fixed EMIs. In months with higher sales, they pay more, while in months with lower sales, they pay less.

Think of this as converting a fixed cost to a variable cost! Young start-ups in hyper-growth mode don’t have straight-lined revenues, they have far more volatility in their sales. Hence, start-ups have greater flexibility and experience lower cash flow pressure by taking the RBF route over traditional debt. Another differentiation from traditional debt is that there is no requirement for security or collateral via the RBF route, making it less onerous for start-ups to raise capital.

Contrasting this with the other end of the funding spectrum, i.e. equity financing (VC / PE), when companies take on RBF, there is no dilution of ownership for the founders. RBF firms also don’t take a board seat in the portfolio company. On the other hand, raising via equity of course entails significant dilution of ownership, along with board-level intervention from investors.

Last, and perhaps the most important advantage of RBF, it could be a perfect fit for companies that don’t fit the typical venture capital investment profile. This is an important point, so let’s dig a little deeper into this.

Is venture capital a good fit for all companies?

With massive war chests of cheap capital currently available in the venture ecosystem, a lot of start-up founders may not stop to ask themselves if they’re even building a venture business. Fundamentally, the VC model excels at finding and backing early-stage opportunities at the intersection of huge markets, technology/business model innovation & founders that dream of taking over the world.

But most companies are not venture-scale unicorn opportunities, neither should they aspire to be! Most entrepreneurs would be perfectly happy building healthy profitable & cash-flow generating businesses that grow slowly over time, rather than the explosive blitzscaling model that is advocated by venture-funded companies.

Equity financing for early-stage start-ups comes with a high cost of capital (accounting for higher risk). It is ideal to power the early journey towards finding product-market fit or figuring out the monetization engine and subsequently, a start-up’s unit economics. But once a start-up has successfully navigated till this point, i.e., it has ironed out its business unit economics, it can go one of two ways. First – Adopt the grow-at-all-costs mentality and pursue market share over profitability. Second – Adopt a more conservative approach and grow more sustainably with linear profitable growth.

There is definitely the case to be made that certain sectors possess winner-take-all dynamics due to factors like marketplace network effects, data as a moat or high switching costs. In these cases, it is critical to grow fast by pursuing multiple tranches of dilutive equity financing to build the early advantage needed to emerge as the category leader. This is the ideal definition of a venture scale opportunity, one that has the potential to scale into a unicorn, and eventually an IPO. But as we noted earlier, most companies don’t have IPO aspirations, and are aiming to build low-risk profitable businesses.

Ideal investment profile for RBF

Consider for instance a D2C (direct-to-consumer) online business selling leather bags & wallets, and let’s call this Company X. Company X likely sells across multiple channels like their own website powered by the likes of Shopify along with third-party sales on Amazon, and has digital marketing spend for customer acquisition across Google ads, Facebook ads, YouTube & Instagram.

Now Company X already possesses the required data to determine its gross margins, customer acquisition cost, return on ad spend, average order values, repeat rates, return rates. All of these metrics provide a comprehensive snapshot of the business’ unit economics. X has built a repeatable growth engine with a predictable return on ad spend (ROAS), one where $1 of digital marketing spend produces say $3 of revenue.

In this case, raising via dilutive equity financing often makes little sense as the high cost of capital is no longer commensurate with the low-risk predictable growth engine that the company already has figured out.

Enter Revenue Based Financing firms like Clearbanc. Clearbanc analyses X’s historical revenue trajectory, unit economics & historical return on ad spend. It makes a financing decision and then disburses growth capital that is paid back from future revenues. This capital is non-dilutive, comes with little covenants, does not require any collateral, and provides significantly more flexibility than traditional debt. Raising via RBF allows start-ups to keep raising repeated rounds of financing and use it purely for one purpose – to pour it on the marketing engine and scale up revenues.

Revenue Based Financing is especially effective for direct-to-consumer brands and subscription revenue companies that have already achieved predictable unit economics. Different players in the RBF space have specific business model nuances in their model, and it is worth unpacking the whole spectrum of RBF players, what’s similar & different among the various companies.

Clearco (formerly Clearbanc), based out of Toronto, was founded in 2015. It is the most prominent RBF firm globally. Clearco built its reputation on its iconic ‘20-minute term sheet’, their automated data-science engine that allowed direct-to-consumer brands to raise marketing growth capital.

How does this automated decision engine work?

Clearco directly plugs into a start-up’s digital marketing and revenue channels, and processes all its key business metrics to reach a data-driven funding decision, with term-sheets disbursed in a matter of minutes.

Since this is a purely data-driven automated engine, it is more efficient, eliminates personnel costs & automatically refines the algorithms over time as more data across businesses is fed to the engine. Another key benefit of this data-driven funding process is that it removes the inherent bias from investment decisions. Biases around pedigree, gender, race etc which are naturally present in a human-driven process are simply not there in an automated evaluation process.

In fact, in an interview, Clearbanc Founder & CEO Michele Romanow said that just through their data-driven process, with no manual intervention, their % of women entrepreneurs funded was 8 times the industry average.

So, there is a strong case to be made that RBF also levels the playing field in terms of expanding access to capital for entrepreneurs!

Clearbanc co-founder and president Michele Romanow in 2019 – “Everyone is watching this flurry of tech IPOs this year, but no one is talking about how little of these companies the founders actually own. Our vision is that if Clearbanc is successful, there’s a world where founders can own a much greater percentage when they IPO.”

Birth of Revenue-based Financing in India

In India, RBF is currently a burgeoning space, with several new players bursting onto the scene since the beginning of 2020. Some of the prominent players in India are Klub, Velocity & GetVantage, among others.

Velocity was founded in March 2020, and had raised a $10.3 million seed round earlier this year from Peter Thiel’s Valar Ventures, which interestingly enough, is also Thiel’s first bet on an Indian start-up. This clearly highlights the immense potential that RBF has to disrupt the Indian entrepreneurship ecosystem.

Velocity provides D2C brands and e-commerce start-ups with funding between INR 10L and INR 2 crore to fund marketing spend and working capital needs. This capital is paid back with a revenue share arrangement of anywhere between 5% and 20% of future revenues until the principal + fixed fee (anywhere between 4% and 7%) is paid back.

Klub was founded in 2019, and was part of Sequoia’s Surge program. They recently raised a $20 million seed round in August 2021 from existing investors (Sequoia Surge, 9Unicorns) along with new investors (Alter Global, GMO Venture Partners). Much like Velocity, Klub provides capital to finance recurring spend on marketing & inventory.

Most RBF firms raise their capital from institutional investors. However, Klub follows a unique hybrid marketplace business model, wherein they raise capital through two ways – institutional investors & also individuals, who are called patrons. Klub is pioneering a patronage model where they enable individuals to invest in and support their iconic loved brands in exchange for attractive returns.

Moreover, patrons get exclusive access to brand rewards like invite-only events, special discounts, branded memorabilia and curated masterclasses. These perks in turn improve brand loyalty, word-of-mouth marketing and drive the growth flywheel for these digital-first brands!

In a short span, Klub has already funded popular brands like Eat.Fit, The Man Company & Healthy Cravings. Klub has plans to deploy capital aggressively, with up to INR 500 crore expected to be disbursed over the next few quarters through its hybrid marketplace model.

Evolution of RBF value proposition: Moving up the value chain

A lot of RBF firms initially started out as financiers but are now aiming to extend their range of solutions providing data-driven solutions and business insights for companies.

For instance, Clearbanc rebranded itself as Clearco to transition from pure-play writing checks to supplementing that with providing business intelligence tools for companies to help them grow. Clearco raised $215 million from Softbank Vision Fund II in July 2021, just 2 months after raising a $ 100 million Series C.

The message from the founders is clear: Clearbanc wants to take the mentorship and personalized advice you get from investors and extend the same helping hand to thousands of companies, but using a self-serve data-driven approach. Several RBF firms across the world are evaluating the same transition, to expand the scope of their offering.

Closer to home, Velocity has extended its offering beyond pure-play RBF and is currently piloting its ‘Insights’ platform in beta access right now. This platform provides comprehensive & intuitive business dashboards for business owners to easily get a bird’s eye view of their company’s vitals on a day-to-day basis. Velocity Insights is integrated with all popular business tools used by e-commerce start-ups like Google Ads, Google Analytics, Amazon, Facebook Ads, Instagram Ads, Shopify and WooCommerce.

Using the Insights platform, key growth metrics for a business can be easily tracked over time. Furthermore, the product also provides access to the industry-leading benchmarks for all these metrics. This facilitates an easy reference point for founders to gauge areas of improvement in their business operations and act upon them in real-time.

Future Outlook for RBF in India

The RBF ecosystem started to take off in India along with the onset of the Covid-19 pandemic, and this is no coincidence. When the pandemic struck, young start-ups struggled to raise funds for a few months and needed a viable financing alternative. Furthermore, since offline store traffic dried up, the pandemic has led to the rapid digitization of businesses, with the transition to online or omnichannel a must to survive and thrive.

In one of our previous posts, we covered how social commerce could shape the future of e-commerce in India. Similarly, another trend that is currently taking centre stage in Indian e-commerce is the rise of D2C (direct-to-consumer) brands. Owing to their digital-first approach, D2C brands provide new ways for customers to interact with and buy from the brands they love, while also providing the brands greater control over their operations, along with access to online data that can drive their future strategy.

In 2020, D2C websites saw a 88% growth in their order volume vs 32 % growth in order volume on e-commerce marketplaces. The D2C revolution is still in its early innings, and will likely give birth to thousands of aspirational entrepreneurs building digital businesses over the next decade.

As we continue to witness the unlocking of digital entrepreneurship in India, there will also be a tremendous growth in capital required to fund these companies. Venture capital, private equity and venture debt unquestionably will play a pivotal role in funding these start-ups, but they largely satisfy other use-cases and stages of companies.

We believe that there is fundamental whitespace in terms of the availability of flexible non-dilutive growth capital, which is where revenue-based financing can plug the gap. This market is ripe for massive growth in the next decade, it’s going to be interesting times ahead for emerging RBF firms in India!

This piece has been co-contributed by Vivek Premnath